Sulphur 416 Jan-Feb 2025

31 January 2025

The rapid growth of nickel sulphate

NICKEL SULPHATE

The rapid growth of nickel sulphate

Nickel sulphate is an intermediate step in the production of materials for batteries, and is seeing rapid demand growth as the auto industry moves towards electric power trains.

The sixth most abundant element on earth, nickel is a key raw material for many applications, but has historically mainly been used in the production of stainless steel, as well as various alloys, other steels and plating applications. But its use in various battery chemistries have propelled it into the limelight in recent years. Nickel metal hydride (NiMH) batteries have long been the preferred power train for hybrid electric vehicles. Two of the most commonly used types of batteries, nickel cobalt aluminium (NCA) and nickel manganese cobalt (NMC) use 80% and 60-90% nickel respectively. Most lithium ion batteries also now rely on nickel lithium nickel manganese cobalt oxide (Li-NMC). The nickel in these batteries is present in the form of nickel sulphate hexahydrate crystals, NiSO4. (H2O)6, often a vivid turquoise colour, as shown on our front cover. While there are non-nickel battery technologies which also have wide uptake, such as lithium iron phosphate (LFP), nickel is likely to be present in about 50% of batteries used in vehicles and stationary power applications by 2030, and the battery share of the nickel market will rise from around 16% in 2022 to 28% by 2030.

Conversion processes

Nickel ores broadly group into two types; laterites (ca 60%), which are oxides found close to the surface, mostly in tropical areas, and sulphides (ca 40%), which are generally deeper and often in remote areas. Laterites can usually be recovered by open cast mining, which makes them cheaper to extract, but they are generally lower grade (~1.4% Ni compared to 2.8% for sulphides). Laterites include saprolites, which are higher in magnesium, and limonites, which are higher in iron. The high cost of underground mining compared to open cast means that laterites have become the preferred source of nickel, especially for new projects, and they represent 70% of nickel production.

Historically, laterites have generally been heat treated, at lower temperatures to produce lower grade (4-15% Ni) ‘nickel pig iron’ (NPI), or at higher temperatures to produce higher grade (20-40% Ni) ferronickel, both of which are used in steelmaking – NPI generally for lower grade steels. Sulphide ores, meanwhile, are processed using a traditional flotation, smelting and refining processing route. The concentrate generated by flotation is smelted to form a mixed nickel-iron sulphide known as a matte, which contains 30-60% Ni. The matte is passed through a rotating converter which converts the iron to an oxide and uses a silica flux to remove it, leaving a nickel sulphide matte. Final conversion uses leaching or electrorefining to produce high purity end products such as nickel cathode, briquettes or nickel sulphate, depending on the finishing process used. Nickel sulphide ores can also be treated using a biological leach process, leading to a mixed sulphide precipitate.

A growing (ca 25%) proportion of nickel is also recovered from other nickel products, including spent batteries, generally via a pyrometallurgical process, with stainless steel the final destination. But growing demands for higher grade (‘Class 1’) nickel for battery use have required the development of bridging technologies from laterite to high grade nickel products. The most prominent of these is high pressure acid leaching (HPAL), which uses sulphuric acid at high temperatures and pressures to convert limonite and similar ores to a mixed hydroxide precipitate (MHP) or mixed sulphide precipitate (MSP), which then require a further refining step using sulphuric acid to produce nickel sulphate and/or ammonium sulphate. An alternative is heap leaching, which occurs at atmospheric pressure, but which takes more acid and much longer time to extract the nickel. Nickel pig iron can also be smelted to produce a nickel matte, followed by solvent extraction and purification to produce nickel sulphate, though this is an energy intensive process. Other processes for conversion are under development, including oxygen side blowing (OSBF) to produce matte from laterite ore at a lower operating cost compared to the NPI to matte conversion via rotary kiln electric furnace (RKEF). Atmospheric leaching processes to sulphate conversion include direct nickel (DNi) and pressure oxidation (POX). DNi permits leaching of all laterite ore types, while POX uses concentrate beneficiated from sulphide ores as the feedstock for the POX autoclave.

Production

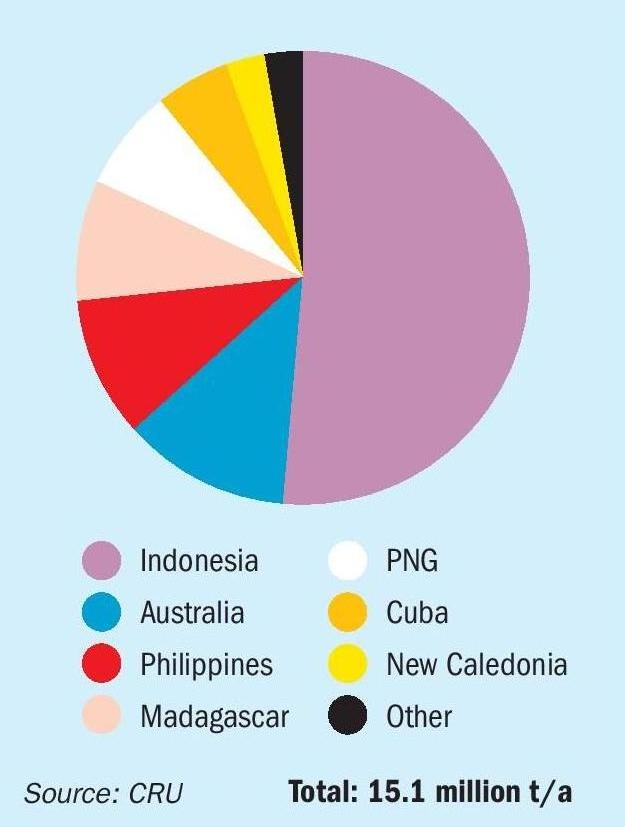

The complexity of these processing options means that manufacturers must balance various factors, from cost of recovery of ores, energy and labour costs, and even carbon intensity of production – pyrometallurgical processes are needless to say that most carbon intensive. Producing battery materials for lower carbon electric vehicles via a high carbon intensity extraction process would seem to defeat the object. At present, HPAL seems to have a clear advantage in terms of production of nickel sulphate, and has become the dominant technology for the current wave of nickel capacity, most of it based in Indonesia. Indonesia’s policy regarding low-grade nickel ore exports, commencing with a ban in 2014, a relaxation of the policy in 2017, followed by a return to the original ban in 2020, has incentivised the development of domestic refining capacities, bolstered by investments from Chinese companies. Since the ban in 2014, Indonesia’s refined nickel output has increased from just 24,000 t/a to around 1.4 million t/a, with several new projects under development. The Chinese producers have focused on MHP production, seeing it as the most cost effective material to be transported to China for processing. Figure 1 shows just how dominant Indonesia has become in acid leaching, with more than half of all production in 2024.

Overcapacity

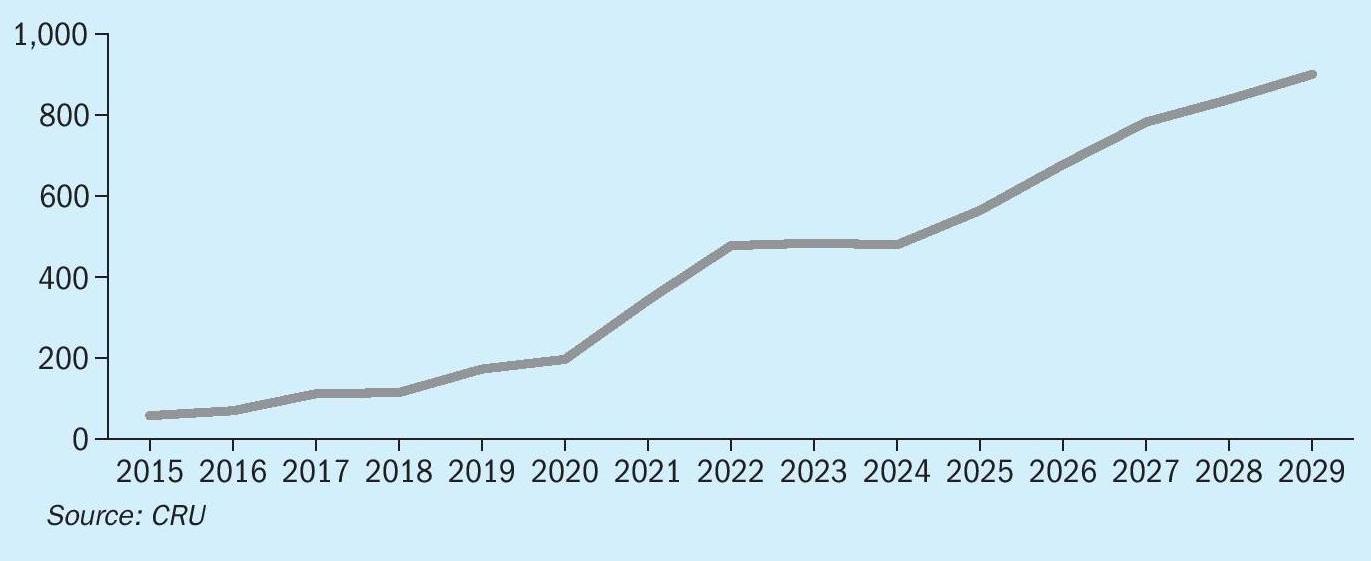

The rush to build new HPAL capacity has had its own effect upon the market, with a glut of nickel on the market at present, and prices at low levels; the LME nickel price has traded at around $16-17,000/t during the second half of 2024. There has been an oversupply of nickel sulphate and nickel battery precursors as a result of overproduction of NMC and NCA from 2021 to 2023, which resulted in significant stock building, and these stocks have been drawn down during 2024, during which time actual demand for nickel sulphate has been relatively flat, and it has been Chinese stainless steel demand which is carrying the nickel market at present, rising by 6.5% in 2024 and forecast to rise by 5% in 2025. Higher net exports of stainless have supported the rise in Chinese stainless production, although over the medium term (to 2029), global stainless production is forecast to rise by a CAGR of 3.8% with China remaining the key driver. Meanwhile, in spite of flat demand in 2024, in the medium term, nickel sulphate demand from the battery sector will rise at a CAGR of 12%. By 2029, it is projected that global nickel sulphate demand will reach 1.1 million t/a. Outside of China, CRU forecasts that production will more than double by 2029. This will mainly be supported by capacity ramp-up and new capacity additions in Indonesia and South Korea. But the market will remain oversupplied going into 2025, as oversupply will likely increase further as production growth will more than offset the recovery in consumption. This surplus will likely persist through 2029, keeping nickel sulphate prices in China slightly lower than LME cash prices out to 2029. Nevertheless, Indonesian HPAL producers remain towards the bottom of the industry cost curve, and the surplus is unlikely to affect them too badly.