New merchant ammonia projects

Although global ammonia supply is set to increase this year, there is a shortage of new merchant capacity after 2024 which may lead to rising prices in the medium term.

Although global ammonia supply is set to increase this year, there is a shortage of new merchant capacity after 2024 which may lead to rising prices in the medium term.

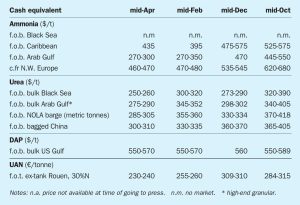

The ammonia market reverted to recent norms at the end of April, with prices more or less unchanged in the east, and several benchmarks west of Suez moving downward in line with May’s Tampa settlement. Following a trio of high-priced c.fr spot deals many wondered whether such business would be replicated in Asia, but the hype did not live up to the expectation, with the majority of tonnes continuing to move on a contract basis into the likes of South Korea and Taiwan, China. The $430/t c.fr concluded into China has been attributed to both supply uncertainty and an uptick in domestic demand, though several inland prices declined this week, rendering price direction difficult.

The board of Petrobras has approved the resumption of operations at the company’s Araucária Nitrogenados SA (ANSA) site at Araucaria, Parana state. The plant, which has the capacity to produce 475,000 t/a of ammonia and 720,000 t/a of urea, has been idled 2020.

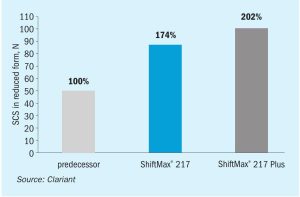

Anton Kariagin and Stefan Gebert of Clariant discuss the benefits and commercial performance of the new low temperature shift (LTS) catalyst – ShiftMax 217 Plus. A case study demonstrates the benefits of this catalyst, providing ultra-low methanol formation resulting in increased ammonia production and/or energy savings.

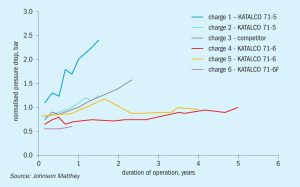

Johnson Matthey's latest KATALCO™ 71-7F high temperature shift catalyst with its robust shape provides lower lifetime pressure drop.

Prices in the West are unlikely to garner much support moving into the latter stages of Q2. The May Tampa ammonia settlement was settled by Yara and Mosaic at $450/t c.fr, down $25/t on the $475/t c.fr agreed for April. With seasonal domestic demand in the US drawing to a close 2H April, many had anticipated that either a rollover or a slight decline would be agreed.

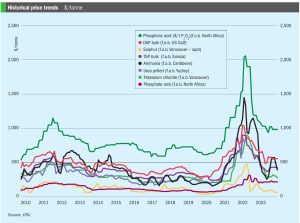

More than 900 delegates from 400 companies and 56 countries gathered at the Hilton Downtown Hotel, Miami, Florida, 5-7 February, for the 2024 Fertilizer Latino Americano (FLA) conference. The event was jointly convened by Argus and CRU. We present selected highlights from this year’s three-day conference.

Urea. As February ended, urea prices found support in the US and Brazil while Europe remained subdued and Egypt struggled to find buyers. New Orleans was the one bright spot in the urea market – with NOLA prices benefitting from the meeting of suppliers and buyers at the TFI’s domestic conference. With positive sentiment all round, prices moved up $30/st, peaking at $390/st f.o.b. for March.

Mark Brouwer and Jo Eijkenboom of ureaknowhow.com examine the major shifts in global urea production. They also discuss the future of the urea industry and, in particular, how the sector is being affected by the increasing focus on low-carbon ammonia production.

Phospholutions, Inc., a sustainable fertilizer company headquartered in the United States, recently launched its flagship technology, RhizoSorb ® , to improve phosphorus fertilizer efficiency.