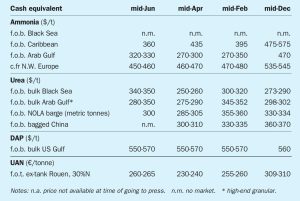

Price Trends

Ammonia markets were quiet in June, though both CF Industries and Grupa Azoty were reported to be looking for July tonnes and the enquiry will test how tight the market is going forward. Algeria has traded in the $400-405/t f.o.b. range, suggesting c.fr values in Europe might be slightly higher at $450-460/t c.fr. Supply from Algeria has been and continues to be somewhat restricted because of constraints caused by the hot weather. Gas supply however is easing in Egypt and further ammonia exports should emerge shortly.