Potash project listing 2023

Fertilizer International presents a global round-up of current potash projects.

Fertilizer International presents a global round-up of current potash projects.

We report on fertilizer production, consumption and pricing in the US market. The country’s fertilizer industry, ranked fourth globally in terms of total production capacity, has grown and developed alongside its increasingly sophisticated domestic agricultural sector.

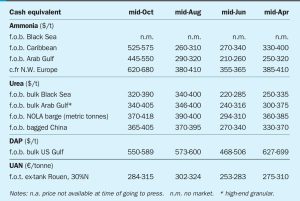

Market Insight courtesy of Argus Media. Urea: Prices in general fell further in late October. Suppliers in most regions were forced to accept lower than expected net-backs due to low import demand and high producer inventories. India was the exception with IPL securing 1.7 million tonnes of urea at $400-404/t cfr under its 20th October tender.

Bruce Bodine will become the new CEO of The Mosaic Company from the 1st January 2024. He was unanimously elected by the company’s board of directors at the end of August. His appointment followed the announcement that the current CEO Joc O’Rourke will retire next year. Mr Bodine was also elected company president in August and appointed as a member of Mosaic’s board with immediate effect. He was previously the company’s SVP -North America.

Argus in collaboration with CRU will convene the 2024 Fertilizer Latino Americano conference at the Hilton Downtown Miami, Miami, Florida, 5-7 February 2024.

Mangalore Chemicals & Fertilizers Limited has appointed Vighneshwar G Bhat as company secretary and compliance officer. Bhat, is an associate member of the Institute of Company Secretaries of India and a Law Graduate and holds master’s degree in commerce with more than 20 years of experience in secretarial and legal functions. Prior to joining the company, he was company secretary for Sobha Ltd, and has specialised in corporate secretarial matters including mergers and acquisitions, handling liquidations and SEBI & FEMA compliances.

Market Insight courtesy of Argus Media

Merchant markets for ammonia have faced considerable disruption in recent years due to the covid pandemic and the war in Ukraine.

While phosphate fertilizer production represents the main slice of demand for elemental sulphur and sulphuric acid, sulphur fertilizers continue to be a growing sector of demand due to changes in the way that we use sulphur.

Adani Enterprises says that its new greenfield copper smelter at Mundra in Gujarat, being developed by its subsidiary Kutch Copper Ltd, will begin operations in March 2024. The $1.1 billion project will have an annual production capacity of 1 million t/a of copper once the second phase is complete, but the March 24 start-up will be for the first, 500,000 t/a phase. The plant will also produce 25 t/a of gold, 250 t/a of silver, and 1.5 million t/a of sulphuric acid and 250,000 t/a of phosphoric acid as by-products. India currently imports roughly two million t/a of sulphuric acid since the closure of the Vedanta smelter in Tamil Nadu.