CRU Phosphates 2024

More than 370 delegates from over 150 companies and 40 countries gathered at the Hilton Warsaw City Hotel, Warsaw, Poland, 26-28 February, for CRU’s Phosphates 2024 conference.

More than 370 delegates from over 150 companies and 40 countries gathered at the Hilton Warsaw City Hotel, Warsaw, Poland, 26-28 February, for CRU’s Phosphates 2024 conference.

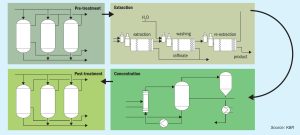

KBR designs and builds customised phosphoric acid purification plants tailored to the individual demands of clients. Christopher Heikkilä, KBR’s Business Development Manager, outlines the process design requirements and the challenges associated with impurities removal.

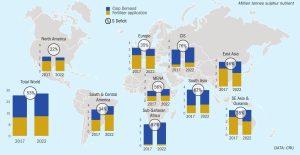

Sulphur plays an important role in crop nutrition. Indeed, sulphur is increasingly being recognised as the fourth major crop nutrient alongside N, P and K. However, a combination of intensive agricultural practices, increasing application of high-analysis fertilizers and tighter air quality regulations has led to increasing sulphur deficiency in soils. In this insight article, CRU’s Peter Harrisson looks at what’s driving sulphur deficiency and whether there’s a gap in the market for sulphur fertilizers.

While there has been a lot of talk about decarbonising ammonia and methanol production, for as long as blue and green production is more expensive than conventional production, uptake will be dependent upon markets which are prepared to pay a premium for such chemicals, perhaps because they have no other reasonable choice, given environmental mandates. One sector above all has dominated the prospects for medium term demand for low carbon ammonia and methanol alike, and that is shipping.

Although global ammonia supply is set to increase this year, there is a shortage of new merchant capacity after 2024 which may lead to rising prices in the medium term.

The phosphate industry, the dominant consumer of sulphuric acid worldwide, has grown to its present size on the back of fertilizer consumption. And while this has seen considerable growth over the past decades, especially in countries like China, India and Brazil, it has generally been fairly steady and – subject to the annual vagaries of weather and the commodity cycle – relatively predictable. However, the world economy is now in the throes of a major transformation towards less carbon intensive generation and use of energy, and that is disrupting many markets, including that for phosphates.

More than 900 delegates from 400 companies and 56 countries gathered at the Hilton Downtown Hotel, Miami, Florida, 5-7 February, for the 2024 Fertilizer Latino Americano (FLA) conference. The event was jointly convened by Argus and CRU. We present selected highlights from this year’s three-day conference.

Nitrogen magazine, as it originally began life in It has been a tough few years for the European nitrogen industry, and between covid, gas price spikes and Russian sanctions, not all companies have weathered the storm. Now that the initial shock of the sky-high ammonia prices that the closure of the Black Sea and the cutting off of almost 40% of Europe’s gas supplies has passed, and the world gas and ammonia markets have largely adjusted to the new reality, prices are coming back down. But it seems that in its wake it may leave quite a different European nitrogen industry from the one that existed in 2019.

“ The need for technical knowledge and insights has never been more important.”

As Europe struggles to move away from its previous dependence on imported Russian natural gas, prices have been high and volatile, with a corresponding catastrophic impact upon domestic ammonia production.