Sulphur 415 Nov-Dec 2024

30 November 2024

Sulphuric Acid News Roundup

Sulphuric Acid News

MOROCCO

OCP Group to boost fertilizer production

OCP Group has launched what it calls the Mzinda-Meskala Strategic Programme, aimed at significantly expanding fertilizer production in the country. Initially announced in December 2022, the program is set to enhance production capacity in two key regions: the Mzinda-Safi Corridor and the Meskala-Essaouira Corridor. This initiative is part of OCP’s broader strategy to meet growing global demand for fertilizers while committing to long-term sustainability goals, including achieving carbon neutrality by 2040.

The programme has two primary objectives: boosting fertilizer production to strengthen OCP’s global supply capacity and adhering to its environmental goals. It aims to develop a new mine in Meskala and construct a state-of-the-art chemical and mining complex in Mzinda, both of which will process phosphate rock from key deposits in Ben Guerir, Youssoufia, and Meskala. By 2028, OCP plans to reach an annual production capacity of 12 million t/a of rock, 3 million t/a of phosphoric acid, and 8.4 million t of fertilizers within the Mzinda-Safi Corridor. Simultaneously, the Meskala-Essaouira Corridor is projected to produce 20 million t/a of phosphate rock, 1 million t/a of phosphoric acid, and 2 million t/a of fertilizers.

A central aspect of the programme is a focus on cost control and optimising the value chain. The expansion is designed to ensure that OCP can continue to meet rising demand in key global markets, including Europe, Africa, and India. By increasing production capacity while maintaining a strong focus on efficiency, the group aims to remain competitive in a highly dynamic global fertilizer market.

AUSTRALIA

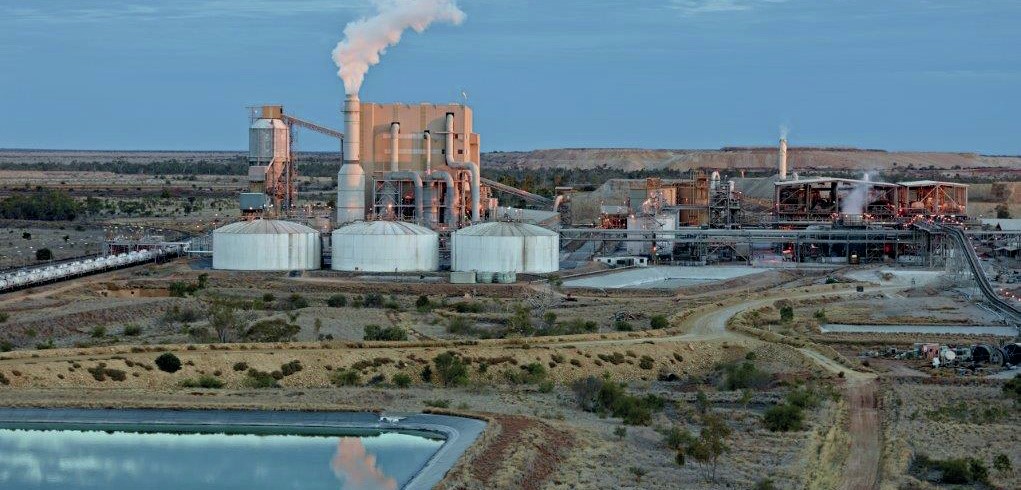

IncitecPicot considering closure of Phosphate Hill

IncitecPivot is conducting a strategic review of its operations over the next 6-12 months, and “considering all options” according to CEO and managing director Mauro Neves, speaking to an investor meeting. CFO Paul Victor added that the company is assuming that its Phosphate Hill operations will be closed in the near future, but the company is still evaluating whether this will be an outright closure, a move to ‘care and maintenance’, or whether it was still possible to “utilise other parts of the asset in still a very productive manner”. The company is also working with the Queensland Government to determine the possible costs to remediate the site. Phosphate Hill has faced issues with flooding, rail line and gas supply disruptions and uneconomic production costs for its diammonium phosphate output in recent years and last year cut production rates.

In the meantime, Neves said that IncitecPivot continues to look for a buyer for the company. “We truly believe that under different ownership IPF should benefit from greater synergies and operational efficiencies,” he said. “This includes a full sale of the business or the selling of the business in its parts.” Prior talks on a sale with PT Pupuk Kalimantan Timur broke down in July 2024.

UNITED STATES

OCP says phosphate tariffs may be withdrawn

OCP Group says that it understands that Mosaic has withdrawn its request to the US Department of Commerce (DoC) for a third annual administrative review of the countervailing duties imposed on Moroccan imports of phosphate fertilizers to the US. OCP said it expects the DoC to rescind the duties in the coming weeks. These tariffs were initially set at 19.95%, but have been provisionally reduced to 7.42%. OCP said that it hopes “this development will prove to be a first step toward ending these tariffs that are preventing US farmers from having reliable access to a high-quality supply of an essential input for growing abundant and healthy crops to feed their fellow citizens and compete in global markets.” It also said that it would continue to pursue appeals against these tariffs in the Court of International Trade.

Hurricanes affect phosphate production

Florida has seen extensive damage from hurricane Helene, which made landfall on September 26th, and hurricane Milton, which arrived on October 10th. Tampa received around 18 inches of rainfall from the extreme weather event in October, which left three million Florida homes and business without power in the immediate aftermath.

Mosaic said on October 21st that recovery efforts post hurricanes “have progressed well with all Florida production facilities having returned to normal operations except Riverview which has resumed production and is expected to return to normal rates by the end of the week.” The company also confirmed that Mosaic’s mining sites were starting to resume operations. South Fort Meade was expected to return to normal within days, while Four Corners was expected to revert to normal working toward the end of October.

Florida accounts for around 85% of Mosaic’s finished fertilizer production, and US DAP/MAP supply has been very tight for months. Nutrien’s White Springs production plant, around 180 miles north of Tampa, received some damage from hurricane Helene and was still out of action, as of 11th October, while Nutrien assessed the damage and repairs required.

SENEGAL

Coromandel increases stake in BMCC

Coromandel International says that it intends to invest $3.84 million in Senegalese phosphate rock mining company Baobab Mining and Chemicals Corporation (BMCC), as well as loaning BMCC a further $6.5 million to fund expansion projects and meet working capital requirements. The acquisition will take Coromandel’s overall shareholding in BMCC to 53.8%. BMCC, incorporated in 2011, has a renewable exploitation permit for processing phosphate ore. Coromandel acquired a 45% stake in the company in September 2022. The company has since stabilised mining operations and is currently commissioning a fixed processing plant to optimise rock production. The increased output will support securing phosphate rock for the upcoming phosphoric acid plant development at the Coromandel’s Kakinada unit in India.

Commenting on the investment, Coromandel International managing director and CEO S. Sankarasubramanian said: “with India importing the majority of its rock requirement, investment in rock phosphate mines will be critical for attaining long-term supply security for its phosphate fertiliser production. The additional stake in BMCC is strategically important for capturing value chain and building self-sufficiency in our operations,” Sankarasubramanian noted.

INDIA

Metso delivers scrubbers for SO₂ emissions reduction

Metso will deliver four Peracidox™ scrubbers to Hindustan Zinc to minimize sulphur dioxide emissions at their plants. The scrubbers will be installed at the sulphuric acid plants at the company’s zinc smelters in Chanderiya and Debari in India. The scrubbers have been customised for the Indian market to comply with the local environmental regulations and to meet the needs of the Indian customers, according to Hannes Storch, vice president, Metals and Chemical Processing at Metso.

The Peracidox™ scrubbers reduce the residual SO₂ of tail gases, minimising emissions. The solution, an oxidative removal process, features high removal efficiency and ease of control with minimised mechanical equipment.

ANGOLA

Loan finalised for phosphate project

Minbos says that the Fundo Soberano de Angola (FSDEA), the Angolan sovereign wealth fund, has approved a $10 million strategic investment in Minbos, to support the construction of the Cabinda Phosphate Fertilizer Project. Formalities to finalise the strategic investment will commence immediately and are subject to all the normal regulatory and other approvals. FSDEA completed its due diligence in co-operation with the Industrial Development Corporation (IDC) of South Africa, and understands its investment will enable the Company to meet IDC’s condition precedent of raising $11 million for equity funding to support the development of the CPFP. Minbos expects to finalise the balance of IDC’s conditions precedent for the $14 million construction funding provided by the IDC in the coming weeks.

The Cabinda phosphate project is an open-pit mining and fertiliser production project in the enclave of Cabinda, north of Angola. It is being developed by a joint venture between Minbos Resources (85%) and local partners (15%). At peak it will mine 1.2 million t/a of phosphate-bearing rock at 30.1% P2 O5 grade, with an ore processing plant capable of generating 187,000 t/a.

ZAMBIA

Contract for copper project

Barrick Gold Corporation has awarded Metso a contract for the supply of copper concentrator plant equipment to their Lumwana expansion project in North-Western Province in Zambia. Metso’s scope of delivery includes key equipment for grinding, flotation, thickening, feeding and filtration. The value of the order is approximately euro 70 million.

Lumwana is a significant contributor in Barrick’s copper portfolio, catering to the rapidly increasing demand for copper required for the energy transition. Barrick says that the project is also elemental in reviving Zambia’s copper industry and contributing to the local economy, and will turn Lumwana into one of the world’s major copper mines, with projected annual production of 240,000 t/a of copper.

“We are honoured to have been selected by Barrick as the strategic partner for this project. The copper concentrate production process in Lumwana has been designed with sustainability and production efficiency in mind, with most of the equipment selected from our Planet Positive offering,” said Markku Teräsvasara, president of the Minerals business area and deputy CEO of Metso.

SWEDEN

Iron ore miner LKAB outlines phosphate market re-entry

CRU has visited Swedish iron ore producer LKAB’s vast Kiruna underground mine to see the company’s early-stage plans for valorising its phosphate-bearing (apatite) tailings. LKAB ultimately intends to produce both a rare earth element (REE) concentrate and ammoniated phosphates at a planned facility in Luleå as part of a wider company strategy to decarbonise its iron production and extract “critical” minerals from its waste streams.

The “ReeMAP” project will potentially generate merchant-grade phosphoric acid (MGA) for export. Despite the large scale of its iron ore output – 26.2 million t/a in 2023 –planned MGA production will be small at closer to 150,000 t/a P2 O5 . This would be comfortably absorbed by Western Europe’s current import demand. However, the company anticipates a “protracted” process for acquiring environmental permits as well as technical challenges in handling high chloride levels. The company estimates the project will incur a total capital expenditure of around $1 billion.

ALGERIA

Phosphate project to be fast tracked

Algeria’s President Abdelmadjid Tebboune has urged for the fast-tracking of three key mining projects aimed at bolstering the country’s economy beyond oil and gas exports. The Algeria Press Service (APS) says that during a cabinet meeting, Tebboune called for the swift completion of the Gara Djebilet iron ore mine, the zinc and lead mine in Valley Amizour, and the phosphate mine in Bilad El Hadba. Bilad El Hadba, located in Tebessa, is projected to produce over 6 million t/a of phosphate rock. A railway line currently under construction will link the mine to the mining network, enabling the transport of over 10 million t/a of phosphate each year. The project is expected to generate $2 billion in annual revenues and approximately 14,000 jobs.