Sulphur 416 Jan-Feb 2025

31 January 2025

Chinese phosphate exports

CHINA

Chinese phosphate exports

Although China remains the world’s largest phosphate producer, it has been overtaken as the largest exporter by Morocco in recent years as domestic producers face continuing restrictions on exports.

China’s huge domestic phosphate industry continues to set the pace for the global sulphur markets. In 2024, of a traded international sulphur market of around 36 million t/a, China was responsible for importing one quarter of that, and only Morocco is comparable in terms of import requirements. China consumes one third of all sulphuric acid produced worldwide, and its phosphate industry accounts for about half of that.

The Chinese phosphate industry grew rapidly during the first two decades of this century, as the country sought to replace its rapidly growing imports of ammonium phosphates (MAP/DAP) to feed increasingly intensive agriculture with domestic phosphate production. China has the world’s second largest reserves of phosphate rock, and used ammonia produced from coal gasification to feed ammonium phosphate production. Overbuilding of capacity turned China into a large net exporter of phosphates, a position which it continues to maintain.

However, attempts to rein in domestic over-application of fertilizer and consequent environmental impacts, as well as increasing curbs on emissions from Chinese factories and tightening environmental legislation led to a fall in both domestic phosphate demand and production from around 2015.

Phosphate production

Chinese phosphate rock mining has been falling as costs of production rise. China actually became a net importer of phosphate rock in 2023, and this continued into 2024, when rock imports totalled around 2.9 million t/a. However, last year’s imports look to be the peak as higher phosphate prices within China encourage more output from miners, and Chinese phosphate rock production capacity is expected to increase by 25 million t/a (product) from 2023-2029, a growth of 25% from its figure of 101 million t/a in 2023. Net import volumes are expected to fall from 2025 and end by around 2027-28. Domestic rock prices have remained elevated in China due to strong demand. The government has expressed its aim for food security on several occasions, with fertilizer and animal feed production accounting for 73% of China’s rock consumption.

Higher phosphate prices have also driven greater domestic phosphate production in China in 2024.

China’s January-November DAP/ MAP production increased 11% year on year to roughly 27.94 million t/a (tonnes product) from 25.09 million t/a, according to government figures. January-November MAP production rose 15% year on year to 13.92 million t/a, while DAP output was up 8% at 14.02 million t/a. By comparison, China’s full-year 2023 DAP/MAP production reached roughly 27.5 million t/a, itself a 9% increase from 25.3 million t/a in 2022.

Export restrictions

Domestic capacity rationalisation led to spikes in Chinese phosphate prices, which the government began to control via export restrictions. These became particularly acute during the covid-19 pandemic. Hubei province, where the outbreak began and was initially at its worst, is the heartland of the Chinese phosphate industry, with 28% of production capacity. Closures dropped the fertilizer industry utilisation rate by 30-40% during 2Q 2020. At the same time, demand held up relatively well, falling only 2.5% in 2020 compared to 2019, and China’s ministry of agriculture mandated an increase in grain planting in 2021, including requiring rice farmers to plant two seasons of the crop, to ensure sufficient food supply.

The upshot was that China introduced a series of export restrictions on phosphates in order to keep domestic markets supplied and ease prices to farmers. In effect exporters have only been granted licenses to export for 6 months of the year over the past few years. Total Chinese exports of finished phosphates (MAP+DAP+TSP) fell from an average of 10 million t/a P2O5 in 2019-21 to 6.5 million t/a P2O5 in 2022, recovering somewhat to 7.9 million t/a P2O5 in 2023.

Last year, export restrictions were tight for the first quarter of 2024, and there were virtually no exports from January-March, when restrictions were eased again until October, when they were tightened again; restrictions have tended to follow this pattern, with almost no exports in Q1 and Q4, before loosening in Q2 and Q3, and very high availability at those times.

No new DAP/MAP export business from China has been reported in the past few weeks, as the country suspended phosphate export inspections and customs clearance from the start of December 2024 until further notice. The current market consensus expectation is that the suspension will, as previously, continue through 2025 Q1 to guarantee domestic supply and stabilise domestic prices for the 2025 spring application season. DAP/MAP producers who still have some remaining export quota allocation will likely exercise self-discipline by not applying for any fresh export inspections. Producers also hope that previously-signed contracts will be executed on time, though there is currently no guarantee this will be possible.

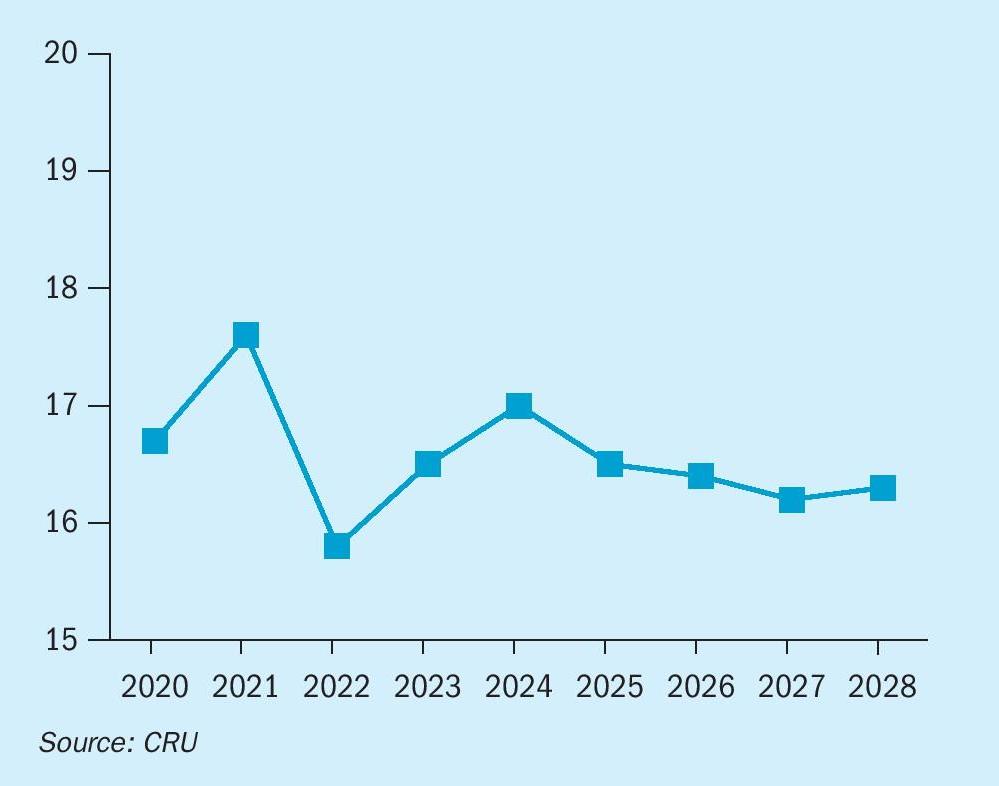

Overall Chinese DAP/MAP/TSP exports are expected to have been 6.9 million t/a P2O5 for 2024, and will stabilise at a total figure of 7.0-7.1 million t/a for the next few years (see Figure 1).

India

Chinese exports to India – one of the largest importers of phosphate – have dropped because of tensions over the two countries’ disputed border along the Himalayan mountains. Frictions over the border led to clashes between Chinese and Indian troops in 2020-21, and tensions continued into 2022-23. There have recently been signs of an easing as China and India agreed in October 2024 to resume joint patrols, but the Chinese government has placed pressure on Chinese fertilizer companies to reduce exports to India. DAP exports in 2024 Q1–Q3 dropped to 622,000 tonnes, a 71% year on year decrease, further tightening Indian availability. India in turn has moved towards greater imports of triple superphosphate (TSP) to make up for the shortfall.

There are no signs of a quick resolution to this issue, and exports between China and India will probably continue to be suppressed into 2025. With lower DAP exports, this could see China switch a little more towards MAP for its overseas sales in 2025. Overall, CRU expects full-year Chinese DAP exports to fall from 4.2 million t/a in 2024 to 4.0 million t/a in 2025, while full-year MAP exports rise from 1.8 million t/a to 2.1 million t/a, barring a political resolution to the issues and a resumption of DAP exports.

Phosphoric acid

The other wrinkle in the Chinese export picture at present is an increase in merchant grade phosphoric acid (MGA) exports. Exports began around 2021 and have increased year on year. In 2024, Chinese MGA exports were expected to have reached 230,000 t/a P2O5 , possibly as a way of Chinese phosphate producers circumventing restrictions on exports of processed phosphates. Chinese MGA exports were mostly destined for Bangladesh and Pakistan.

Looking forward

Chinese fertilizer consumption continues to be on a long term slowly declining trend as farmers move to more efficient use of nutrient. The current Chinese MAP/DAP capacity rationalisation is also drawing to a close, and there is some new capacity to come on-stream over the next few years. However, the new government directive to prioritise domestic food security and fertilizer means that China’s seasonal phosphate export restrictions are likely to continue on an annual basis, keeping exports to around 7 million t/a P2O5 of processed phosphates, with a possible small boost due to phosphoric acid exports.

The global phosphate market has enjoyed a run of higher prices of late, much of it due to Chinese export restrictions which have taken up to one third of Chinese MAP/DAP exports off the market. However, new capacity is continuing to come on-stream in Morocco and Saudi Arabia, and this will alleviate prices in the longer term.

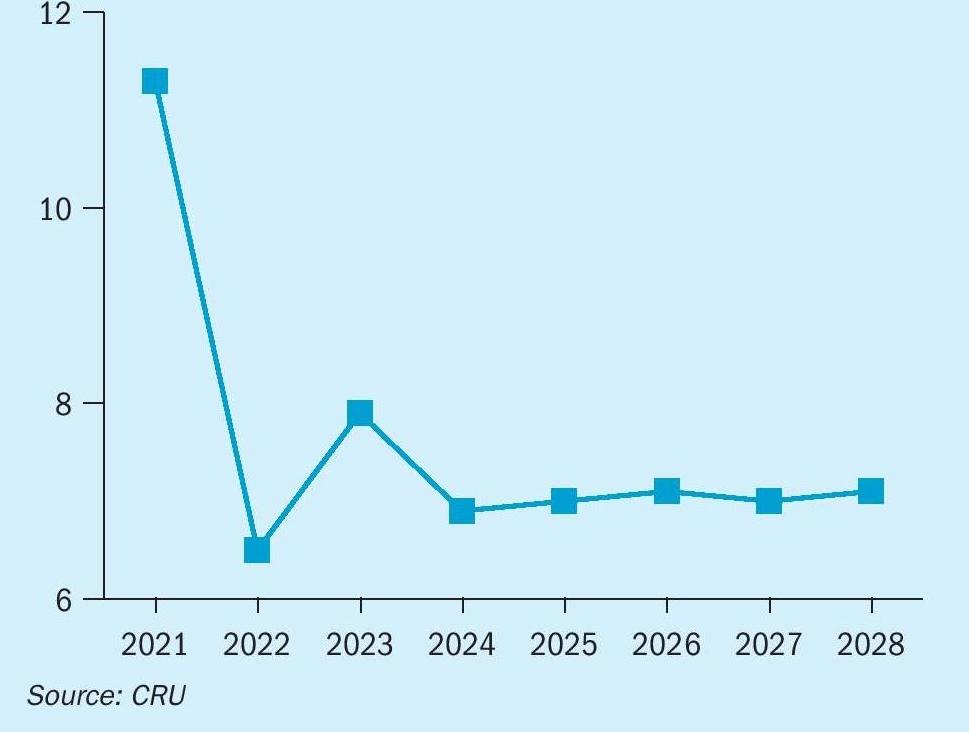

The impact on sulphur markets is likely to be a gradual decline in Chinese imports. Overall Chinese phosphoric acid production, as shown in Figure 2, has declined slightly due to the overall reduction in phosphate output, and is forecast to stagnate over the next few years. Set against increased domestic production of sulphur from refineries and sour gas processing, the implication is a continuing fall in Chinese sulphur imports, from an estimated 9.7 million t/a in 2024 to around 6.2 million t/a by 2028.