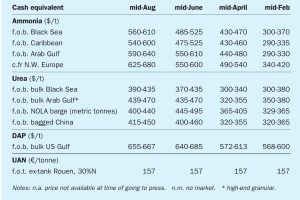

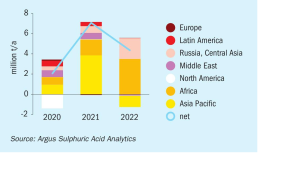

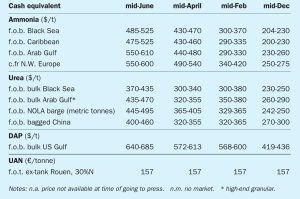

Price trends

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

The first half of 2021 has been characterised by tight supply in the ammonia market, exacerbated by plant outages in Europe, Trinidad, Saudi Arabia and Indonesia. At the same time, higher spot demand has fuelled significant price increases in both the eastern and western hemispheres. Low inventories and reduced export availability in the Far East forced Indian phosphate producers and industrial consumers of ammonia to source product from other locations.

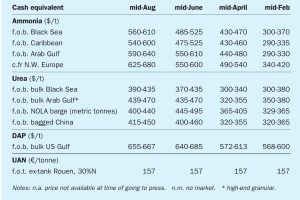

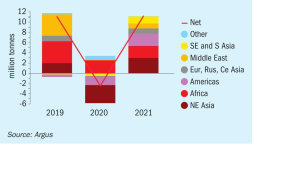

China is the world’s largest importer of sulphur, mainly to feed domestic phosphate production. Sour gas in Sichuan and new refinery production, coupled with rationalisation in the phosphate sector are all leading to reduced imports, while new smelters are increasing sulphuric acid production and reducing the need for pyrite-based and sulphur burning acid production.

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

The processed phosphates market view is supporting sulphur demand. The average DAP price for Morocco f.o.b. is forecast to rise significantly on 2020 levels. As the leading end use for sulphur consumption and trade, this has implications for pricing. The expected downward correction in DAP in 2022 will likely lead to a parallel decline in sulphur, at a time when supply is expected to improve in the oil and gas sector, adding further pressure for prices to ease.

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

Ammonia markets continue to be dominated by unplanned outages in Saudi Arabia (where the SAFCO 4 and one of the Ma’aden ammonia plants are both down, removing 2.3 million t/a of merchant ammonia from the market). This comes on top of other shutdowns earlier in the year on Trinidad, in the US and Australia.

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

With demand for conventional fuels projected to peak and fall over the next decade, some refiners are looking to petrochemical production as a way of diversifying their product slate.