Market Outlook

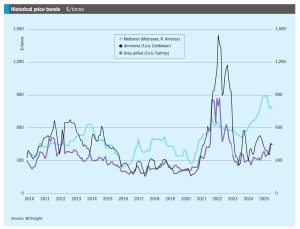

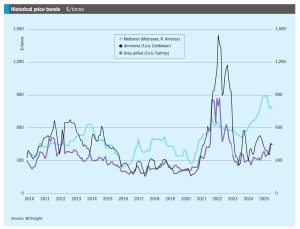

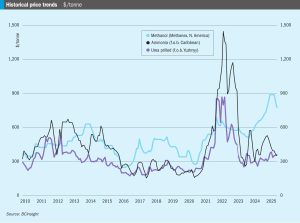

• Ammonia prices look well insulated against any declines over the immediate term, though the upside may be more limited in some regions than others.

• Ammonia prices look well insulated against any declines over the immediate term, though the upside may be more limited in some regions than others.

Ammonia prices in both hemispheres had levelled out by the end of August, with the exception of a few marginal upticks in some regions on the basis of the latest supply-demand dynamics. All eyes are now on September’s Tampa settlement, which should spell out the extent of the upside pressure set to emerge over the coming weeks.

CRU's analyst Viviana Alvarado discusses the effect of smelter outages and maintenance, a copper concentrate shortage, and Asian capacity ramp ups, on sulphuric acid supply and prices.

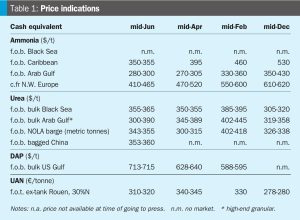

Price trends and market outlook, 21st August 2025

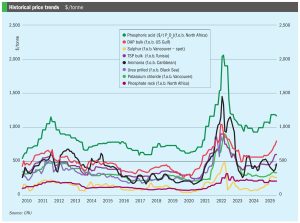

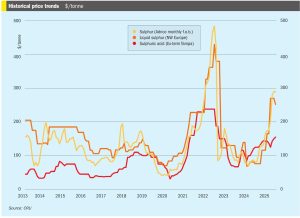

• Global sulphur prices are expected to experience decreases over the next few weeks. Buyers in Asia report that they are covered for contracted supply throughout July, and domestic prices in China are likely to decrease further, putting downward pressure on sulphur prices.

Phosphate prices have been at high levels for a couple of years now, and talk at the recent International Fertilizer Association (IFA) meeting in Monaco was that it was not only continuing to support higher sulphur prices in spite of oversupply in the sulphur market, but that there seemed to be no prospect of it falling in the short term.

The mid-year negotiations between Antofagasta (AMSA) and Chinese smelters have concluded with a historic settlement of $0/0¢. While unprecedented, the outcome is not surprising, as it lands slightly above the midpoint of the believed negotiating range, from -$15/-1.5¢ proposed by Antofagasta +$10/1.0¢ from the Chinese smelters. Moreover, this result aligns with market participants' rumours circulating prior to the agreement. Separately, rumours suggest Q3 contract negotiations between one top miner and Chinese smelters concluded at levels ranging from -$25/-2.5¢ to (+)$5/0.5¢.

The end of June saw declines in sulphur prices in many regions amid subdued global demand across regions. Most import markets are sufficiently covered through July at least, resulting in limited activity while supply increases. These conditions have exerted downward pressure on prices as bearish sentiment spread across regions.

Ammonia benchmarks on both sides of the Suez were little changed in mid-June with a seemingly balanced supply-demand outlook, although those of a more bullish persuasion continue to support the notion that prices will soon – if they have not done so already – reach a floor. In Algeria, while activity was limited, producer Sorfert was believed to be seeking prices of $410415/t f.o.b. for July delivery, up $10-15/t and equivalent to >$450/t c.fr NW Europe. Imminent tariffs on imports of Russian fertilizers into the EU may trigger an uptick in downstream capacity utilisation across the continent.

• The short term outlook appears balanced for the most part, although more bullish participants seem to be holding sway over market sentiment.