Fertilizer Industry News Roundup

CF Industries has signed an agreement with thyssenkrupp to develop a commercial-scale green ammonia project at its Donaldsonville production complex in Louisiana.

CF Industries has signed an agreement with thyssenkrupp to develop a commercial-scale green ammonia project at its Donaldsonville production complex in Louisiana.

Mayo Schmidt , the former chair of Nutrien, became its president and CEO on 18th April. He succeeds Chuck Magro who is stepping down to pursue new opportunities outside the company. In a coordinated move, Nutrien also announced that Russ Girling , TC Energy’s former president and CEO, would replace Mr Schmidt as the new chair of its board. Mr Magro made himself available to Nutrien until 16th May to allow a smooth transition.

The Chemical & Process Technologies business unit of thyssenkrupp Industrial Solutions is celebrating a milestone in 2021. It is one hundred years since engineer and entrepreneur Friedrich Uhde founded his own plant engineering company in a barn at his parents-in-law’s farm in Dortmund-Bövinghausen on April 6th, 1921. Now, in this centenary year, the origins of the firm are to become visible in its name again: thyssenkrupp is changing the business unit’s name to thyssenkrupp Uhde.

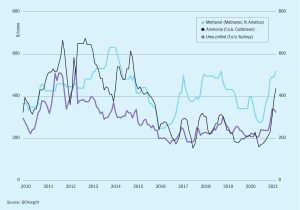

February saw ammonia prices jump due to a series of plant outages, including EBIC in Egypt, and several plants in North America, including two on Trinidad; the 760,000 t/a Nutrien 4 plant and 500,000 t/a Tringen 2 plant, both due to gas shortages, as well as Yara and BASF’s 750,000 t/a unit at Freeport, Texas.

Hans Vrijenhoef has stepped down as Chief Executive Officer of Proton Ventures with immediate effect. He will continue to serve as non-executive chairman of the management board for at least another three years to support the growth of the existing business of green ammonia production technologies. Paul Baan succeeded Hans Vrijenhoef as of April 1st, 2021. Baan has served in leadership positions at Ørsted and EON. He is an engineer by background who has a strong understanding of Power to X technology and business cases.

Gas availability and pricing continues to affect ammonia and methanol output from Trinidad, while Venezuela struggles with sanctions and political instability.

While the covid pandemic has kept refinery run rates down in 2020, new refinery sulphur capacity will nevertheless form the bulk of new additions to sulphur production over the next few years. But delays to projects on both the supply and demand sides could tip a fairly balanced market in either direction.

Calgary-based Pieridae Energy Ltd says that it has hired a new Chief Operating Officer as from April 5th. Darcy Reding is a professional engineer with 30 years of experience in small and medium-sized private and public upstream oil and gas companies, 20 years of that in leadership roles. Reding spent the last decade at NAL Resources as VP of Operations and VP Operations & Geoscience. Prior to NAL, Reding held technical and leadership roles with Norcen Energy, Northrock Resources, Samson Exploration and Enterra Energy Trust.

The Belarusian Potash Company (BPC) has agreed new annual potash supply contracts with India and China.

ICIS, the independent commodity intelligence company, provides an overview of the nitrogen market. The world supply of urea looks set to outpace market demand in 2021, as several new projects come on-stream. Global ammonia demand, in contrast, is expected to rebound strongly this year after a difficult 2020. The flurry of recent green ammonia projects announcements is another significant market development.