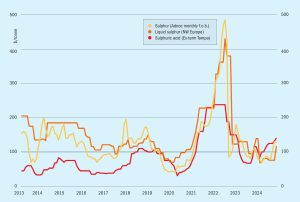

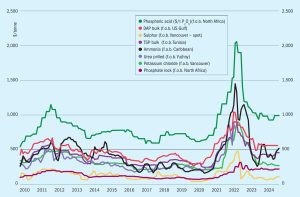

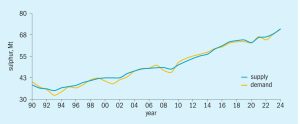

This issue of Sulphur magazine contains a preview of CRU’s Sulphur + Sulphuric Acid conference in Woodlands, Texas, which is being held from November 3rd to 5th this year, giving delegates the opportunity to meet and discuss some of the trends which are continuing to change the sulphur and sulphuric acid industries. Some of this is echoed in our editorial coverage this issue; the rise of electric vehicles and the continuing electrification of society is changing demand for metals and impacting upon both sulphur and sulphuric acid markets alike. As CRU’s principal analyst Peter Harrison discusses on pages 36-37, battery demand for nickel is leading to a surge in new nickel leaching capacity in Indonesia which is drawing in greatly increased volumes of sulphur, while rising demand for copper is leading to additional volumes of smelter acid from China, India and Indonesia which are impacting the merchant market for acid, as detailed by CRU’s Viviana Alvorado on pages 38-40. In the United States, new lithium mines will require additional sulphur (see pages 22-23). Rare earths and battery metal recovery will form a major topic on the first day of the Sulphur + Sulphuric Acid conference, with speakers from Lithium Americas, one of the pioneers of the new US lithium industry.