People

Dr Burkhard Lohr , the chair of the executive board of K+S Aktiengesellschaft, will retire at the end of May next year, after more than 12 years in the role, having decided not to extend his current mandate.

Dr Burkhard Lohr , the chair of the executive board of K+S Aktiengesellschaft, will retire at the end of May next year, after more than 12 years in the role, having decided not to extend his current mandate.

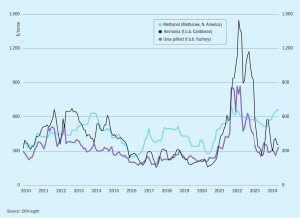

In our May/June issue I discussed the race to be the next major green shipping fuel, in which methanol and ammonia both remain significant contenders, but which methanol appeared to be pulling ahead in. But more recently, a few stories from the past few weeks have left me not quite as sure as I was about that. Firstly, there’s the news in our Syngas News section this issue that the FlagshipONE green methanol project in Sweden is being delayed and possibly abandoned, because demand for green methanol for shipping has not actually materialised as fast as was anticipated.

In China, domestic prices are expected to come under significant downward pressure, with seaborne indications already following suit, with buyers said to have rejected offers around the $375/t c.fr mark.

Join us at the CRU Sulphur + Sulphuric Acid 2024 Conference and Exhibition in Barcelona, 4-6 November, for a global gathering of the sulphur and sulphuric acid community. Meet leading market and technology experts and producers, network, share knowledge, and learn about market trends and the latest developments in operations, process technology and equipment.

Prices in the Eastern Hemisphere, whilst still flat-to-firm, do not appear as supported as they have been over the past month, whilst indexes. There are still no signs of softening in the Far East although demand remains underwhelming and supply improving. While production in Indonesia is said to be back up and running, traders do not expect any spot cargo to emerge in July other than possibly some small part cargoes. August could see spot offers.

With all of the focus on low carbon ammonia and methanol developments, one could occasionally be forgiven for forgetting that most of the syngas industry relies upon natural gas as a feedstock, and that gas pricing and availability remain the key determinants of profitability for producers. As our article this issue discusses, even low carbon ammonia is likely to be largely based on natural gas, albeit with carbon capture and storage, at least for the remainder of this decade.

While there has been a lot of talk about decarbonising ammonia and methanol production, for as long as blue and green production is more expensive than conventional production, uptake will be dependent upon markets which are prepared to pay a premium for such chemicals, perhaps because they have no other reasonable choice, given environmental mandates. One sector above all has dominated the prospects for medium term demand for low carbon ammonia and methanol alike, and that is shipping.

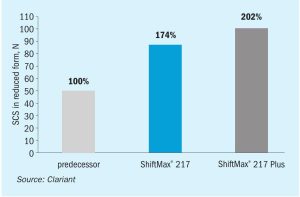

Anton Kariagin and Stefan Gebert of Clariant discuss the benefits and commercial performance of the new low temperature shift (LTS) catalyst – ShiftMax 217 Plus. A case study demonstrates the benefits of this catalyst, providing ultra-low methanol formation resulting in increased ammonia production and/or energy savings.

Prices in the West are unlikely to garner much support moving into the latter stages of Q2. The May Tampa ammonia settlement was settled by Yara and Mosaic at $450/t c.fr, down $25/t on the $475/t c.fr agreed for April. With seasonal domestic demand in the US drawing to a close 2H April, many had anticipated that either a rollover or a slight decline would be agreed.

Prices will remain stable-to-soft across the board, though benchmarks could remain slightly more supported in the short-term than previously thought, with more significant declines likely in Q2-Q3.