What’s driving the fertilizer price rally?

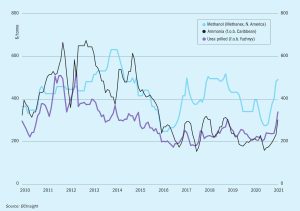

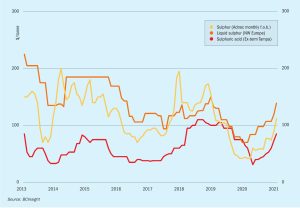

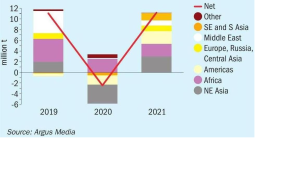

Fertilizer markets are rallying to an extent not seen in almost a decade. This is primarily being driven by strong demand fundamentals, with crop prices moving to their highest point since 2013. But low pipeline inventories and supply disruptions have also played a part. In this guest editorial, CRU’s Chris Lawson explains what’s driving this rally and highlights the key supporting factors.