Sulphur 416 Jan-Feb 2025

31 January 2025

Market Outlook

SULPHUR

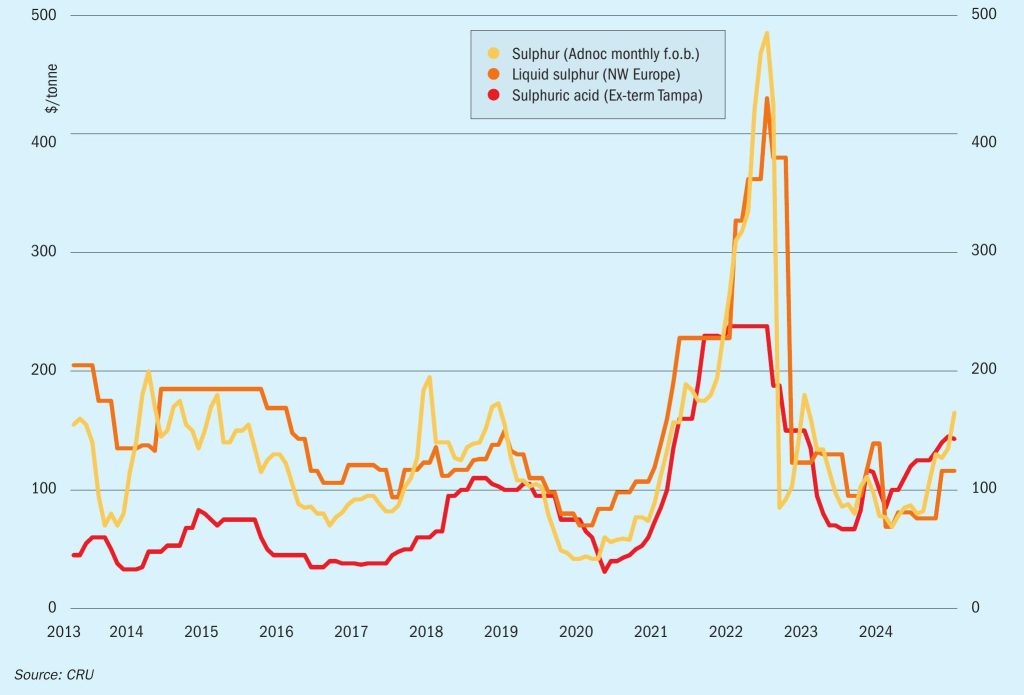

- Sulphur prices may remain stable before decreasing on muted demand and transactions may increase in frequency contributing to price decreases in the first half of 2025.

- Price weakness in late 2023 was driven by overstocked consumers, stable supply volumes and high freights. Prices started increasing in 2024 Q2 but remained lower than the 2023 average. Slower stock drawdowns and reduced Chinese inventory has pushed sulphur prices higher.

- Sulphur supply increases are dominated by growth in the Middle East, which will allow new production to reach the traded market rapidly. High phosphate prices in 2024 H2 has maintained support for sulphur prices.

- Demand growth is expected to exceed the supply growth rate, pushing the market balance to deficit and increasing prices. The requirement for stock drawdown will increase the marginal cost of supply and provide support to sulphur prices.

- A programme of intentional stock drawdown in Saudi Arabia and Kazakhstan, along with high Chinese port stocks, will limit how fast the market can rebalance and move to deficit. However, a return to tighter market conditions and higher sulphur prices forms the base case forecast.

SULPHURIC ACID

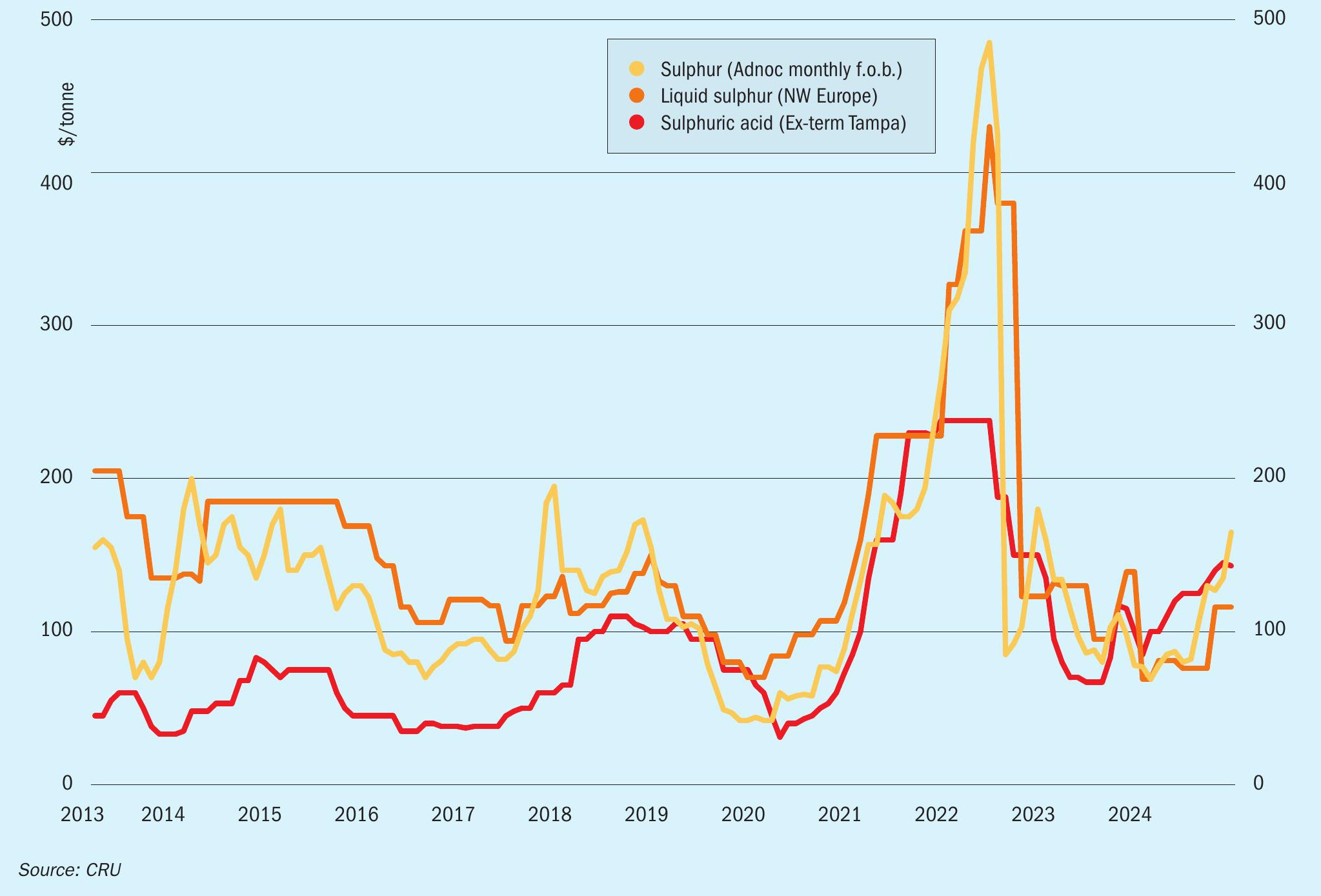

- The current global sulphuric acid prices are being kept largely stable by the presence of subdued demand which has offset the tight availability in regions like Northwest Europe. However, both demand and availability are set to return to more normal levels later into Q1.

- Sulphuric acid prices are expected to gradually decline in the first quarter of 2025. Subdued demand is currently offsetting tight availability. This has kept the prices largely unchanged for most of the past year. However, demand is anticipated to pick up in the initial two months of 2025, possibly coinciding with the return of supply.

- Prices for Northwest Europe have held for three weeks and could continue to do so as supply is not expected to return until later in Q1. However, a lower price could stimulate market activity, according to some market players. According to CRU’s latest short-term forecast, prices are expected to average $105/t in February and $95/t by March.

- In India, Adani Enterprises is on track to commence operations at its 500,000 t/a copper smelter by the end of Q1. It is expected that the copper smelter will produce around 1.5 million t/a of sulphuric acid. Similarly, Paradeep Phosphates Ltd (PPL) is scheduled to commission its 4,000 t/day sulphuric acid plant by the end of Q2. Market participants remain cautious due to an anticipated influx of domestic sulphuric acid. In the short term, limited activity is expected to persist until later in Q1 ,after which an uptick in activity is expected. Flat demand in Chile is expected to last at least until February.