Sulphur 417 Mar-Apr 2025

19 March 2025

Sulphur in agriculture

AGRICULTURE

Sulphur in agriculture

Sulphur’s key role as a plant nutrient means that its use as a fertilizer continues to be a major area of demand.

Sulphur is a vital nutrient for plant and animal health, and is essential for plants to form proteins, enzymes, vitamins and chlorophyll. Crops with high sulphur requirements include legumes such as alfalfa and soybeans, as well as canola and rapeseed, but because of its effect on nitrogen uptake, it is also important for crops with high nitrogen requirements such as maize and cotton. Persistent experiments show that sulphur application can increase crop yields by around 20%. Sulphur also helps the uptake of other micronutrients, such as zinc.

Sulphur requirements in soils have tended to increase as environmental sources of sulphur have declined, in particular – in industrialised countries – sulphur dioxide emissions from power plants and vehicle exhausts. In the thirty years from 1985-2015, for example, atmospheric deposition of sulphur on fields in the US Mid-West fell by around 80% due to improvements in air quality. This period also coincided with a move away from traditional fertilizers like ammonium sulphate, potassium sulphate and single superphosphate, which had ‘coincidentally’ contained sulphur to higher analysis fertilizers such as urea, potassium chloride and diammonium phosphate.

The requirement for additional quantities of sulphur fertilizer have been recognised and this is leading to increasing use of sulphur containing fertilizers.

Sulphur vs sulphate

There are essentially two forms in which sulphur can be applied to soils; as elemental sulphur, or as a sulphate. Sulphate is the form in which plants are able to take in the nutrient, as it is soluble and can be transported via water into the roots. Conversely, elemental sulphur must first be broken down by thiobacteria into soluble sulphates before it can become available to the plant, comparable to the way that urea must be oxidized to a nitrate before plants can use the nitrogen, but the conversion process for sulphur is much slower and can take months. This process can be sped up by increasing the surface area of elemental sulphur by using it in a micronised form, or by breaking up sulphur granules into smaller particles. A common technique is to use 5% bentonite clay in the sulphur granule. The clay absorbs water and swells, leading the brittle sulphur granule to fracture. Some of the major developments in the past decade in sulphur fertilization have involved greater control over sulphur particle size and dispersion in conventional fertilizers, leading to a growing range of ‘sulphur enhanced’ fertilizers.

Sulphur fertilizers

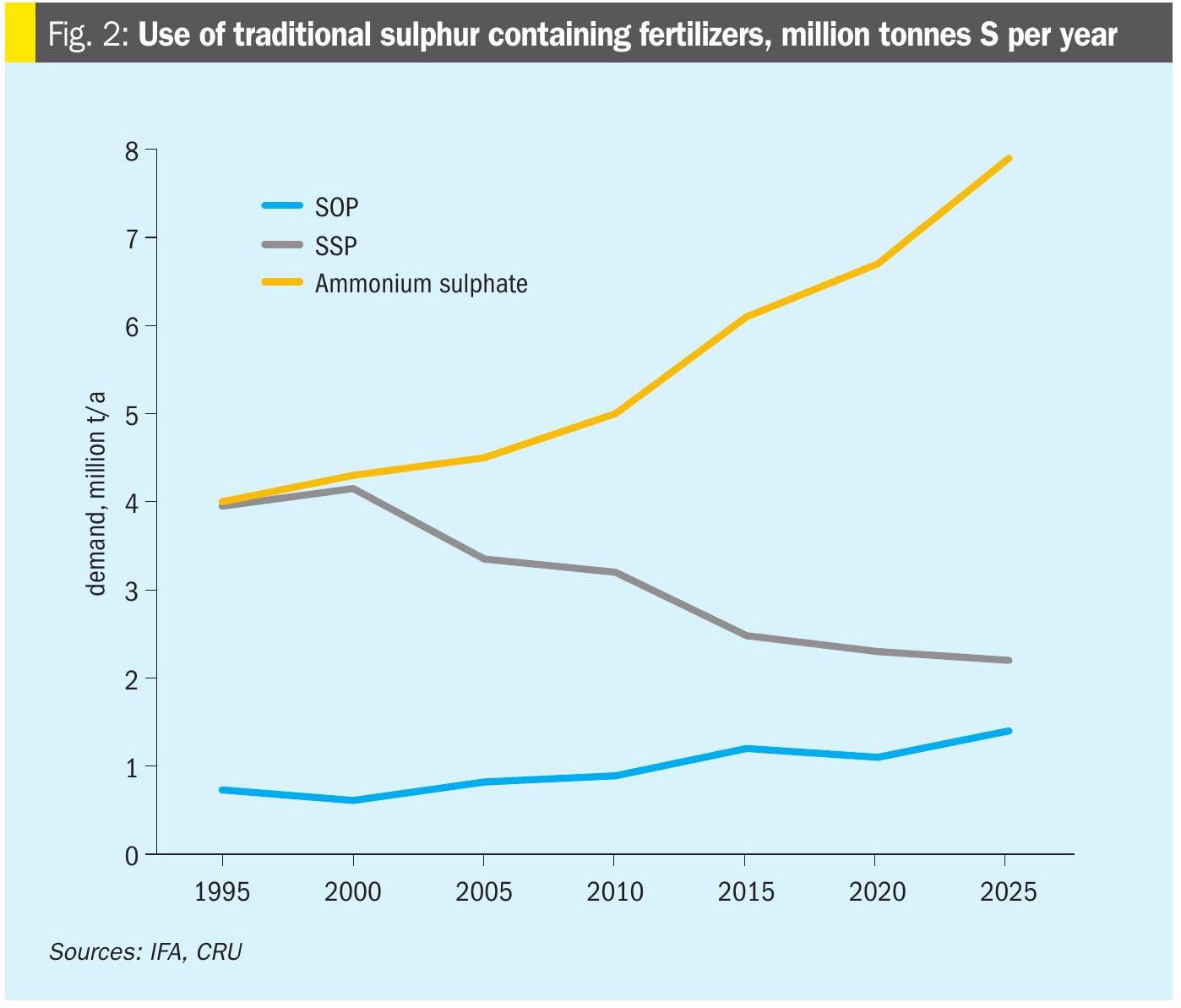

The three main ‘traditional’ sulphur-containing fertilizer – ammonium sulphate, single superphosphate and potassium sulphate – still represent a significant majority (ca 70%) of sulphur fertilizer applications.

Ammonium sulphate

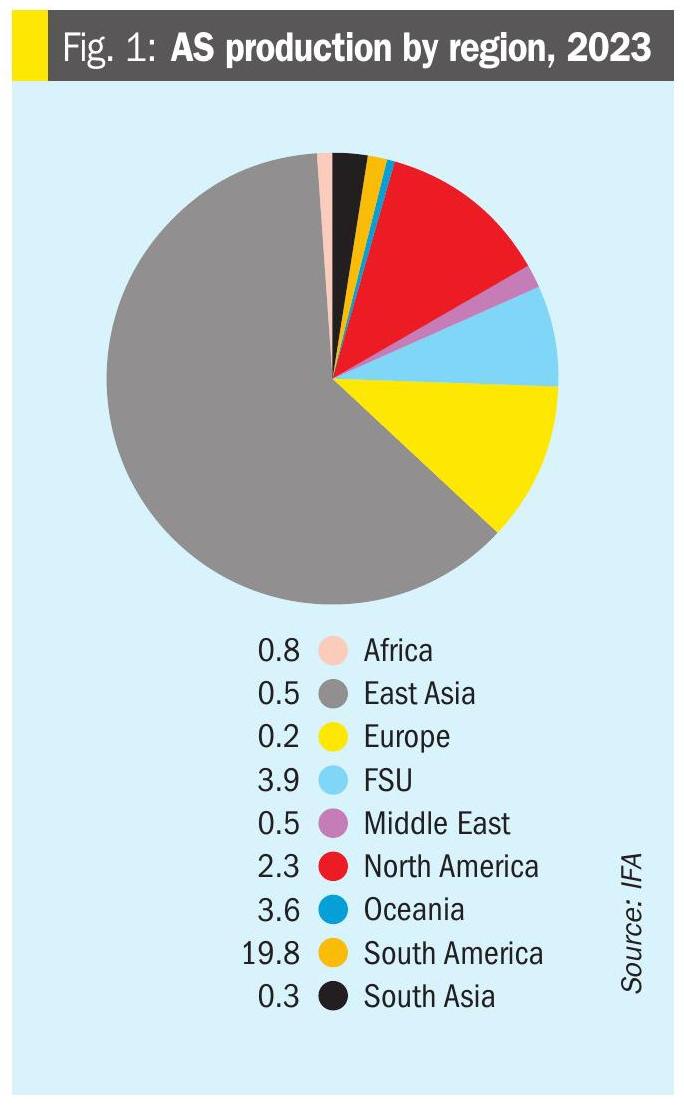

Ammonium sulphate is still the largest sulphur fertilizer by volume. Global ammonium sulphate production was 31.9 million t/a in 2023, or around 7.6 million t/a of sulphur. Figure 1 shows the geographical distribution of capacity. As can be seen, most is in China, where there is a great deal of involuntary production as a by-product of caprolactam manufacture for nylon fibres, methylmethacrylate, acrylonitrile, methionine production etc. Overall around half of all ammonium sulphate production comes as a by-product of caprolactam production, but that figure is higher in China, where the rapid increase in artificial fibre production has led to a major increase in caprolactam production there, and concomitant demand for sulphuric acid. Other major involuntary sources of AS production are ammonia scrubbing of coke oven gas, and as a by-product of lithium iron phosphate production, the latter again increasingly important in China due to the rapidly expanding battery manufacturing industry for electric vehicles. About 70% of AS capacity is based on by-products from other production, and in China this figure is 83%. It is also 90% in Europe and 73% in North America. However, in the Middle East, Africa and South America, the opposite is true, and on-purpose production predominates, between 75% of production (in South America) to 95% (in the Middle East).

Overall, the world consumed around 18.2 million t/a of sulphuric acid in 2024 to make ammonium sulphate, or about 6% of all acid demand. China represented almost exactly half of that acid demand (9.1 million t/a). Chinese AS production has tripled in the past 15 years, and is forecast to grow by another 25% out to the end of the decade as industrial sources continue to grow.

AS consumption is virtually all (95%) as a fertilizer, with its sulphur content becoming increasingly relevant. Consumption is more widely distributed than production, with the strongest demand in Asia (though not China, which uses relatively small quantities) and Latin America – particularly Brazil. There are some exports from Europe, but low operating rates for caprolactam production there means that there are also imports, but the AS trade is dominated by China, which is by far the largest exporter, at 17.1 million t/a in 2024, an increase of 25% on 2023. Chinese exports go mainly to southeast Asia (about 30% of exports) – especially Indonesia, Vietnam and Myanmar – and Brazil, which took 36% of Chinese exports (6.1 million t/a) in 2024. An increasing amount (7% of exports in 2024) go to African countries, especially Nigeria, South Africa and Egypt. The US is also a major importer (1.0 million t/a), but takes AS from Europe, Canada and Mexico as well as China.

Sulphuric acid use for AS production is expected to grow from 18.2 million t/a to 22.7 million t/a in 2029, with China representing around 75% of that, but increased production is expected in western Europe as production there recovers, and some additional production in the US, India and elsewhere. As AS production remains largely involuntary, output tends not to be determined by fertilizer prices but rather the markets for fibres and the other products that it is a by-product of, meaning that AS will probably continue to represent the largest slice of sulphur fertilizer production going forward.

Single superphosphate

Single superphosphate (SSP) is the simplest phosphate fertilizer, made by treating phosphate rock with sulphuric acid. Production is based mainly in Brazil (26% in 2024), India (24%), China (13%) and Australia and New Zealand (12% between them). Egypt is also a major producer. Total sulphuric acid use for SSP production in 2024 was 9.1 million t/a. Because of its relatively low phosphate nutrient content compared to mono- and diammonium phosphate (MAP/DAP), it tends to be consumed in the country of origin, and export volumes have declined due to increasing competition from more economic high-analysis phosphates. SSP capacity and production fell from 2015 to 2020, as Figure 2 shows, but since then has remained relatively constant, and is even expected to increase slightly towards the end of the decade, with increasing production in India and Brazil masking a continuing fall in Chinese production. Overall SSP production is expected tog row by 7.7% between 2024 and 2029.

Potassium sulphate

Potassium sulphate/sulphate of potash (SoP) has always been a niche product compared to the much more widely used potassium chloride (aka ‘muriate of potash’/MoP), but it is valued as a chloride-free source of potash for cash crops such as tobacco, tree nuts and citrus fruits. Global production was 7.8 million t/a in 2024, representing about 1.4 million tonnes S. China accounts for 65% of world capacity, and Germany another 11%. Other major producers are the US, Egypt and Belgium. China also dominates consumption, using virtually all that it mines in various NPK formulations, but export restrictions are tight, and it exports only a fraction of its production. Both Chinese consumption and production increased by 17% in 2024. North America and Europe are also major consumers. Higher price premiums for SoP in recent years again due to its sulphur content (17-18%) may encourage new production, but long lead times mean that overall production is likely to be flat out to the end of the decade.

Sulphur-enhanced fertilizers

While these three still make up the mainstay of sulphur fertilizer applications, there are an increasing number of sulphur enhanced fertilizers which typically use innovative technologies to incorporate elemental sulphur into higher analysis fertilizers, either within granules or as an external coating. Introducing a liquid sulphur spray to Urea, TSP, MAP or DAP during drum or pan granulation, for example, results in N and P products with a 5-20% elemental sulphur content. Sulphur-enhanced fertilizers combine nutrient availability with high use-efficiency, and also have good storage and handling properties. The market for sulphur-enhanced NP+S products has developed over the past decade, with particular take-up in the US, Brazil, India and parts of Africa.

Controlled release fertilizers (CRFs) can be produced by coating highly soluble nutrients such as urea with relatively insoluble coatings. While India uses the plant fibre neem, other polymers can be used, and elemental sulphur (usually with a polymer outer coating) is also used as a coating – the sulphur breaks down slowly, eventually allowing the encapsulated to become available over a longer time period. India’s Rashtriya Chemicals and Fertilizers Ltd (RCF) has introduced a sulphur coated urea which it markets as ‘Urea gold’, with 37% N and 17% sulphur. The sulphur acts as a controlled release coating for the urea, increasing its nutrient use efficiency, while also providing plant nutrient sulphur. RCF says that it can be applied at 75% of the amount of conventional urea to achieve the same effect. However, at present uptake remains low. At the end of 2024, RCF said that it had sold 12,200 tonnes of Urea gold during the year.

Coromandel International has also recently started up a new 25,000 t/a plant making sulphur bentonite at its Visakhapatnam facility in Andhra Pradesh. Visakhapatnam produces approximately 1.2 million t/a of of complex fertilizers along with phosphoric acid and sulphuric acid. The site also has an sulphur fertilizer plant with 25,000 t/a production capacity, meaning that the new plant will effectively double the site’s sulphur fertilizer capacity. Coromandel says that the new plant uses German technology to fortify sulphur fertilizers with multiple micronutrients, addressing evolving nutrient deficiencies in Indian soil.

The popularity of liquid fertilizers in North America, especially liquid ammonia and urea ammonium nitrate solution (UAN) has led to the use of soluble thiosulphates to produce sulphur enhanced liquid fertilizers.

Still room for growth

While reliable statistics are hard to come by, total fertilizer sulphur nutrient consumption is currently estimated to be about 13.5 million tonnes S, against a potential global requirement of 27 million tonnes S. The shortfall is lowest in North America (ca 20%), with Europe and Latin America at around 35%, but for Asia the figure is closer to 50% and in sub-Saharan Africa it is over 90%. Despite growing sulphur nutrient demand over the near term, the gap between supply and demand is projected to narrow. CRU expects the premiums now achievable with sulphur containing fertilizers and the demonstrable success of sulphur enhanced fertilizers to continue to incentivise investment in sulphur-enhanced fertilizer technology to meet projected future demand.