Price Trends

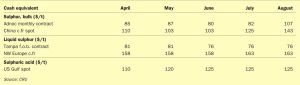

At the end of August, the Qatar Chemical and Petrochemical Marketing and Distribution Company (Muntajat) tendered for 35,000 tonnes of sulphur for September loading from Ras Laffan, with offer prices reported at or around $130s/t f.o.b., according to market sources. Bids were received at multiple levels, with market participants initially anticipating awards around the mid-$120s/t f.o.b. The tender result was higher than market expectations and would equate to delivered prices to key Asian markets at $150-155/t c.fr. But prices in China and Indonesia remained lower this week at around $140-145/t c.fr, with India at $145-150/t c.fr. Prices have increased steeply since Muntajat’s 25 June session, which was indicated awarded in the mid-$80s/t f.o.b.. and Muntajat posted its Qatar Sulphur Price (QSP) for September at $125/t f.o.b., up $19/t from $106/t f.o.b. in August. This represents the highest QSP since March 2023 at $133/t f.o.b., and reflects delivered levels to China nearing $150/t c.fr at current freight rates. Tight supply and strong downstream demand have pushed tender prices higher. Muntajat tenders were previously awarded at $92/t f.o.b. in April, up from $88/t in March and the low $80s/t f.o.b. in February.