Sulphur 416 Jan-Feb 2025

31 January 2025

Sulphur in central Asia

CENTRAL ASIA

Sulphur in central Asia

The Caspian Sea region is home to extensive sour gas reserves which produce large volumes of sulphur. Exports are difficult, but the Kazakh uranium industry is consuming an increasing amount.

The Caspian Sea region is one of the key supply centres for the world sulphur industry, mostly based on sour gas processing in the north Caspian region, but in the wider central Asian area there is also gas processing in Turkmenistan, Uzbekistan, and potentially also Iran. Oil and gas exploitation in the region has a long history, dating back to the 1920s when the first oil wells were drilled around Baku in what was then the Soviet Union, and sour gas processing likewise dates back almost 60 years to the opening of the Orenburg gas processing plant in southern Russia.

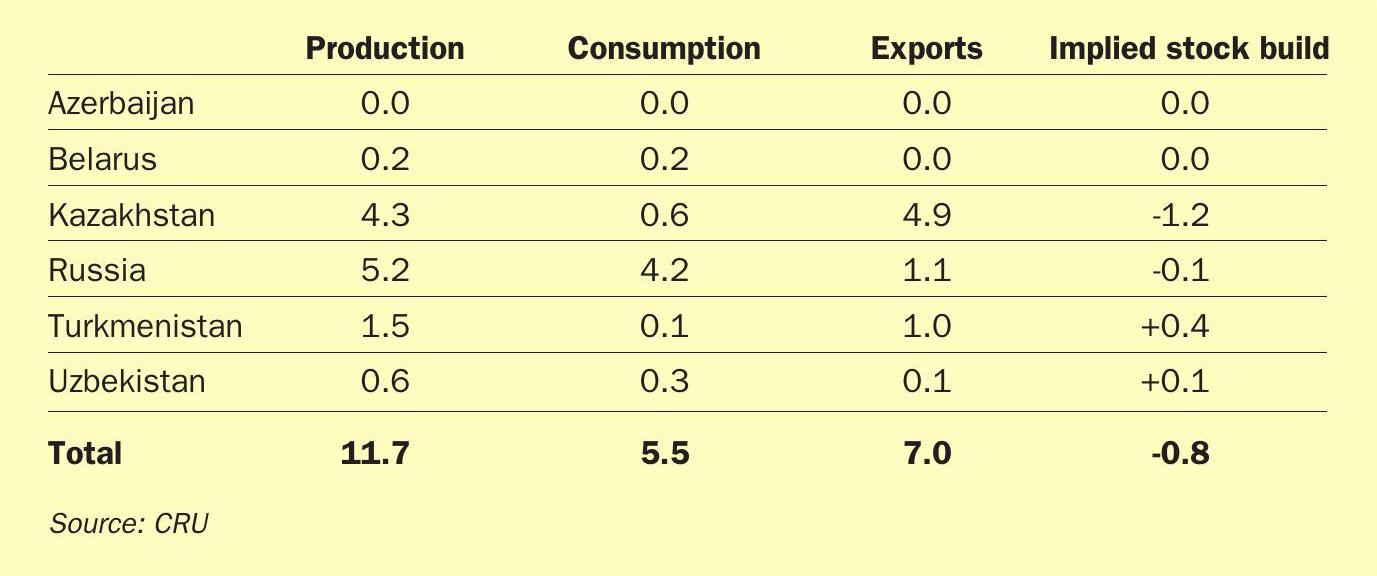

Total sulphur production in the CIS as a whole is about 11.7 million t/a, or around 17% of global sulphur production, most of it coming from central Asia, and last year sulphur exports from the region jumped to 7.0 million t/a due to extensive stock drawdowns, representing 20% of all traded sulphur.

Domestic consumption in the region is relatively low, with Russia’s phosphate industry representing most of the region’s sulphur consumption, and likewise Kazakhstan’s highly significant uranium mining industry is consuming increasing volumes of sulphur. But sulphur exports from the region must often trace a long and tortuous route to reach a port, making logistics challenging and favouring acid gas reinjection in many projects.

Russia

Most of the sulphur in Russia comes from two large Soviet-era sour gas processing facilities operated by state gas major Gazprom via two subsidiaries, Gazprom dobycha Orenburg and Gazprom dobycha Astrakhan. Orenburg is a large oil and gas processing complex which processes gas from local oil and gas fields as well as very sour (up to 13% H2S) gas from the Karachaganak gas field which lies across the border in Kazakhstan. Sulphur output at Orenburg was around 1 million t/a (1.07 million t/a in 2021), but this dropped to 0.89 million t/a in 2022 and 0.88 million t/a in 2023, and the full year figure for 2024 is expected to have declined further to around 0.84 million t/a.

The Astrakhan facility processes gas from the Krasnoyarsky gas and condensate field, where gas is highly sour; up to 31% H2S. This means that Orenburg actually processes more gas, the Astrakhan gas plant is the largest producer of sulphur in Russia. In its heyday output was around 4.5 million t/a, but more recently output has declined, running at 3.34 million t/a in 2021, 3.56 million t/a in 2022, and 3.30 million t/a in 2023. Full year figures for 2024 are anticipated to be around 3.25 million t/a.

These two hubs between them represent about 80% of Russia’s sulphur production. The rest mainly comes from oil refineries. Total Russian sulphur production has been in long term decline, and fell from 6.3 million t/a in 2020 to an estimated 5.2 million t/a in 2024. But exports have been dropping faster still. Prior to covid they ran at around 4-5million t/a, both via rail and barge eastwards to China as well as westwards to the Baltic Sea and Black Sea ports. Exports dropped from 3.3 million t/a in 2020 to 1.8 million tonnes in 2021, and down to 1.0 million t/a in 2022 and 2023. Some stock reduction in 2024 means that Russian sulphur exports are expected to be slightly up, at around 1.06 million tonnes, but thereafter exports are forecast to decline further. A combination of sanctions, stock building and rising domestic demand may reduce Russian sulphur exports to only 500-600,000 t/a over the next few years. Demand has mainly come from increased phosphate production, itself down to rapidly increasing domestic phosphate demand as agriculture expands, meaning that Russian phosphate exports are actually stagnant even as production grows. Russia is currently near its phosphoric acid production capacity.

Kazakhstan

While Kazakhstan’s gas originally mainly fed the Orenburg gas plant as mentioned above, in the 1980s and 90s, the discovery of large onshore and offshore oil and gas fields in and around the Caspian Sea led to major domestic developments there, at Karachaganak, Tengiz, and finally Kashagan.

The onshore Karachaganak field, near the Russian border, began producing oil in 1984, and currently represents around 30% of Kazakhstan’s gas production, via associated gas from the oil wells. It is operated by the Karachaganak Petroleum Operating (KPO) consortium, with partnership from ChevronTexaco (18%), Agip and BG (29.25% each), Lukoil (13.5%) and KazMunaiGaz (10%). About 50% of the gas produced is reinjected to maintain pressure or used as fuel gas. Gas from Karachaganak is piped across the border to the Orenburg gas plant in Russia for processing and sulphur from the gas thus forms part of Russia’s output.

Tengiz was developed in the 1990s and 2000s, by the Tengizchevroil (TCO) joint venture, formed between ChevronTexaco and the Republic of Kazakhstan, with the current shareholding being Chevron 50%, ExxonMobil 25%, KazMunaiGaz 20%, and Lukoil 5%. Tengiz is the largest sulphur generating enterprise in Kazakhstan, and produced 2.7 million t/a of sulphur in 2021, 2.65 million t/a in 2022, and 2.4 million t/a in 2023. The completion of the Wellhead Management Project in 2024 has lifted output slightly, and full year production is expected to be 2.65 million tonnes in 2024. Tengiz also has a Future Growth Project which will further lift oil output, and which is due for completion in 2025, but it will reinject all of the additional associated gas to maintain reservoir pressure.

TCO has had a running battle with the Kazakh government over sulphur storage. In the 2000s most of the sulphur was poured to block, but complaints over fugitive dust led to the stockpile – which reached 9 million tonnes in 2006 – gradually being melted down and sold off.

The other major project in Kazakhstan is the huge offshore Kashagan oil and condensate field in the north Caspian Sea, run by the North Caspian Operating Company (NCOC), which includes ExxonMobil, Eni, Shell, Total and KazMunaiGas (KMG), each with a 16.8% stake, as well as Japan’s Inpex with 7.56%, and the China National Petroleum Corp (CNPC). Kashagan has been a large and complex development, with technical factors complicating the project including high concentrations of H2S in the oil and associated gas (ca 17%). Corrosion caused by H2S meeting water in the pipelines led to it being shut down for repairs until 2016. About half of the associated sour gas is reinjected into the wells to maintain pressure, but the rest is processed onshore at the Bolashak gas sweetening plant. Kashagan produced 1.34 million t/a of sulphur in 2021, 1.0 million t/a in 2022, and 1.36 million t/a of sulphur in 2023. Output for 2024 is expected to be around 1.4 million t/a.

Similar to the situation in Russia, the Tengiz and Kashagan sour gas plants collectively represent more than 90% of overall Kazakh sulphur production, which was 4.0 million t/a of sulphur in 2023, and an estimated 4.3 million t/a in 2024. The Kazakh government has been encouraging domestic use of the sulphur, via the country’s large uranium mining industry. The uranium is extracted via sulphuric acid leaching, and the relatively high pH of the rocks means that large volumes of acid are needed. In 2023 uranium mining consumed 210,000 tonnes of sulphur. Phosphate processing represented another 160,000 t/a. Overall consumption runs at about 600,000 t/a, leaving a surplus of 3.7 million t/a of sulphur, meaning that Kazakh exports have overtaken Russia’s to become the largest source in the region.

Strict regulations on storage of sulphur means that almost all of this is exported, and recently the producers have also been running down stockpiles, leading to a spike in Kazakh sulphur exports in 2024 even after reaching a historical high in 2023. Kazakhstan sulphur exports totalled 4.02 million t/a for the year to Oct 2024, up 35% year on year. Morocco has been the main destination, accounting for 73% of total sales, followed by other African countries (12%). The export surge has been driven by a stock drawdown. Kazakhstan started a stock drawdown programme in 2023 with crushed lump sulphur sales. This volume flow has increased in 2024 which, along with a rise in production, has pushed exports to record levels. It is estimated that an additional 1.2 million tonnes of stockpiled sulphur has been sold during 2024. The sale of inventory is expected to end in 2025, allowing exports to fall back to typical levels of around 3.5 million t/a from 2026 onwards. Exports are mainly via rail across Russia to the port of Ust-Luga near St Petersburg.

Turkmenistan

Turkmenistan, south of Kazakhstan, also borders the Caspian Sea. It is a relatively modest holder of oil reserves, and produces only around 220,000 bbl/d, mostly for domestic use. However, it is the world’s fourth largest holder of natural gas reserves, after Russia, Iran and Qatar. With relatively low levels of gas demand, development of natural gas production for export has been seen as a way of monetising those reserves, but disputes with Russia over pipeline access slowed development in the 1990s and 2000s. Gas production has been increasing rapidly over the past two decades, however, on the back of Chinese investment.

About half of Turkmenistan’s gas comes from a series of fields that make up the Galkynysh reservoir, including South Yolotan, Osman, Minara and Yashlar. Production from the field began in 2013, and amounts to around 30 bcm per year, with a significant (about 6%) content of H2S. The Galkynysh (formerly South Yolotan) gas processing plant has the capacity to produce 1.8 million t/a of sulphur. Production in 2022 and 2023 was about 1.2 million t/a, but this increased last year to about 1.54 million t/a, representing essentially all of Turkmenistan’s sulphur output. Further expansions are expected to take sulphur production to 2.1 million t/a by 2028.

Around 120,000 t/a of sulphur are consumed in Turkmenistan for industrial uses, but again most of the sulphur must be stored or exported. Turkmen exports of sulphur currently run at around 1.0 million t/a, but are expected to rise towards 2 million t/a over the remainder of the decade.

Uzbekistan

Uzbekistan, south and east of Kazakhstan, is a relatively minor oil and gas player. Its oil reserves are comparable to Turkmenistan, but its gas reserves are much smaller. They are however, sour, and so processing of gas and condensate from the Kandym, Kuvachi-Alat, Akkum, Parsanal, Khoji and West Khoji is processed at the Kandym sour gas plant in Uzbekistan, which began operations in April 2018. Uzbekistan produces about 550,000 t/a of sulphur, and exports around 300,000 t/a.

Export issues

Sulphur exports from central Asia are problematic because of the immense distances involved. The port of Ust-Luga on Russia’s Baltic cost is 2,300 km from Orenburg, and further still (3,000 km) from Tengiz. River and canal travel is impossible during winter as waterways freeze over, so much of the sulphur must travel by rail, taking weeks and placing a major logistical burden upon exports. This has encouraged the use of gas reinjection in region for acid gases, though these place their own burden in terms of cost of acid-resistant piping and the potential for leaks which can shut down processing facilities for months. For this reason, sulphur prices need to be high enough to justify exports rather than stockpiling (although Kazakhstan has its own issues with sulphur stockpiles and a government that has tried to monetise them via lawsuits against producers).

Sulphur prices are presently on their way up again after a relatively low period during 2022-24, and this has tempted additional volumes of sulphur onto the market from central Asia. Sulphur supply from the CIS region is expected to have increased in 2024 for the first time since 2019, mainly due to increased utilisation at existing facilities in Kazakhstan and Turkmenistan and stock drawdowns in Russia and Kazakhstan. From 2026, exports from the CIS region are expected to rebound as global demand will encourage these volumes to enter the market, with Turkmenistan leading trade growth due to expansions at its sour gas processing facilities.