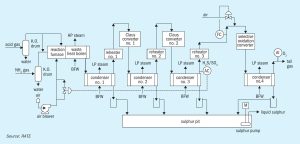

Advanced catalysts meeting the need for stricter regulations

M. Rameshni and S. Santo of Rameshni & Associated Technology & Engineering (RATE USA) report on advanced catalysts for increasing the sulphur recovery efficiency of new and existing sulphur recovery units to meet stricter environmental regulations.