Sulphur 415 Nov-Dec 2024

30 November 2024

The market for ammonium sulphate

AMMONIUM SULPHATE

The market for ammonium sulphate

Continuing growth in Chinese ammonium sulphate production is leading to a continuing flood of exports, as greater awareness of the utility of sulphur as a fertilizer leads to increasing global demand.

Ammonium sulphate (AS) remains a popular fertilizer for its combination of nitrogen and sulphur nutrients. Indeed, the growing awareness of sulphur deficiency in soils, caused by a switch away from sulphur-containing fertilizers such as AS and single superphosphate (SSP) towards urea and mono/di-ammonium phosphate (MAP/DAP), and the reduction in deposition of sulphur on soils from sulphur dioxide pollution in the air as power plants and car exhausts become cleaner, mean that the soil nutrient sulphur requirement is growing. This in turn is leading to a resurgence in popularity for ammonium sulphate as a fertilizer and its use growing by about 3% year on year, faster than overall growth in fertilizer demand.

Production

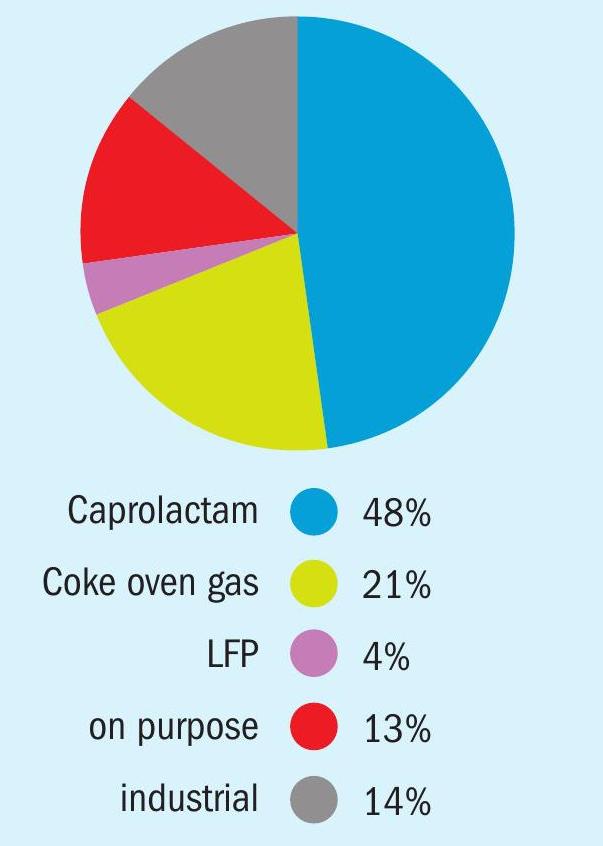

Ammonium sulphate production worldwide was 32.5 million t/a in 2023. About half of all ammonium sulphate production (15.6 rolactam production (see Figure 1). One of sulphuric acid’s prominent chemical uses is in the production of caprolactam, with ammonium sulphate generated as a by-product. The switch of global fibre production to China has led to a major increase in caprolactam production there, and concomitant demand for sulphuric acid.

Almost all (about 95%) of caprolactam is produced by reacting cyclohexanone (made from cyclohexane or phenol) with ammonia and sulphuric acid. Cyclohexanone oxime is converted to caprolactam via a process known as the Beckmann rearrangement, which occurs at 100°C in the presence of sulphuric acid. The oxime rearranges to become the lactam sulphate, which is then neutralised with ammonia, releasing the caprolactam with co-production of ammonium sulphate. The amount of AS generated depends upon the process. Earlier versions might produce up to 4.5 tonnes per tonne of caprolactam and consume relatively large volumes of acid, but more modern processes such as DSM’s HPO process have managed to get this figure down to 1.5-1.8 tonnes of AS per tonne of caprolactam.

Other routes for production of AS are ammonia scrubbing of coke oven gas (about 6.7 million t/a in 2023), and as a by-product of lithium iron phosphate production (1.3 million t/a). Other industrial processes such as nickel pressure acid leaching, methyl methacrylate (MMA) and acrylonitrile production, and ammonia scrubbing of emissions from coal gasification or coal fired power stations, which collectively represent another 4.7 million t/a of production. The rest (4.1 million t/a) is on-purpose production; there was a resurgence for on-purpose production of AS in the early 2000s, mainly of higher grade product which can attract a premium price, and such developments are continuing, but on-purpose production of AS still accounts for only 13% of the industry.

Overall, the world consumes around 17 million t/a of sulphuric acid to make ammonium sulphate, or about 6% of all acid demand in 2023, with the lion’s share of that coming from China, which consumed 6.9 million t/a of acid to make AS in 2023, or about 40% of production. Chinese AS production has risen because of a massive expansion in caprolactam production for synthetic fibres. China now represents around 60% of a total world caprolactam production of about 6.7 million t/a.

Ammonium sulphate (AS) has historically been used mainly (95%) used as a nitrogen fertilizer and AS consumption accounts for about 5.7% of the global nitrogen fertilizer market – a share which fell to a low point around 2010, but which has since been climbing significantly. One of the main reasons for this is that it is now also increasingly valued as an important source of plant nutrient sulphur; AS has a high sulphur content in the sulphate form, making it readily absorbable by plants. It also has a low pH, making it suitable for alkaline soils. Outside of fertilizer use, industrial use of AS accounts for only about 5% of world consumption, in applications such as cattle feed supplements and a variety of small pharmaceutical and chemical uses.

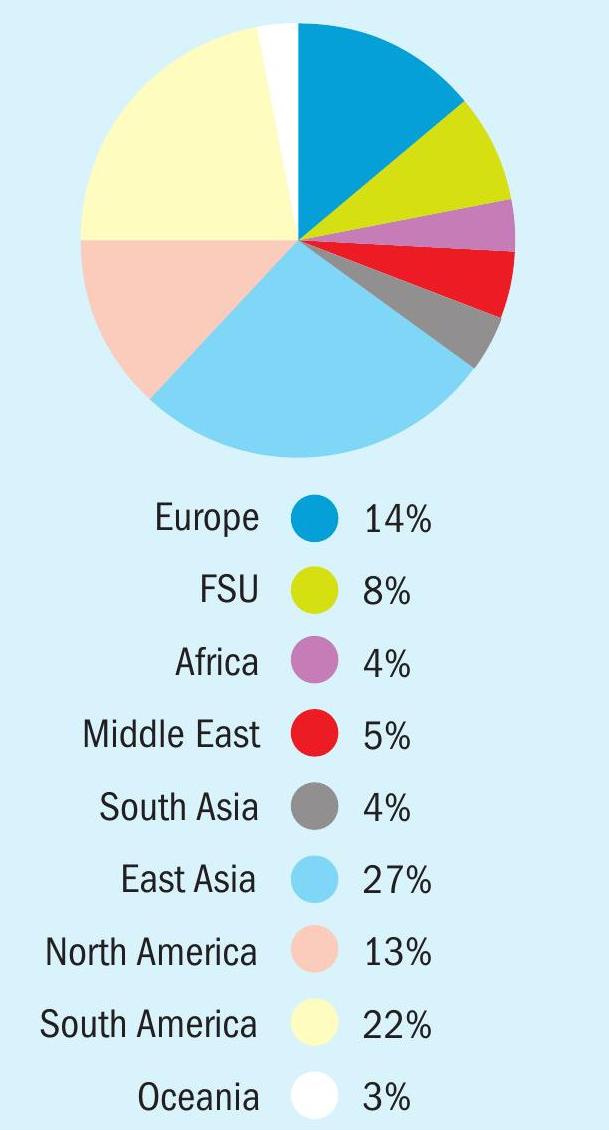

Consumption of ammonium sulphate declined during the 1980s and 90s as other nitrogen fertilizers like urea and ammonium nitrate became preferred, due to AS’s relatively lower nitrogen content, but the market moved back into growth in the 21st century, rising at 2.8% per year from 2000–2013, then dropping to 2.3% per year from 2013–2018, but the past few years have seen growth take off; AS consumption grew by 4.5% from 2022 to 2023, and it is forecast to top 5% this year. Demand is concentrated regionally; Southeast Asia, Latin America and Western Europe between them account for about 50% of world AS consumption. Figure 2 shows the regional breakdown of demand worldwide. The South American figure is dominated by Brazil, which represents two thirds of regional consumption.

Going forward, AS is expected to continue to capture a higher share of world nitrogen fertilizer demand, because of its sulphur content. Brazil has been a major growth market for AS, where it is beginning to substitute for urea and ammonium nitrates. China has responded with a surge in compacted granule capacity to meet Brazil’s requirements. China accounted for 95% of Brazil’s total imports in 2023 which has pushed European and US exports to find new locations to sell to. The surge in Chinese supply arrivals has also cut the value of the granular premium in the Brazilian market. Indonesia has been a major user, though consumption dipped in 202223, and southeast Asia in general remains a major consumer, with consumption rising in e.g. Myanmar. Overall, southeast Asian demand is forecast to rise from 6.5 million t/a in 2023 to 7.6 million t/a in 2028.

The surge in the Chinese caprolactam industry (and indeed other industries) discussed earlier means that most new AS capacity growth over the past decade has occurred in China, and China is forecast to continue to account for the major growth in AS capacity over the next few years. Chinese AS capacity has grown from 6.0 million t/a in 2010 to 22.3 million t/a in 2023, with a further 6.0 million t/a of capacity expected by 2028, some from new caprolactam based production, but mostly from LFP battery production, offsetting a decline in coke over gas production as China shifts towards lower carbon methods of steel production. By 2028, China is expected to represent 42% of all AS production.

At the same time, Chinese domestic demand for AS is relatively small, mostly for some blended products, and urea remains the preferred nitrogen fertilizer for Chinese farmers. This means that more than 85% of Chinese production is exported, and as a result, Chinese supply represents about half of all internationally traded AS. China exported 13.8 million t/a of AS in 2023, up from 8.7 million t/a in 2020, which has necessitated the hunt for new import markets.

Costs

A key determinant of AS demand is affordability. The cost of caprolactam production is mainly determined by the cost of benzene raw material to make phenol or cyclohexane precursor, but sulphuric acid and ammonia prices, energy costs, and the potential netback in terms of ammonium sulphate sales all have a bearing on production cost. Thus while AS production from caprolactam is involuntary, the AS market can nevertheless feed back into whether it is profitable to operate caprolactam capacity. AS tends to sell at a slight premium to per tonne nitrogen prices of other fertilizers due to its sulphur content. Nitrate prices in general are trending downwards at present, while sulphur and acid prices are rising. Prices at port for Chinese crystalline AS are expected to average $157/t f.o.b. in 2024 Q3 and follow a similar increasing trend to the end of 2024.

The effect on sulphur

As noted earlier, AS co-/by-production from caprolactam is in effect an index of sulphuric acid consumption in the process, with more modern processes requiring less acid. Most of the new plants in China use either ammoximation or HPOplus technology, both of which produce about 1.5 tonnes of AS per tonne of caprolactam, and consume slightly less than that in terms of tonnes H2 SO4 (100%). Even so, the same trends are visible in acid consumption as in AS production – most growth of acid demand from caprolactam production this century has been and is likely to be in China. While Chinese consumption of sulphuric acid continues to be mainly for fertilizer, caprolactam has contributed to the boost to Chinese acid consumption provided by industrial uses, as our article elsewhere in this issue discusses.