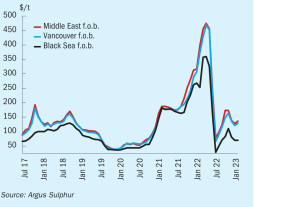

Price Trends

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

As it is an involuntary product, sulphur tends to be sold at whatever price the producer can get for it. This means that one of the major determinants of the sulphur price is the cost of transporting it to the customer, and in this regard one of the key indices is the Baltic Dry Index (BDI), which measures the cost of shipping dry bulk goods around the world, reported daily by the Baltic Exchange in London. The BDI has been on quite an excursion over the past couple of years – perhaps not as wild as the period from 2004-2009 when everyone wanted to ship goods to and from China, there was a shortage of vessels to carry it, and oil prices were at record highs - but eye-catching nevertheless.

Chinese domestic sulphur supply growth remains strong. Production is expected to rise in 2023, putting pressure on import demand potential. In 2022 total imports were 7.6 million tonnes, with a stable view for the year ahead.

Rising costs of fossil fuels in many markets, including coal in China and high gas costs in Europe are pushing up ammonia production costs. Can the falling cost of electrolysis make green ammonia production cost competitive in the near future?

Market Insight courtesy of Argus Media

The EU benchmark TTF natural gas price had fallen to $16.89/MMBtu on average for February, down 19% on January’s average and 36% lower than the figure for February 2022. By the end of the month it had fallen to $14.83/MMBtu, its lowest level since the outbreak of war in Ukraine. EU gas storage was assessed as 61% full on 28 February, compared to a five-year seasonal average of 40%, due to strong LNG imports and mild weather over the winter. Over one third of European ammonia capacity has returned to production as gas prices fall.

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2023.

After two turbulent years, could the fertilizer market finally start to stabilise in 2023? Well, that’s what Dutch agricultural finance house Rabobank is predicting…

Market Insight courtesy of Argus Media. Urea: The market remained weak at the start of the year with urea prices falling as producers fought for liquidity. Egyptian product fell by $40/t to $495/t f.o.b. in a matter of days, while f.o.b. prices in the Middle East and southeast Asia similarly fell to around $440/t. Urea prices in many end-user markets also slumped: US prices fell over the course of the first week of January by $30/t, Brazil by $15/t and many European markets by around $20/t.

The global potash market has endured a tumultuous 18 months, says Andy Hemphill, senior editor for potash and sulphuric acid at ICIS Fertilizers. Export sanctions, high offer prices and buyer unrest persist as we enter 2023.