Fertilizer International 524 Jan-Feb 2025

22 January 2025

Latin American low-carbon ammonia projects

FLA PREVIEW – GREEN AMMONIA OUTLOOK

Latin American low-carbon ammonia projects

Latin America has become a desirable destination for green ammonia projects. This is linked to the region’s abundance of relatively inexpensive renewable energy, and large-scale fertilizer demand from a growing, high-value and import-dependent agricultural market. Ahead of Fertilizer Latino Americano 2025, Fertilizer International discusses regional green ammonia project prospects with leading players ATOME, Casale, Atlas Agro and Stamicarbon.

ATOME

Bringing the hydrogen revolution to the fertilizer sector

Introduction

ATOME is the UK-headquartered developer of three world-scale green fertilizer projects in Latin America: the flagship 145 megawatt (MW) Villeta and 300MW Yguazu projects, both in Paraguay, and its latest project in Costa Rica, expected to be similar in size to Villeta.

The flagship Villeta project will be located 35 kilometres from the capital city of Asuncion, the country’s main import/export centre located on the River Paraguay. The project will produce up to 264,000 t/a of ‘green’ calcium ammonium nitrate (CAN) fertilizer – using surplus hydroelectricity generated by the Itaipu dam on the Brazilian-Paraguayan border (see photo) – potentially displacing up to 500,000 t/a of CO2 emissions versus conventional fertilizer production and application.

Villeta will be sited within an existing industrial complex that is already home to fertilizer producers and consumers. ATOME is due to make the final investment decision (FID) soon, with Villeta scheduled to enter production in 2027. Recent landmark project developments include:

- A 145MW power purchase agreement (PPA) with ANDE, the national power company of Paraguay, the largest single PPA ANDE has signed with an industrial user at the lowest industrial tariff

- The granting of a Free-Trade Zone to ATOME in November 2023, meaning the project will benefit from exemptions on municipal, VAT and corporate income taxes

- The completion of the project’s Environmental and Social Impact Assessment (ESIA) in February 2024

- The completion of the project’s front-end engineering and design (FEED) during the first half of 2024

- The signing of a heads of terms for the long-term sale of all of the project’s renewable fertiliser output to Yara International in July 2024

- Announcement of Casale as the project’s engineering, procurement and construction (EPC) contractor in November 2024.

ATOME’s three-year journey

Olivier, it’s only three years since ATOME was first listed on the London Stock Exchange’s AIM market. In fact, the company remains the only pure play green fertilizer producer on the London market. Could you give our readers a quick pen portrait of the company and outline the remarkable progress it’s made during the last 36 months?

“The genesis of ATOME is really about the hydrogen revolution. It comes down to our very fundamental view that a lot of hydrogen today is used to make ammonia – and that 80% of all ammonia makes fertilizer.

“So we saw that the hydrogen revolution – from a business and investment point of view – will initially be the fertilizer revolution. Then the next hard realisation is that the fertilizer sector emits more annual emissions than shipping and aviation combined, and yet feeds half of the world, right?

“ATOME’s ethos is how to develop green fertilizer projects, which have a market impact, a climate impact, with the least requirement for, or exposure to, subsidies. Number one for us was how can we be commercially viable without subsidies – which take forever – and also be seen as a partner in the countries where we operate.

“Our ethos is also to actually kill two birds with one stone, taking action on climate change and on food security – that’s at the heart of a big opportunity today. It’s an opportunity to move away from having big, centralised fertilizer supply centres, in Egypt, in Saudi, in Russia, in the US, and give countries with access to renewable power the opportunity to suddenly have decentralised low-carbon, domestic fertilizer production instead.

“That’s a great opportunity for a number of reasons, one obviously being security of supply. With the Ukraine war, has come the reality that we are highly dependent on other countries, especially in Latin America, which imports the majority of its nitrogen fertilizers, and in 2022 saw prices absolutely shoot through the roof.

“It comes down to our fundamental view that most hydrogen today is used to make ammonia – and that 80% of all ammonia makes fertilizer. The hydrogen revolution – from a business and investment point of view – is initially a fertilizer revolution.”

“We clearly saw there was an opportunity to accelerate the change from old ‘grey’ fertilizer production systems to the new ‘green’ low-carbon systems and also do that in an economical way, because everybody says that if it’s ‘green’ it has to be more expensive. Well, guess what, if you have the right type of renewable power in the middle of the right agricultural demand markets, you can actually produce green fertilizers very competitively.

“That’s one of the reasons we chose calcium ammonium nitrate (CAN27) for our first project, Villeta in Paraguay. Most of the world’s CAN-27 is produced and used in Europe but by the time it gets into the hands of farmers in Brazil, Argentina and Paraguay – adding logistics, demurrage, taxation, you name it – it’s actually quite pricey. So, producing CAN-27 domestically, without all of the logistical costs, can actually be competitive.

“There’s also a need to understand how to develop infrastructure projects, which are inherently complicated and take a long time, in a certain way. You’re going from electrons to molecules, from long-term power purchase agreements (PPAs) to short-term commodity events, in the middle of a green fertilizer market that’s still in its infancy.

“One of ATOME’s strengths, let’s call it our secret sauce, is a team capable of combining the right type of project development with what’s very much a risk-based approach across the entire value chain. The risk of this market has a supply side, a policy side and a technology side.

“How do you make sure you don’t take technology risks? Obviously, it’s about right sizing, finding the right technology partner and finding the right type of power – because these are chemical facilities that need to run 24/7. ATOME’s projects are in certain countries in the world where you have a lot of hydroelectric power. That baseload supply gives us a very real competitive advantage.

“Why did we list on the London Stock Exchange (LSE)? Well, number one for us is the expertise of the company.

“It’s a small team with a lot of individual expertise. Terje Bakken spent 20 plus years with companies like Yara and EuroChem as a senior VP. Our chairman and major investor Peter Levine has successfully floated and exited a number of energy and infrastructure companies on the LSE. And I was Chief Investment Officer at the International Finance Corporation, part of the World Bank Group, with a seven billion dollar portfolio of infrastructure and energy projects.

“It’s all about putting the right complementary team together, with technical capacity, financing capacity, and fertilizer industry expertise, and also understanding the proposition going into Paraguay and Costa Rica first. Being listed on the London Stock Exchange provides full transparency and clarity, so it’s much easier to cut through at the government level and for them to understand very quickly who we are.

“This helps with creating and establishing industry-leading partnerships. Energy engineering company Baker Hughes became an investor because they saw we are a small, agile team punching above our weight who can get things moving very quickly. This is something we recognise with our engineering and construction partner Casale – a company with a long history yet is family-owned and also agile.

“With such a big market, you can start small, inch by inch by inch, because 260,000 tonnes of fertilizer production capacity per project is barely 1% of Latin American regional nitrate demand. So it’s all about making a dent, but starting slowly, rather than the worldview of some fertilizer producers – which is go big or go home.

“That’s one of the reasons that we’ve really found a kindred spirit in Casale – they’re very focused on reducing emissions, increasing efficiency at the lower end of the production capacity scale.”

Why Latin America?

I’m sure delegates at the forthcoming Fertilizer Latino Americano conference in Rio in January will be interested to learn why ATOME chose to locate its project slate within the region – and Paraguay and Costa Rica in particular?

“Paraguay was by far and long the first country in the list as, in a good year, they only use about three of the seven gigawatts net of hydroelectric power available from the Itaipu dam and export the rest to Brazil and Argentina. So there’s a motivation for Paraguay to use more of these electrons to create more value domestically.

“With hydroelectric power, ATOME can produce fertilizer at a stable, longterm cost. And from a government point of view, Paraguay can create more green jobs, more value-added from this incredible domestic hydroelectric resource and support its agri sector.

“Paraguay is a country which has been extremely stable over the past 40 years, is fully dollarized, now investment grade, and whose biggest export is electricity and second biggest export is agri-products. And, guess what, within a 2,000 kilometre radius, ATOME can sell multiples of the fertilizer volume it produces in Paraguay into Argentina and Brazil, part of free trade bloc Mercosur.

“Yara, our offtake partner at Villeta, has just signed a green fertilizer supply agreement with coffee producers in Brazil and already has an agreement with a large potato grower in Argentina. So this is a regional agricultural market which wants stability, security of supply and is looking for green credentials as well.

“Costa Rica is for us a country which, again like Paraguay, has a very good investment reputation in general combined with very high premium crops, like pineapples, bananas and so on. So the costs of fertilizers for growers in this region, on a relative basis, is a lower than if we went straight for other lower value broad acre crops.

“The ability to add value from zero-carbon fertilizers is higher in Costa Rica and the right type of power supply, a mix of hydro and wind, is also there. I think it also comes down to the fact that we are trying to right size our projects as well and have positive development impacts in the country.”

Flagship Villeta project

Is ATOME pleased with general progress at its flagship Villeta project over the last 12 months or so. Do the company’s plans to develop a world-scale green fertiliser project remain on track?

“Are we pleased? Yes, with what the project has evolved into from the first discussion three years ago – it originally started as a 60 megawatt project not a 145 megawatt one – to where we are today. We’ve basically modernised, found ways to save costs, because at the end of the day green fertilizer is great in principle, but it’s a cost story.

“You’re not going to be able to sell expensive fertilizer anywhere. You have to be the lowest cost product available in the market where you are to ensure you always sell all of your products.

“Could project progress have taken less time? Yes, but that was to always make sure we de-risked everything as much as possible. As a result of that, we’ve had a lot of interest in debt finance and subscriptions from all the major development finance institutions – IFC, IDB, CAF, DFC, you name it – because we are bang in the middle of addressing both climate change and food security. So, from that point of view, we’re also very pleased with their support.

“We are with the right partners on the equity side of the project. But I think we shouldn’t shy away from saying, guess what, it’s bloody hard.

“Technology wise, there’s nothing new as we are using alkaline electrolysers, an existing 100 year old technology, at an industrial scale because that’s what you need to be commercially competitive. But we are still asking investors to do something they have never done before by combining green electrons to make green fertilizers.

“You can finance power plants a dime a dozen and finance chemical plants a dime a dozen. But in combining the two together in one project as ATOME is doing you have a very different investment profile, falling between industrial investors and infrastructure investors, which has certainly been an interesting challenge for us.

“We are pleased with Casale as EPC contractor for the Villeta project. We’ve been able to benefit from their experience on green ammonia projects elsewhere and bring that experience into Villeta.”

“On the engineering side, are we pleased where we landed with Casale as EPC contractor? Yes, we are. We’ve been able to benefit from their experience on low-carbon ammonia projects elsewhere and bring that experience into the Villeta project and some of the relationships.

“As mentioned, it’s all about managing every single risk along the way. So we’ve made a lot of noise around our achievements with the operating license, permitting and the Environmental and Social Impact Assessment (ESIA).

“Yes, it’s a relatively low impact project from an environmental point of view, but we’ve seen so many projects delayed because people leave the ESIA until the last minute. So the ESIA was one of these things we tackled head on, early on, basically as soon as we bought the land, and did it to IFC performance standards.”

Yara’s backing

Yara is committed to growing the market for green fertilizers, particularly through strategic partnerships. In that context, how important – for both companies – is the offtake agreement with Yara for all of Villeta’s output?

“We chose CAN-27 and not another type of fertilizer as it’s a big Latin American market and it’s also a premium fertilizer with valuable agronomic qualities. That’s important because you start with a premium market, you prove your concept with a premium market with higher margins which provide more space to be competitive.

“We are not going to be fertilizer distributors – this is not the ethos of ATOME. Instead, we will be producing the molecules and will then partner with the best offtakers.

“It really is a partnership with Yara. We have a very strong strategic alignment on what we want to do together and on growing the market together. Because when it comes to CAN, Yara is the best fertilizer producer around, bar none, and are also the most mature producer on the green fertilizer market side of things.

“Each company is good at what we do. Yara invests a lot to make sure that they get the best premium for fertilizer and bring it to the right market. And ATOME is investing a lot to make sure that we have a green fertilizer product to deliver.

“Sustainability goes hand in hand with profitability, at the end of the day, and we have an ambition to be highly environmental, but we are not a charity. This is, again, where we push back hard on anybody saying that they need subsidies to succeed – if you need long-term subsidies, you’re a charity, not a business. We have the same view with Yara, it’s a partnership that needs to make long-term economic sense.”

Casale secured as EPC contractor

What does having the backing of a hugely experienced and highly regarded technology licensor such as Casale mean for the project’s future?

“We try to have the best partners along the way. AECOM who act as Owner’s Engineer in the early phases of Villeta had a lot of engineering expertise across the power side, electrolysers and compressors, and also on the ammonia side, because it’s such a big group. They were tasked with shortlisting potential FEED and EPC contractors for our plant.

“We landed on Casale and Urbas Energy for front-end engineering design as people who could move into engineering, procurement and construction. The Urbas team has expertise in Latin American projects and has done the engineering for hydrogen projects in Spain.

“Casale has delivered over 300 ammonia plants globally and the whole dialogue was much easier with a smaller, more integrated company. It was smart of Casale doing the FEED stage as a JV with Urbas, with expertise on the hydrogen side.

“After that, what we saw clearly as we scaled up the project was that Casale was uniquely placed – on the ammonia side, on the nitric acid side, on the granulation side – with all of these various technology add-ons that are unique to them and offering an integrated solution to ATOME.

“We push back hard on anybody saying that they need subsidies to succeed – if you need long-term subsidies, you’re a charity, not a business.”

“As project developers, we need to know the maximum engineering and construction cost to help resolve the financing, the price we have to sell our product, and to make the project bankable. We’ve all seen cost inflation going through the roof and projects being cancelled in the US and elsewhere – so keeping a tight cost control has been key to ensure we get the project to construction.”

Financing and go ahead

What are the next steps enabling Villeta to move to a final investment decision (FID) – and is this still on track?

“On the debt side, we are widely oversubscribed, which is going to help us optimise terms. And on the equity side, we are basically in the final negotiation rounds. All of the costings have been done, all of the permitting is in place – and we know the project makes sense economically. But until we have final clarity on equity finance, we will not announce the details.

“That said, we do expect to start early works on the ground in Paraguay, clearing the land and starting the basic civil engineering in due course. We have aggressive timelines and will just continue with these.”

Progressing the Yguazu and Costa Rica projects

ATOME has even more ambitious plans with the larger-scale 300MW Yguazu project in Paraguay and a project venture in Costa Rica. How are both projects progressing and what are the likely timescales for these to enter production?

“The Villeta project’s development phase has taken about three years and we expect the development of our next two projects to take between 18 months and two years. The whole idea of everything we’re doing – by creating the relationships, the templates and the engineering – is we can use all of the lessons learned to accelerate project deployment so we can do it faster and cheaper.

“As soon as the FID and full financing of Villeta are announced, we will start the hard miles on the Yguazu project. We finished the electromechanical study, which tells us which location has the least negative effect on the grid and makes the most sense from an infrastructure point of view, and, all in, I think Yguazu will be trailing about 18 months behind Villeta.

“When it comes to Costa Rica, it’s going to be roughly the same size as Villeta, so what we’re trying to do from an engineering point of view is have it as a ‘copy-paste’ of Villeta. We also have a decent idea of the location and are working in a formal partnership with ICE, the power producer.

“There is a strong dynamic in Costa Rica but it is a slightly different discussion in Costa Rica because unlike Paraguay you do not have five gigawatts of excess capacity in a smaller country. There’s close alignment with ATOME because we fit exactly with where Costa Rica wants to invest – which is in green agriculture and taking care of its farmers.

“Overall, we can apply a lot of things from Villeta in Costa Rica. So, while I would expect that the Yguazu project will be 18 months before reaching FID, I would say add another sixth months on for our project in Costa Rica.”

CASALE

Casale – leading the green fertilizer revolution

Francesco Baratto, the Head of Casale’s Syngas Department

Introduction

The Villeta Green Fertilizer Project (GFP) in Paraguay represents a step change in fertilizer industry sustainability – by capturing renewable energy and transforming this into zero-carbon fertilizers using innovative technologies.

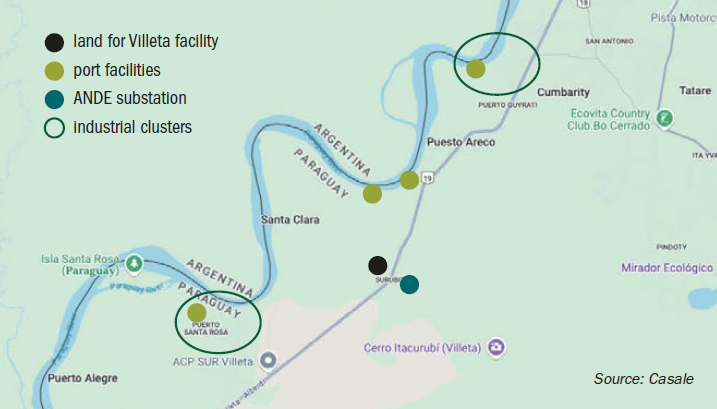

The project, located 35 kilometres from Asunción along the Paraguay River, will establish a world-scale green fertilizer production plant using Paraguay’s abundant hydropower. The project is designed to meet both domestic and international fertilizer demand while significantly reducing GHG emissions, offering an exemplary model for sustainable industrial development.

Paraguay – a land of opportunities

Paraguay is uniquely positioned to lead the green energy revolution. With nearly 99% of its electricity derived from renewable sources, primarily from the Itaipu Dam, Paraguay boasts one of the world’s greenest energy profiles. The country uses only 30% of its 50% share of Itaipu’s electricity, leaving a significant surplus available for industrial development.

The demand for fertilizers in Paraguay is driven by the need to maintain and increase agricultural productivity. Ultimately, agricultural sector growth is also determined by fertilizer availability, given the strong link between fertilizer use and crop yields.

Villeta Green Fertilizer Project – the fundamentals

Spanning a 75-acre site in a designated free-trade zone, the Villeta project will produce green fertilizers using 100% renewable baseload electricity. Its location is ideal logistically, offering proximity to the river and the capital city with easy access to import and export routes. These excellent logistics – by enabling the efficient transportation of raw materials and finished products – are a major contributor to the project’s economic viability.

Key project partnerships

The Villeta project brings together a consortium of top level international and domestic partners:

- ATOME is a leading UK-based green fertilizer project developer listed on the London Stock Exchange. It is spearheading the project alongside a global pipeline of other green energy ventures with a total capacity of more than 600MW.

- Casale is implementing the project’s cutting-edge green fertilizer production solutions. The century-old engineering firm is renowned for its expertise in ammonia and fertilizer production technologies. The collaboration between Casale and ATOME began in 2022 with the award of the basic engineering design contract for the Villeta project’s green ammonia synthesis loop. Subsequently, the scope of Casale’s project work has expanded beyond engineering design to encompass the licensing of all core technologies — for ammonia synthesis, nitric acid, ammonium nitrate solution (ANS), nitrate granulation — and, most recently, providing all the necessary engineering, procurement and construction (EPC) services required to bring the entire project to completion

- Paraguay’s national electricity authority ANDE, as renewable energy provider, is the project’s backbone.

- Inter-American Development Bank (IDB) acts as the project’s international financial advisor, providing financial stability and credibility while ensuring project objectives align with sustainable development goals.

Collectively, these partner companies, by bringing a wealth of expertise and innovation to the project, should ensure its success and sustainability.

Technology and processes

The Villeta project stands out for incorporating advanced technologies designed to ensure high efficiency, sustainability and scalability. The project’s main technological pillars are:

- Alkaline electrolysis (AEL) technology to generate green hydrogen

- A cryogenic air separation unit (ASU) to supply nitrogen – the other critical input for green ammonia synthesis Combined, these Casale technologies meet the Villeta project’s ambitious output targets by collectively enabling the production of 768 tonnes per day of calcium ammonium nitrate (CAN).

- SMART-N technology for small-scale green ammonia synthesis

- The dual-pressure DualPURE process for nitric acid production

- Finally, the conversion of nitric acid into ammonia nitrate solution and granular calcium ammonium nitrate (CAN), respectively, via NitroPIPE and NitroC-ULTIVA process technologies.

Conclusions

The Villeta Green Fertilizer Project, by capturing Paraguay’s abundant hydropower and implementing cutting-edge technologies, provides a model for green industrialisation. Indeed, it sets a benchmark for the future of fertilizer production by aligning the twin goals of economic growth and ecological responsibility.

The project also exemplifies how renewable energy and industrial innovation can come together to address the dual challenges of environmental sustainability and agricultural productivity. This landmark venture notably combines innovation, entrepreneurialism and leadership with solid engineering and the very highest standards in project execution.

Fig. 1: The Villeta Green Fertilizer Project (GFP) is located in Paraguay, 35 kilometres from the capital city of Asuncion on the River Paraguay

Fig. 1: The Villeta Green Fertilizer Project (GFP) is located in Paraguay, 35 kilometres from the capital city of Asuncion on the River Paraguay

As this project illustrates, Casale remains firmly engaged in promoting sustainable development throughout the global chemical industry and is committed to transforming the production of essential chemicals.

Watch this space!

Casale’s full technical article on the Villeta Green Fertilizer Project and its ground-breaking use of low-carbon technologies will be published in the forthcoming March/ April 2024 issue of Fertilizer International magazine.

ATLAS AGRO

Brazil – the best place to build a green fertilizer plant?

Introduction

Atlas Agro is developing two flagship projects: the Pacific Green Fertilizer (PGF) plant, located in the Horn Rapids industrial park in Richland, Washington, in the United States, and the Uberaba Green Fertilizer (UGF) plant in Minas Gerais, Brazil.

Brazil, as a global agricultural powerhouse, offers Atlas Agro great fundamentals as a fertilizer project location. The country is also heavily import-reliant for its nitrogen fertilizer supply. Atlas Agro’s ambition, therefore, is to establish domestic ‘green’ nitrogen fertilizer production to substitute for imported ‘grey’ fertilizers.

The 530,000 tonne capacity UGF project has progressed during 2024, with notable highlights including:

- The award of dual feasibility engineering contracts in February

- Project selection for the Brazil Climate & Ecological Transformation Investment Platform (BIP) platform

- An agreement with Casa dos Ventos to supply 300MW of renewable energy for the production of green ammonium nitrate.

Next steps for the UGF project include the front-end engineering design (FEED) followed by construction. The project is currently scheduled to enter commercial production in 2028.

Flagship projects

What’s the history of the company, Petter, and what’s so innovative about its project portfolio?

“Already, when I was Head of Production of Yara, we found out there was no technical reason you couldn’t build zero-carbon fertilizer plants, as the production technology was proven and available and the environmental benefits were clear – so all that was then left was to find the right business model.

“When I left EuroChem some years later, the industry itself still had no real plans to move away from fossil fuels. It was dabbling, as it is now, in carbon capture and storage, but not really considering green fertilizer plants, and had not yet seen the full potential of the green production model.

“I then thought: hey, this presents an opportunity, why not try to pioneer green fertilizers – it has to be done now. That was the reason for starting Atlas Agro and, at that time, the optimal place to construct a green fertilizer plant was in Brazil.

“Fundamentally, If you do not rely on government support or carbon taxes, Brazil is the most attractive place to build, as it imports 95% of its nitrogen fertilizer, represents a large and growing ag market, grows high-value crops and has abundant renewable energy. Brazil is also large – so building in-market green fertilizer plants has strong transportation costs advantages.

“That’s why I reached out to Knut Karlsen, my co-founder, who was then living in Brazil. And we started the business development on the Uberaba Green Fertilizer (UGF) project three years ago.

“Following the launch of the Inflation Reduction Act the US sailed up as an attractive place to construct, which is why we’re developing the Pacific Green Fertilizer (PGF) plant in Richland. Lately, we see Europe becoming an attractive region too, following the introduction of the RED III and CBAM legislation.

“That’s our early portfolio – and our focus is on getting the first plants built in each region.

“When it comes to expectations, the US Pacific Green Fertilizer plant is close to getting its final permits and confirmation of the grid connection it needs. So our hope is to start construction in 2025.

“In Brazil, we’re a little bit behind, but plan to start the front-end engineering design (FEED) on the Uberaba Green Fertilizer (UGF) plant soon – which will be based on the design of the Richland plant. Hopefully we’ll have started by the time of the FLA conference and, if not, it’s imminent. The UGF FEED should be efficient, which means, realistically, I hope we can make the final investment decision (FID) in Uberaba in early 2026.”

Uberaba Green Fertilizer (UGF) project update

Delegates at Fertilizer Latino American in January will be very interested to learn more about Atlas Agro’s Uberaba Green Fertilizer (UGF) project in Minas Gerais, described by the company as a first-of-its kind venture in the southern hemisphere. Why did Atlas Agro decide to locate in Brazil, what advantages does the country confer, and how is the $1.15 billion UGF project progressing?

“Brazil requires a lot of fertilizer, but most of it is imported. Local supply increases food security, brings jobs and economic activity and replaces hard currency imports. Brazil also has a lot of high-value crops like sugarcane, citrus, coffee that benefits from using nitrates instead of urea.

“Richland is an agricultural centre for high value crops in the US that also imports most of its fertilizers. It’s a fruit and vegetable market – much of the potatoes and apples grown in the US are grown there. So the Richland and Uberaba projects are both in good places.

“Fortunately, a site was available in Uberaba in an industrial zone that was previously slated for an ammonia plant, reducing siting and permitting risk.

“We’ve concluded a dual feasibility engineering study on Uberaba and expect to start front-end engineering design (FEED) soon as a next step. And we’ve signed a cooperation agreement with Casa dos Ventos, a good renewable energy partner.”

Pacific Green Fertilizer (PGF) plant update

Atlas Agro’s flagship Pacific Green Fertilizer (PGF) project made major strides in 2024. The company recently completed the project’s front-end engineering design (FEED), for example, became part of Pacific Northwest Hydrogen Hub, and also signed a binding strategic offtake and partnership agreement with International Raw Materials Ltd (IRM). What’s the current state of play with the PGF project, Petter?

“Our hope is to start construction in 2025. The front-end engineering and design (FEED) was completed this year and we are working on the optimal execution strategy.

“Our strategy for the project and the amount of equity we need partly depends on the US Inflation Reduction Act’s (IRA) green hydrogen tax credit (45V). The final guidance will be out by the time of the conference, but now at the end of 2024 we are eagerly anticipating the details.

“Then there will be a new US administration, which may or may not influence the IRA. We’re using the time now – in anticipation of 45V – for continuous improvement of the project and to get the final environmental permits and the details about the grid connection clarified.”

COP29 announcements

Atlas Agro recently secured a $80 million grant from the USDA’s Fertilizer Production Expansion Program (FPEF). The announcement was made by Tom Vilsack, US Department of Agriculture Secretary, at the COP29 summit in Baku, Azerbaijan, at the end of November. The grant will support the development of the PGF plant in Richland, Washington. Additionally, Atlas Agro also revealed it had been selected for the final cohort of the global Agriculture Innovation Mission for Climate (AIM for Climate) initiative designed to accelerate climate-smart agriculture solutions. Atlas Agro clearly had a busy and productive time at COP29 – how important are the announcements made during the summit to the company and its project ambitions?

“We were honoured to be invited to COP29. The World Intellectual Property Organization, WIPO, had invited us to speak, for example, as they’d selected our technology as part of a their annual book on the most promising climate technologies.

“The second invitation was from the consortium behind the industrial transition accelerator (ITA) – a programme to find energy transition projects and help them become reality. Our Uberaba project was one of three selected from Brazil.

“The Pacific Green Fertilizer plant received $80 million from the USDA to expand the fertilizer production, as the Pacific Northwest imports most of its nitrogen, partly from the US and Canada but also from Russia.”

Imaginative new policies necessary

Petter, you’ve spoken recently about the limitations of current market interventions. Subsidies like the US Inflation Reduction Act require taxpayers to foot the bill, for example, while taxes like EU’s Carbon Border Adjustment Mechanism (CBAM) and Emissions Trading System (ETS) require the customer to pay. You’ve suggested instead that a more efficient and effective solution would be for the industry itself foot the bill – in the form of a ‘minimum price guarantee fund’. How would this fund work in practice and what are its key advantages, in your view?

“Our projects are profitable and are getting built. But it’s too little and too slow. Because if we want to decarbonise nitrogen and remove the 2% of global emissions they make up, we need about 800 green fertilizer plants of our size globally. With each one taking about five years and one and a half billion dollars to build – the challenge is very large.

“The main impediment to faster growth is the need for project finance and the risk perception of the banks.

“If the newly built green nitrogen plants pay into some kind of insurance fund, the fund can cover bank repayments in case world market prices for fertilizers fall below what is needed to pay back. This would give banks confidence to support the energy transition.

“The beauty of such a mechanism is that, unlike a grant or a loan, there is not an official selecting winners and losers – as participating plants would already have been built, leaving the private sector to take care of selecting the most viable projects. There is also no risk of wasting grants or loans on projects that are never completed.

“The scheme can cover a large number of plants. An initial $2-5billion fund would cover the 30 plants Brazil needs to become self-supplied by fertilizer. If you look at the tax revenues that would accrue to Brazil from the plants built those would be factors higher.”

Reaching a final investment decision (FID)

There’s an exciting 12 months ahead for Atlas Agro, given the company’s ambition is for its two flagship projects – one in the US and one in Brazil – to reach a final investment decision (FID). What’s the pathway and key steps to achieving that goal?

“Green doesn’t mean more expensive, it means different. We don’t need a green premium to compete on average. We don’t have variable input costs like fossil gas, we have fixed power costs – so we can offer fixed price fertilizer on long-term contracts, ceiling prices and other mechanisms to food companies, for example.

“We very much want to be the partner of choice to the Brazilian authorities and agricultural community – to work towards self-sufficiency for nitrogen fertilizers in Brazil. Our Uberaba plant has come far and we hope it is the first of many in the country.”

STAMICARBON

Insights on the future of nitrogen technology

Introduction

Stamicarbon is the nitrogen technology licensor of NEXTCHEM (MAIRE group). Ahead of Fertilizer Latino Americano 2025 in Rio In January, Mauricio Medici, the company’s regional licensing manager, sat down with Fertilizer International to discuss the opportunities and challenges faced by regional fertilizer producers – and how cutting-edge technologies for green ammonia and emissions reduction can help Latin American countries meet their agricultural and environmental goals.

Opportunities in a dynamic regional market

Mauricio, as a company, Stamicarbon is committed to sustainable and efficient fertilizer industry growth. What are the main challenges and opportunities for innovative production technologies in the Latin American market?

“Latin America is a dynamic and growing market for nitrogen fertilizers. That’s being driven by the region’s strong focus on agriculture and the growing emphasis on improving crop yields. The region does face its own challenges, however, such as infrastructure constraints and the diverse regulatory and political landscape.

“It’s a market therefore that requires adaptable nitrogen production technologies capable of catering to these differing dynamics. For example, Stamicarbon’s proprietary urea and nitric acid technologies, as well as being highly advanced and designed for maximum efficiency, can be specifically tailored for different scales and infrastructure set ups.

“This adaptability is definitely a real strength – as it offers significant opportunities for Latin American companies to make the shift to more sustainable, viable and efficient fertilizer production even when limited infrastructure is available.”

Supporting Latin America’s energy transition

How will Latin America contribute to the global shift to sustainable fertilizer production in future – and what role will Stamicarbon play in supporting this transition?

“Latin America, in my view, with its abundant renewable energy sources, like hydropower, wind, and solar, is well positioned to set up low-carbon nitrogen plants and provide local markets with much needed reduced carbon footprint fertilizers. Stamicarbon is supporting this transition by providing small- to medium-scale ammonia technology – at capacities between 50 and 500 tonnes per day – that is scalable and can utilise these renewable resources to synthesise green ammonia.

“Our partnerships with regional EPC companies – together with our continuing commitment to innovation – are making the production of ammonia with a reduced carbon footprint both economically feasible and environmentally sustainable. This will definitely enable Latin American producers to contribute significantly to global efforts on decarbonisation in my view

“I feel very positive about the region’s future potential. Especially as our ability to offer full life cycle solutions – from feasibility studies and technology implementation all the way through to technical support and services – means we are ready to help Latin American producers navigate and lead in the transition toward a more sustainable nitrogen fertilizer industry.”

Overcoming practical hurdles to adoption

What practical challenges to the adoption of green ammonia in Latin America, have you encountered – and how is Stamicarbon working to overcome these hurdles?

“A good question! The capital cost associated with green ammonia installations, where electrolysers take a major portion, is one of the primary challenges, along with the need for stable renewable energy sources, plus the necessary infrastructure to allow hydrogen production at reasonable scales.

“Responding to that, Stamicarbon has focused on developing modular and scalable green ammonia technologies that can, firstly, lower entry costs and, secondly, be compatible with smaller, decentralised renewable energy sources. These flexible solutions provide Latin American producers with the opportunity to start small initially, and then scale up as renewable infrastructure and/or demand improves, making low-carbon ammonia a viable option, even for emerging markets in the region.”

Emissions reduction – another priority

Are you seeing demand from the region’s producers for technologies that help reduce emissions, particularly in countries with stringent environmental regulations?

“Yes, absolutely, as Stamicarbon offers a range of effective technologies, each one designed to offer its own tailored approach to emissions reduction. Our NX Stami Urea™ portfolio, for example, features a range of advanced designs. These minimise ammonia emissions during urea production, while also reducing steam consumption, which is typically generated by natural gas-fed boilers. The end result is a cleaner, more sustainable fertilizer manufacturing process.

“What’s more, we also offer NX Stami Nitrates™ , a tertiary abatement system, part of the NX Stami Nitrates™ portfolio, specifically designed to help producers reduce nitrogen oxides (NOx) and nitrous oxide (N2O) emissions, the two primary greenhouse gases associated with nitric acid production. These type of systems are highly effective in controlling emissions, and are helping producers in Latin America – and worldwide – meet even the most stringent environmental standards and reduce their carbon footprints.

“In November 2024, and this is a great case study example in the region, we signed a contract to provide a license and process design package (PDP) for a tertiary abatement system at Soluciones Químicas’ nitric acid plant in Minatitlán, Veracruz, Mexico. By efficiently removing nitrous oxide (N2O) from the nitric acid plant’s tail gas stream, this project managed to successfully bring the plant’s environmental performance in line with current emission regulations in the country.

“Latin America, in my view, with its abundant renewable energy sources, like hydropower, wind, and solar, is well positioned to set up low-carbon nitrogen plants and provide local markets with much needed reduced carbon footprint fertilizers.”

New process and digital technologies

Are there any advances in urea production technology that can help Latin American producers operate more efficiently and sustainably?

“In urea production, Stamicarbon’s is pursuing improvements in energy efficiency and resource consumption – mainly by targeting process optimisation and heat integration. Our Ultra-Low Energy (ULE) design for large-scale urea production, for example, delivers significant reductions in steam consumption, these translating into lower operational costs and a reduced environmental impact.

“Latin American producers, by adopting advanced urea production technologies – to increase their yield and efficiency and reduce emissions etcetera – can realistically position the region as a leading and self-sufficient centre for fertilizer production in my view.

“The integration of digital technologies can also play a crucial role in enabling plant operators to achieve their environmental goals – by tracking emissions, ensuring compliance with environmental regulations and helping plants minimise their carbon footprint. Stamicarbon’s Digital Process Monitor tool is a case in point, as it combines real-time process monitoring with predictive analytics and an advanced mathematical model, so enhancing productivity while also reducing energy consumption.

“For us, equipping personnel with the necessary skills to run their plants at maximum capacity, safely and with minimal emissions is always a priority. That’s why we developed our Technology Training Simulator.

“This highly advanced training tool realistically simulates operating scenarios and process upset conditions – and is suitable for operators, engineers, and management. It’s customisable too and can precisely replicate all the elements of a customer’s urea, ammonia, or nitric acid plant, including its process equipment, control systems, and interlocking mechanisms, while also maintaining a realistic look and feel.

“We’re convinced that The Digital Process Monitor and Technology Training Simulator – both part of our NX STAMI Digital™ portfolio – really do offer fertilizer producers in Latin America an opportunity to optimise their operations and improve efficiency.”

Vision for the future

What are Stamicarbon’s long-term goals in Latin America, particularly for low-carbon technologies?

“Well, in the long-term, our aims in Latin America are to promote sustainable growth in the nitrogen fertilizer industry, and support regional players in transitioning to technologies with a reduced carbon footprint. We do recognise the global challenges faced by green hydrogen and ammonia projects and, as a result, the slow market development for green ammonia itself.

“That’s why Stamicarbon also offers low-carbon ammonia technologies, combining its small- to mid-size ammonia loop (50-500 t/d) with NEXTCHEM’s NX-CPO™ process for ‘blue’ hydrogen production from natural gas – the aim being to bridge the gap between ‘grey’ and ‘green’ ammonia production in the coming years while still significantly reducing carbon footprints.

“Overall, our ambition is to remain a trusted partner for Latin American producers by providing innovative and efficient solutions for urea, nitric acid, and green ammonia production. As a company, we are focused on sustainability, and that includes continuously refining our production technologies to further reduce emissions, lower energy consumption, and encourage the shift to renewables.

“I guess our ultimate vision, and I know this will be widely shared, is to create a thriving Latin American fertilizer industry that contributes positively to the global nitrogen market and environmental goals. Stamicarbon will be part of that future, in my view, by empowering producers with the right tools and knowledge to achieve their sustainability targets.”

Acknowledgement

Additional reporting by Nikolay Ketov, Stamicarbon’s public relations officer.