Price Trends

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

The EU benchmark TTF natural gas price had fallen to $16.89/MMBtu on average for February, down 19% on January’s average and 36% lower than the figure for February 2022. By the end of the month it had fallen to $14.83/MMBtu, its lowest level since the outbreak of war in Ukraine. EU gas storage was assessed as 61% full on 28 February, compared to a five-year seasonal average of 40%, due to strong LNG imports and mild weather over the winter. Over one third of European ammonia capacity has returned to production as gas prices fall.

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2023.

After two turbulent years, could the fertilizer market finally start to stabilise in 2023? Well, that’s what Dutch agricultural finance house Rabobank is predicting…

Market Insight courtesy of Argus Media. Urea: The market remained weak at the start of the year with urea prices falling as producers fought for liquidity. Egyptian product fell by $40/t to $495/t f.o.b. in a matter of days, while f.o.b. prices in the Middle East and southeast Asia similarly fell to around $440/t. Urea prices in many end-user markets also slumped: US prices fell over the course of the first week of January by $30/t, Brazil by $15/t and many European markets by around $20/t.

The global potash market has endured a tumultuous 18 months, says Andy Hemphill, senior editor for potash and sulphuric acid at ICIS Fertilizers. Export sanctions, high offer prices and buyer unrest persist as we enter 2023.

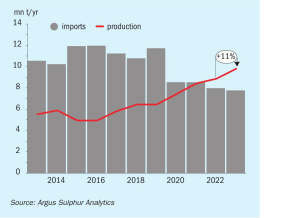

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

Processed phosphates pricing will be a major influence in the coming months. A gap remains between historical levels of sulphur and DAP pricing that points to the potential for sulphur prices to recover to higher levels during 2023.

Covid, demographics and a shift from an industrial to a consumer-led economy have stalled China’s previously breakneck growth, with a potential impact upon all commodity markets, including fertilizer. At the same time, Chinese export restrictions have overheated the urea market.

With Europe facing a long-term shortage of natural gas, and Russia looking east for new customers, how will changing global gas markets affect production of key syngas-based chemicals?