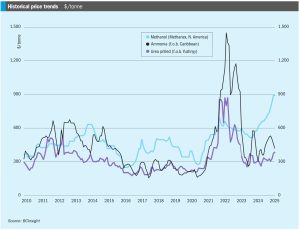

Market Outlook

• Prices look set to come under further pressure moving into March, particularly east of Suez. Prices in the West – specifically in northwest Europe – have enjoyed a partial degree of support through February, though this appears unlikely to hold for much longer.