Market Insight

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

The extensive sweep of financial sanctions against Russia in the wake of the invasion of Ukraine, coupled with Russia’s position as the leading exporter of numerous commodities means that the impact of the 2022 price shock may be worse than 2008.

It was supposedly Lenin who said that there were “weeks when decades happen”, and the past few weeks have felt very much like that. The outbreak of conflict in Ukraine has sent shockwaves across the world and may have changed it permanently.

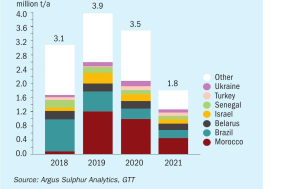

Developments in the Russia-Ukraine conflict is going to be a key influence for the sulphur market through the year. The potential loss of Russian sulphur to key import markets such as North Africa and Latin America is likely to lead to trade flows increasing to these regions from the Middle East and North America.

Market Insight courtesy of Argus Media

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2022.

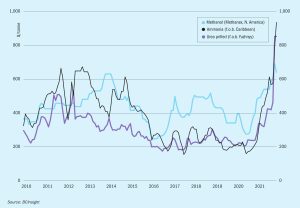

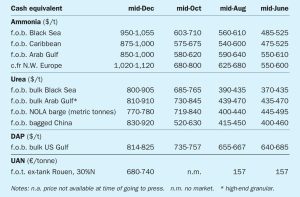

The ammonia market has entered 2022 looking very different to last year, with early January Pivdenny prices $875/t higher on a mid-point basis than they were at the start of 2021, and the likelihood of further gains ahead.

Market Insight courtesy of Argus Media

Recent spikes in natural gas prices, particularly in Europe, have highlighted the tightness of natural gas markets around the world going into the northern hemisphere winter. Are ammonia and methanol producers on for a run of high gas prices in 2022?