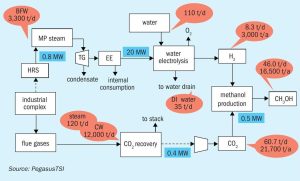

As a quick glance through the Index of last year’s articles and news items in this issue of the magazine will amply demonstrate, 2021 was a year full of project announcements for low carbon ammonia and methanol projects of all hues; blue, green, turquoise and many other shades besides. Market analysts CRU said in December that they calculated that there have been a total of 124 million t/a of low carbon ammonia projects announced, 80 million t/a of which came in 2021 alone, equivalent to 55% of current ammonia capacity. These range from tentative pilot plants that are fully costed and often with government grants already secured to blue sky visions of vast electrolysis hubs in the deserts of Arabia with timescales towards the end of the decade – it’s often the case that the longer the proposed timescale, the less likely a project is to happen.