Argus Fertilizer Europe 2022

More than 650 delegates from 326 companies and 56 countries gathered at the Hotel RIU Plaza España, Madrid, Spain, 17-19 October 2022, for the Argus Fertilizer Europe 2022 conference.

More than 650 delegates from 326 companies and 56 countries gathered at the Hotel RIU Plaza España, Madrid, Spain, 17-19 October 2022, for the Argus Fertilizer Europe 2022 conference.

Fluor demonstrates how SRU/TGTU plants within sour gas facilities can facilitate the capture of CO2 and generate H2 by implementing advanced sulphur recovery technologies.

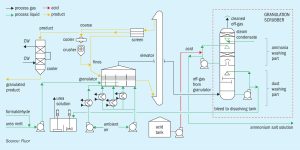

When candle filter mist eliminators installed in the absorption towers in sulphuric acid plants are not sufficiently wet, problems can occur such as free SO3 at the stack, NOx issues and emission non-compliance. Begg Cousland Envirotec discusses how these problems can be overcome by the installation of an annular wetting ring solution.

Industry turnover is a reality, and keeping new employees informed of hydrogen safety procedures in sulphuric acid plants is key to keeping plants fully operational and incident free. Elessent Clean Technologies discusses the steps facilities need to take to prevent hydrogen incidents.

Lithium miner Ioneer Ltd has signed a non-binding Memorandum of Understanding with Shell Canada Energy for the supply of sulphur to Ioneer for its Rhyolite Ridge lithium-boron project in Esmeralda County, Nevada. Ionner said in a statement that “securing the supply of key reagents for ore processing is an important step along the critical pathway to developing the Rhyolite Ridge project”. Under the memorandum, Ioneer will purchase up to 500,000 t/a of high-quality sulphur from Shell, which would fulfil the estimated annual sulphur requirement for the Project.

The world has seen a number of hydrogen explosions in double absorption plants mostly in the intermediate absorption tower (IAT). To review this increase and to determine the causes, an International Hydrogen Safety Workgroup was formed including major acid plant contractors, major acid producers, and consultants in the sulphuric acid arena. Davis & Associates Consulting explores some of the findings.

CRU Events will host the 2023 Nitrogen + Syngas conference and exhibition at the Hyatt Regency Barcelona Tower in Barcelona, 6-8 March.

Cansu Doganay of Lux Research takes a look at the current technology landscape for methane pyrolysis for producing low-carbon hydrogen from natural gas.

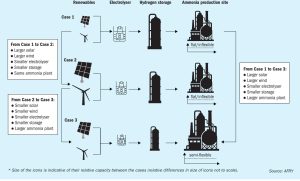

A review of the current slate of plans for green and blue ammonia production.

Due to the inherent nature of the renewable power, sizing eSyngas plants powered with renewable energy brings complexity normally not faced by natural gas-based facilities. In this article, Dr Raimon Marin and Dr Solomos Georgiou of AFRY discuss the application of AFRY’s state-of-the-art modelling tool to optimise the size and production of a green hydrogen system and a green ammonia plant based on given renewable power profiles and their associated variability (e.g., hourly, daily, seasonally, and annually).