Sulphur 416 Jan-Feb 2025

31 January 2025

Sulphuric Acid News Roundup

KAZAKHSTAN

Major acid plant will be part of new fertilizer complex

EuroChem’s local subsidiary EuroChem Karatau has set the onstream date for its new fertilizer complex in Kazakhstan’s Zhambyl region as February 2027, following a two year construction period. Construction is scheduled to begin in March 2025. The fertilizer complex will include an 800,000 t/a sulphuric acid plant, a 260,000 t/a potassium sulphate (aka SoP or sulphate of potash) plant, a 200,000 t/a calcium hydrogen phosphate plant, and a 130,000 t/a calcium chloride facility. The plant is expected to be launched in two stages. The first stage, the SoP Plant, should be commissioned at the end of 2025, while the second phase will be launched in 2027.

About half of the 800,000 t/a of sulphuric acid will be supplied to Kazatomprom for solvent extraction of uranium. The fertilizer plant will use locally-produced natural gas for its production process. According to the CEO of EuroChem Karatau Igor Georgiadi, the facility will need 130 million m3 of gas annually if it operates at full capacity. The plant will be built 14 km southwest of Zhanatas, in the Sarysu district of Zhambyl region. Potassium chloride (218,400 t/a), limestone (230,000 t/a) and solid sulphur (275,000 t/a) will be sourced from third-party producers.

CANADA

First Phosphate to license Prayon phosphoric acid technology

First Phosphate Corp. has signed a technology license agreement with Prayon for the technology to produce merchant grade phosphoric acid from igneous apatite phosphate rock as well as high-purity gypsum. Prayon will grant First Phosphate a license to use its technology to design, build, operate and maintain, within Canada, a merchant grade phosphoric acid plant with a capacity of 600 t/d (P2O5 terms). First Phosphate has also selected Ballestra SpA to fulfill the service agreement for the engineering services portion (FEED and EPC/EPCM) for the project. First Phosphate’s relationship with Norfalco, a division of Glencore Canada remains in place for secure supply of sulphuric acid for the future phosphoric acid facility.

“With these technology, engineering and sulfuric acid supply agreements in place, First Phosphate will have the ability to implement a process to convert approximately 500,000 t/a of igneous apatite originating from its future mining operations into upwards of 190,000 t/a of value-added phosphoric acid,” said Company CEO, John Passalacqua.

“Through the sale of this license, Prayon gives First Phosphate access to a world-renowned technology and highlights its commitment to transforming a critical, strategic material into high-value-added products, while recycling by-products in a well-established circular economy,” said Benoît Van Massenhove of Prayon SA.

First Phosphate is developing phosphate production for the manufacture of cathode active material for the lithium iron phosphate (LFP) battery industry. It plans to vertically integrate from mine source directly into the supply chains of major North American LFP battery producers that require battery grade LFP cathode active material emanating from a consistent and secure supply source.

SAUDI ARABIA

Saudi Arabia agrees $9 billion of mining deals

Saudi Arabia has announced nine mining and metal projects worth more than $9.3 billion, in line with government policy to diversify the economy and reduce reliance on fossil fuels. India’s Vedanta has agreed to invest $2 billion to build a 400,000 t/a copper smelter and refinery plus a 300,000 t/a copper rod plant at Ras Al-Khair. The project will eventually ensure domestic self-sufficiency in copper production, according to the company. A 125,000 t/a copper rod mill will form part of the first stage of the development. All necessary approvals are in place, land acquired, and equipment and technology ordered, work is likely to begin shortly. Commercial production is expected to start in Q1 2027.

Chris Griffith, CEO of Vedanta Base Metals, said: “This project ties in very nicely, both with our own ambitions as Vedanta to grow in India and the Middle East, and with Saudi Arabia’s industrial strategy to secure a copper supply chain.”

China’s Zijin Mining Group has committed to spending $1.6 billion to build a 100,000 t/a zinc smelter with the capacity to produce 200,000 t/a of sulphuric acid as a first phase. In a second phase a lithium carbonate extraction plant capable of producing 60,000 t/a of battery-grade lithium carbonate will be built, and in a third a copper refinery with potential output of 200,000 t/a of copper cathode and around 50,000 t/a of electrolytic foil.

Hastings Technology Metals of Australia has agreed to build rare earth processing plants in several phases for a total investment of up to $1.9 billion. The rare earth elements will be sourced from mines in Saudi Arabia.

Ma’aden has also awarded three contracts worth $920 million for its third phosphate fertilizer plant. The contracts include a $330 million agreement for general construction at Ras Al-Khair with the China National Chemical Engineering Corporation. A second contract, worth $360 million, was awarded to Sinopec’s subsidiary for construction at Wa’ad Al-Shamal. Tekfen Construction secured the third contract for $233 million, with work at Wa’ad Al-Shamal included.

The announced investments align with Saudi Arabia’s Vision 2030 – an ambitious plan to unlock $2.5 trillion in untapped mineral resources, including phosphate, copper, gold, and bauxite. It also aims to boost the mining sector’s GDP contribution from $17 billion to $64 billion by the end of the decade. Currently, Saudi Arabia imports most of its copper to meet domestic demand, estimated at 365,000 t/a. This figure is projected to more than double by 2035.

AUSTRALIA

Sulphuric acid from pyrite tailings

Cobalt Blue Holdings has signed a memorandum of understanding to work with Mount Isa City Council in Northwest Queensland to assess solutions to the region’s looming sulphuric acid supply shortage. Cobalt Blue will provide advice to the city on the requirements, challenges and barriers to a potential pyrite tailings reprocessing operation to produce sulphuric acid. This solution would potentially involve Cobalt Blue’s ReMine+ patented minerals processing technology for the economic recovery of elemental sulphur and metals from pyrite deposits. Mount Isa is facing a shortfall of sulphuric acid due to the announced closure of the Glencore Mount Isa copper smelter in 2030.

Mount Isa Mayor Peta MacRae said: “this MoU with Cobalt Blue aligns with the council’s commitment to a sustainable future for our industries, economy, environment and communities. It demonstrates our commitment to developing a locally-made solution to the looming sulphuric acid shortage that will otherwise have a huge negative impact on many of our largest industries. Mount Isa already has expertise in the production of sulphuric acid and has existing air monitoring systems in place to ensure community safety. Cobalt Blue’s technology solves the issue of dealing with old tailings as well as reinforcing the economics of the supply chain for the whole of Australia. It also reduces the sovereign risk of relying on international sulphuric acid supply.”

ReMine+ technology has been demonstrated at Cobalt Blue’s Broken Hill demonstration facility, producing 10 tonnes of high-purity elemental sulphur from pyrite feedstocks via a commercial rotary kiln typically operating at 150-300 kg/h throughput capacity. It can recover valuable metals (including gold, cobalt, nickel, and copper) while simultaneously generating elemental sulphur or sulphuric acid. However, it has yet to be deployed on the kind of scale that would be required at Mount Isa.

INDONESIA

GEM and Vale in HPAL project

Chinese battery metal producer GEM has signed a project investment cooperation framework agreement with PT Vale Indonesia, the Indonesian unit of the Brazilian mining company Vale, to establish a high-pressure acid leach (HPAL) facility in the central Sulawesi province of Indonesia. The $1.4 billion facility will have the capacity to produce 60,000 t/a of nickel as a mixed hydroxide precipitate (MHP) for use in electric vehicle batteries.

As announced by Indonesian president Prabowo Subianto at an Indo-Chinese business forum, the investment also includes a $40 million research and development centre for knowledge transfer and local talent development, $30 million for an environmental, social and governance (ESG) compound with green landscaping, employee dormitories, domestic water supply and waste treatment, and $10 million for community development and public facilities.

Speaking at the same event, PT Vale CEO Febriany Eddy said: “This project is not just about producing MHP – it is about creating a model for responsible resource management that benefits Indonesia and the world. By integrating advanced technology, eco-friendly practices and a commitment to net-zero production, we are shaping a future where Indonesia is recognised as a leader in sustainable industrial development.”

GEM chairman Professor Xu Kaihua said: “The HPAL Project represents a vital collaboration that merges our expertise in sustainable materials with Indonesia’s rich resources. This project is not only a step toward a cleaner future but a foundation for deeper cross-border cooperation in green innovation. GEM will unite with Vale to apply zero-carbon emission, intelligence, high- technology and ESG concepts in designing this project and create a world-class green demonstration park with green nickel resources, local technologies and local talents, to smelt laterite nickel ore directly into battery material.”

PT Vale Indonesia already has two HPAL plants under construction in Pomalaa and Sorowako on Sulawesi island in collaboration with Zhejiang Huayou Cobalt.

CHINA

Nornickel to send concentrate, acid for processing

Russian nickel-copper producer Norilsk Nickel (Nornickel) has agreed to send copper concentrate and by-product sulphuric acid to China for processing and, in return, will receive technologies from Chinese partners to enable production of battery materials from Russia’s lithium deposits, CEO Vladimir Potanin said in a broadcast interview. He described the arrangements as part of a new, four-year strategy for moderate growth. The plans are part of a strategic shift towards Asia after the company was shunned by Western equipment suppliers and selling into Western markets became more difficult after Russia invaded Ukraine in February 2022. Nornickel is not directly targeted by sanctions.

Nornickel is working with Russian nuclear power supplier Rosatom on a lithium project in the Murmansk region. The plan is to start construction of an open-pit mine at Kolmozerskoye in 2026 with completion in 2029 and production beginning the following year. Nornickel continues to invest in Russia by expanding smelting capacities in Norilsk and the Nadezhda metallurgical plant, among other projects. They are necessary to retain Russian government support, increase its tax base in the country and add 4,500 jobs by 2030, Potanin said.

In a separate statement, Nornickel said it expects to sell all of its metal production volumes next year, despite conditions remaining challenging and the nickel market forecast to be in surplus. The company gave no figures, but in October raised production guidance for this year to between 196,000204,000 t/a for nickel and 337,000357,000 t/a for copper, up from the previous ranges of 184,000-194,000 t/a and 334,000-354,000 t/a, following ahead of schedule completion of major repairs to the No.2 smelting furnace at Nadezhda.

Acid exports rose in 4Q 2024

According to customs data, China exported 256,200 tonnes of sulphuric acid in November 2024, up 34% month on month, although down 29% on a year on year basis. As of November, China’s total sulphuric acid exports reached 2.16 million tonnes, a cumulative year on year decline of 12%. The top three destinations for Chinese acid in November were Chile, Saudi Arabia and India, with volumes of 126,400 tonnes, 62,100 tonnes, and 50,000 tonnes respectively.

Sumitomo Metal Mining (SMM) said that it believed that China’s total sulphuric acid exports for 2024 are expected to have remained flat or slightly increased on 2023, suggesting that December’s export volume would be another increase. Export business from major coastal acid plants has become an important means of balancing the domestic market, and the export operations of these key plants are also progressing steadily. As 2024 comes to an end, while domestic sulphuric acid capacity expands, downstream chemical industry demand has also slightly increased. However, the oversupply situation in the industry remains unchanged. Looking ahead to 2025, China’s sulphuric acid capacity is expected to continue rising, but demand growth may lag behind supply growth. Increased competition in overseas markets adds to the uncertainty of the domestic sulphuric acid market, making the price trend of sulphuric acid in 2025 even more unpredictable.

CHILE

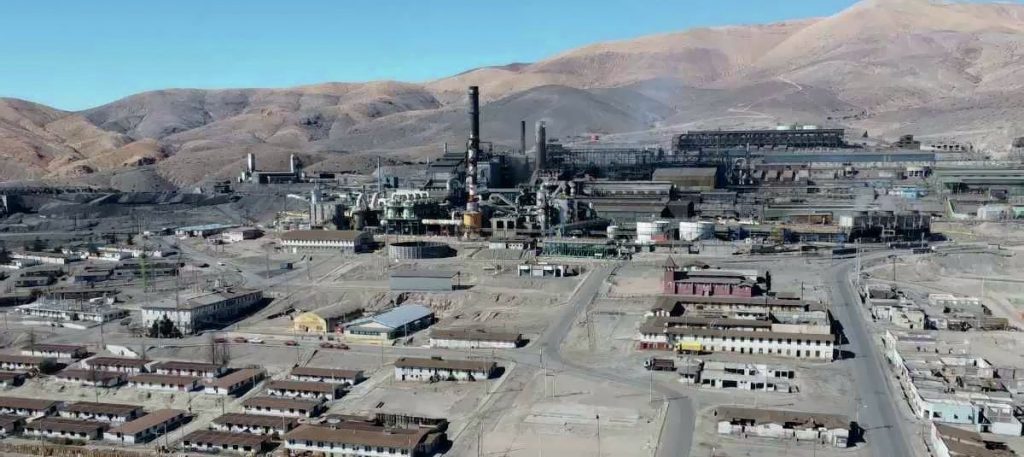

Codelco charged over smelter pollution

Chile’s environmental regulator SMA has filed a charge against state-owned Codelco, alleging emission violations at its Potrerillos copper smelter in the Atacama region of northern Chile. An audit showed the company had not implemented a monitoring system for sulphur dioxide emissions and other procedures in accordance with environmental standards for the plant, Reuters news agency reported. The SMA labelled the charge as serious, which could lead to a fine of around $4.1 million, and possible revocation of the environmental permit or closure. Codelco had ten days to submit a compliance plan, and 15 days to present a defence.

Glencore to test new leaching process

Glencore has signed a memorandum of understanding (MoU) with technology company Ceibo to deploy Ceibo’s proprietary copper leaching technologies in Chile. The process has been validated after two years of testing at Glencore’s Lomas Bayas mine and the company is moving toward scaling up the process to assess it as a way to extend mine life. Ceibo’s leaching processes extract copper in all sulphides using existing leaching plants by catalysing ore oxidation through electrochemical reactions, resulting in higher recovery rates in shorter operational cycles, the company said.

Lomas Bayas’ general manager Pablo Carvallo added: “Ceibo’s ability to produce copper from sulphide-rich ores brings a huge value for assets like Lomas Bayas to sustain production while transitioning from oxides to sulphides.”

Under the terms of the memorandum of understanding, Ceibo’s technology will scale up with on-site testing through the Lomas Lab, a Glencore world-scale test site, and the company’s research and development branch. This agreement opens a significant commercial avenue for Ceibo, demonstrating its unique approach with a major mining company and affirming the value that Ceibo’s advanced leaching technologies bring to copper assets globally.

BRAZIL

Acid tanker spill after bridge collapse

A bridge connecting two states in Brazil’s northern and north-eastern regions collapsed on Dec ember22 as vehicles were crossing, killing at least one person and spilling sulphuric acid into the Tocantins River. The National Department of Transport Infrastructure said the central span of the 533m bridge, linking the cities of Estreito in Maranhao state and Aguiarnopolis in Tocantins state, gave way in the afternoon. A tanker truck carrying the acid plunged into the water, officials said. According to the fire department, one person has been confirmed dead and another was rescued alive. Attempts by divers to reach submerged vehicles were complicated by leaking sulphuric acid from the tanker.

Korea Zinc completes smelter upgrade

Korea Zinc says that it has successfully completed the ‘Onsen Smelter Rationalisation Project,’ a key initiative undertaken throughout 2024 to strengthen the competitiveness of its Onsan Smelter. As a result, the company expects operating profits to exceed its original business targets for the year. Korea Zinc has implemented improvements in operational processes, enhanced energy efficiency, and strengthened cost competitiveness, to address issues with rising energy costs (electricity and coal), and falling treatment charges, which increased raw material expenses. The company says that Korea’s domestic steel industry is struggling due to dumping by other major steelmakers, and the non-ferrous metals market faces numerous challenges with bleak prospects for 2025.

BANGLADESH

BADC signs DAP import agreement

The Bangladesh Agricultural Development Corporation (BADC), under the supervision of the Ministry of Agriculture, has signed an agreement with Banyan International Training Ltd, a Chinese company, to import 440,000 tonnes of diammonium phosphate (DAP) fertilizer for the year 2025. The agreement was signed on January 10th in Fuzhou, China by Mohammed Ruhul Amin Khan, Chairman of BADC, and Li Jin, General Manager of Banyan Group. BADC reports that the price of each tonne of fertilizer has been reduced by $2 compared to the previous rate, resulting in an estimated saving of approximately $900,000.

ALGERIA

Major new phosphate project

The Algerian Chinese Fertilizers Company (ACFC) has launched a $7 billion integrated phosphate project (PPI) in the country’s Tebessa province. ACFC was formed in 2022 as a joint venture between Algerian firms Manal and Asmidal, a subsidiary of Algerian energy giant Sonatrach, and Chinese firms Wuhuan Engineering and Tian’An Chemical, a nitrogen and phosphate fertilizer producer. It was set up to develop and exploit the Bled El Hadba phosphate deposit at Djebel Onk, with the two Algerian firms owning 56% of ACFC and the two Chinese companies owning the remaining 44%.

The project includes a large-scale phosphate rock mine with a capacity of 6 million t/a – approximately 2.5 times higher than Algeria’s current national output – extracted from 2.2 billion tonnes of ore reserves. The scale of this deposit should guarantee a mine life of around 80 years.

The ACFC is also proposing to construct a state-of-the-art production and processing complex at Qued Kebrik, Energy, Capital & Power said, with 21 phosphate processing units also spread across Souk Ahras, Annaba and Skikda. The project could enter production as early as 2027, according to the current timetable, creating 12,000 construction-phase jobs and 30,000 direct and indirect jobs once operational. Existing phosphate producer SOMIPHOS is also planning a one million tonne capacity expansion at its Djebel Onk site.