Sulphur 416 Jan-Feb 2025

31 January 2025

Price Trends

Price Trends

SULPHUR

Global sulphur prices were mostly assessed flat in mid-January, with only slight changes for China, Indonesia and India, while the first quarter contracts for the Middle East, North Africa and Tampa increased from the previous quarter. Overall, the number of transactions taking place globally has declined as subdued demand has limited trading activity in most delivered markets. The current sulphur price environment has been shaped by the combination of rising Chinese demand and higher Middle East f.o.b. prices in the second half of last year. As a result, some consumer markets such as Indonesia and India have been subject to upward pressure in order to remain attractive destinations. But demand remained lacklustre across delivered markets, leaving prices relatively stable.

The sulphur price into China has narrowed slightly to $183-185/t c.fr. Import transactions into China have been limited. The latest reported purchase was of 30,000 t by a phosphate producer at a level of $185/t c.fr, with shipment to the Yangtze River expected in February. Another cargo of non-mainstream sources was reported as sold to southern China at a level of $184/t c.fr. However, this transaction could not be confirmed at the time of writing. Indonesian buyer PT Lygend closed a tender at $187/t c.fr for 50,000 tonnes on 10th January 2025. This price level has supported an overall positive market sentiment in China. The sulphur port spot transaction price is reported at around $214/t. The port price indicates a netback price at around $181/t c.fr. This is $4/t lower than the current price for fresh import products. This has led to end-users preferring to purchase port products rather than fresh import cargoes. Chinese sulphur prices are relatively steady despite the bearish sentiment in the phosphate market. Phosphate producers continue to show a consistent demand for sulphur as end-users still require sulphur in order to prepare for the spring application season. Port inventory is decreasing as activity has focused on domestic stocks. Total sulphur port inventories in China decreased by 61,000 tonnes to 2.04 million tonnes on 15 January 2025. This is the lowest stock level since 20 July 2023. The volume at Yangtze River ports increased 11,000 tonnes to 722,000 t while the Dafeng port inventory declined 60,000 tonnes to 406,000 t.

The spot price for sulphur cargoes into Indonesia has widened and is now assessed at $180-187/t c.fr after holding at $180-185/t c.fr for five weeks. The price has widened as a PT Lygend tender for 50,000 t was awarded at around $187/t c.fr on 10 January. Additionally, reports suggest a tender in Taiwan, China, was awarded at $175/t f.o.b. to Saudi Aramco and is headed to Indonesia, though this could not be confirmed at the time of writing. The lower end of $180/t c.fr is considered as still viable, according to multiple market participants. Transactions into the country had been limited as the market has been experiencing upward pressure as a result of recent Middle East price hikes and Chinese demand for sulphur towards the end of last year. The market is considered to have stable demand, according to market sources.

Sulphur prices in India were assessed slightly lower at $175-185/t c.fr this week, down from the previous assessment of $180-185/t c.fr, as activity in the market was limited by existing stocks and subdued demand. Importers are refraining from purchasing additional cargoes, while major Middle Eastern suppliers maintain high c.fr offers, despite the market’s muted appetite. Recent offers from the Arabian Gulf are reported in the range of $160170/t c.fr, but no transactions have been concluded at those levels. Offers from the Middle East have been heard at $170185/t c.fr. As a result, the current market assessment has reduced slightly to $175185/t c.fr. Market participants consider that this downward trend could persist through March, supported by stable inventory levels and lower downstream demand due to anticipated plant shutdowns in March and April. The pricing dynamic is further influenced by a strategic shift among suppliers, with some transitioning into trading roles. Notably, ADNOC and other major suppliers are increasingly bypassing traders to engage directly with buyers. This shift has created ripples across the trader community, with reports of a Middle Eastern supplier cancelling a 1 million tonne annual allocation with a prominent trader, significantly impacting their operations.

India had imported approximately 61,500 tonnes of sulphur by 10th January 2025, with 78% sourced from Oman and the remainder from Bahrain. The Omani cargoes were delivered to IFFCO Paradip, while the Bahraini shipment was destined for FACT. For January 2024, total imports stood at around 120,000 tonnes, with 73% of the volume loaded from Ruwais and the rest from Ras Laffan, according to the latest Interocean vessel data.

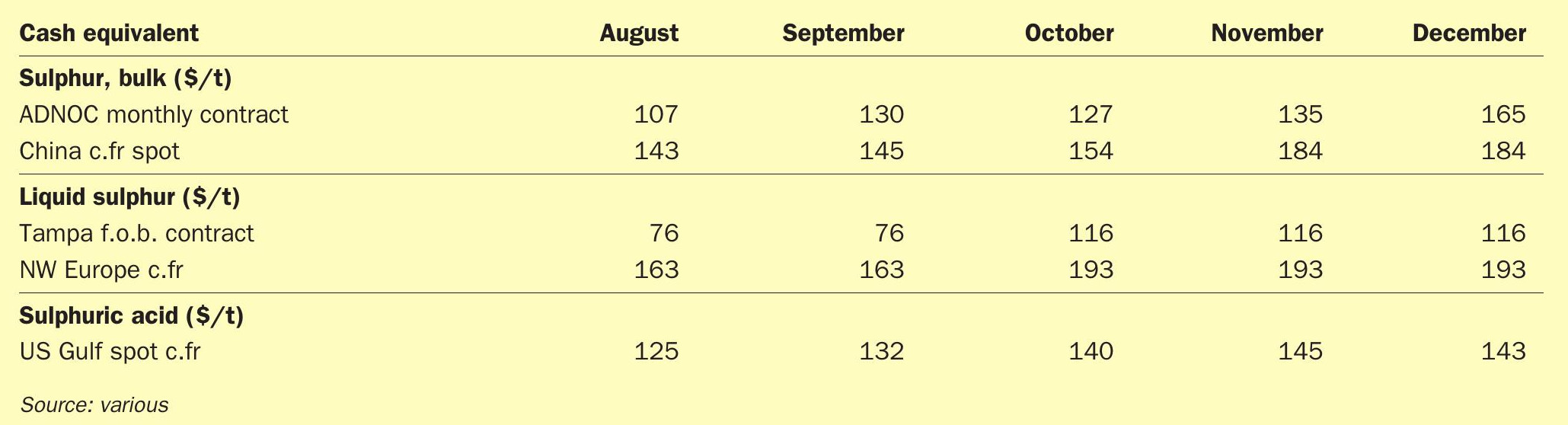

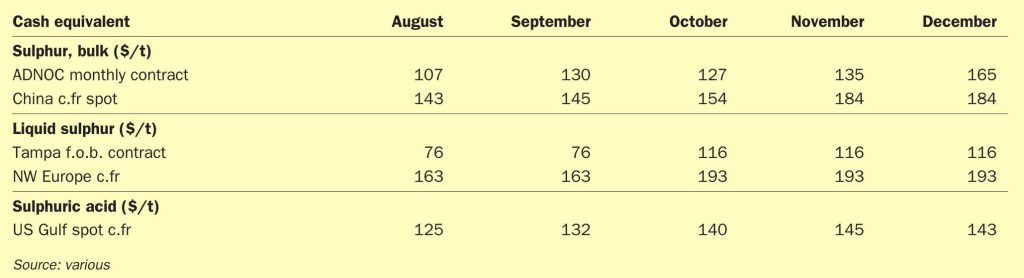

Spot prices in the Middle East were assessed unchanged. A lack of transactions out of this region has left prices flat. This is in contrast to the Mediterranean where there has been an uptick in activity and prices have been increasing since the end of last year. Prices remained flat, but the bullish sentiment persists as demand remains constant from countries like Egypt and Libya. Middle East quarterly contract prices for 2025 Q1 have been settled at $150-160/t f.o.b., which is an increase from the 2024 Q4 prices. The average Q1 price of $155/t f.o.b. is an increase of $33/t from the midpoint of the 2024 Q4 price level of $122/t f.o.b.

The contract price range for supply of sulphur to North Africa in the first quarter of 2025 increased to $160-170/t c.fr based on market feedback, up from $120-140/t c.fr for 2024 Q4. Contract prices have increased for two consecutive quarters after the price range for Q3 was published at $94-103/t c.fr, which was a slight decrease from Q2’s price of $95-105/t c.fr. Origins of contract supply to North Africa are the UAE and a range of other Middle East sources as well as Kazakhstan, Poland and Spain.

The US Tampa quarterly contract prices for the first quarter of 2025 were settled up $49/lt from the 2024 Q4 settlement, market sources confirmed. This leaves the published contract price at $165/lt f.o.b. Tampa for 2025 Q1. The Q4 2024 price was settled at $116/lt f.o.b., the Q3 2024 price was $76/lt f.o.b., the Q2 2024 was $81/lt f.o.b. and the Q1 2024 price was $69/lt f.o.b.

SULPHURIC ACID

Benchmark prices for sulphuric acid were assessed mostly unchanged in mid-January. Europe remains tight on availability while Asian supplying markets have become increasingly tight following sales towards the end of last year and the beginning of this year. Price movements have failed to gain traction as tight availability is being offset by subdued demand in delivered countries. This has kept prices largely stable since the beginning of the year. European supply is expected to increase by mid- to-late Q1, aligning with a potential recovery in demand. As a result, the global sulphuric acid market remains at a standstill, with market participants awaiting either a shift in demand or supply to gain a better price direction.

Acid prices for Northwest Europe were assessed flat at $110-120/t f.o.b. for the third consecutive week amid tight supply. The price previously held at $100-110/t for twelve consecutive weeks. Availability remains tight in the region and although expected in Q1, it is possible that the supply does not materialise until the middle or end of the quarter, according to market participants. The price could soon decrease as several market participants consider the current price to be too high for market activity to take place. However, no transactions were confirmed at lower levels. The current midpoint of $115/t f.o.b. is the highest since the week of 18 August 2022.

In Japan/South Korea the published price has changed on the lower end as quarterly contracts for delivery to China from South Korea were settled at a price level of low $30s/t. The spot price in the region remains assessed unchanged at a level of $50-55/t f.o.b. The market is now under conditions of tightening supply, being mostly sold out for Q1 and with reports of availability expected to be tight for the first half of the year.

Export prices for sulphuric acid in China were assessed unchanged at $50-55/t f.o.b. after narrowing from $45-55/t at the start of the year. Market participants anticipate that the market will remain relatively stable, while others consider that activity could pick up ahead of the Chinese New Year celebrations. Chinese producers ended last year making an effort to maintain low inventories ahead of the upcoming Chinese New Year holidays, according to market participants. As a result, sales were made towards the end of last year with prices below the currently published range. Following a number of sales made at the $45/t f.o.b. level towards the end of last year and the beginning of this year, the price narrowed to its current range. China’s sulphuric acid exports for January-November decreased 3% year on year to 2.1 million tonnes, while its acid imports decreased by around 50% from the same period in 2023.

India’s sulphuric acid market conditions remain unchanged at $105-110/t c.fr as weak demand and sufficient inventories from earlier imports have kept activity subdued. Prices have held steady, with offers from Japan and South Korea currently assessed at $50-55/t. International traders indicated that lower prices could stimulate activity in the market but no transactions have concluded at a lower price range. January 2025 imports have totalled 74,653 tonnes so far, with South Korea contributing 51% of the volume and the remainder has been sourced from Japan. Limited activity is expected to continue until later in the year, when some importers may re-engage in the market to restock, according to market participants. However, the sentiment remains bearish as domestic production is set to rise in the coming months, which could exert additional downward pressure on prices.

In Chile, prices for the spot market were assessed unchanged at $150-155/t c.fr. However, some participants have suggested that the price could be even lower as market activity is extremely limited. However, the purchasing activity is being limited by logistics and meteorological conditions instead of a pricing environment, according to other market participants. This is because the seasonal rough seas along with conditions of limited storage capacity have prevented transactions from taking place. These conditions may persist until around February, according to local buyers.

China’s sulphuric acid exports for January-December 2024 increased by 7% year on year to 2.68 million t/a, according to Global Trade Tracker. Exports to Chile increased by 122% to 1.27 million t/a over the year, up from 577,000 t/a reported in the same period last year, while exports to Morocco decreased 28% to 321,000 t/a. The volume to India increased by 21% to 318,000 t/a, while volumes to Indonesia decreased 62% to 239,000 t/a. Exports to Saudi Arabia dropped 17% on year to 286,000 t/a. China’s acid imports halved on year to 162,000 t/a from January to December 2024, data shows. In 2023, China’s acid exports had dropped by 31% year on year to 2.51 million t/a, after exports for 2022 had increased 28% year on year to reach 3.64 million t/a, representing a new record and surpassing the previous year’s record.