New merchant ammonia projects

Although global ammonia supply is set to increase this year, there is a shortage of new merchant capacity after 2024 which may lead to rising prices in the medium term.

Although global ammonia supply is set to increase this year, there is a shortage of new merchant capacity after 2024 which may lead to rising prices in the medium term.

Low emissions hydrogen is expected to play an increasing role in the syngasbased chemicals industry, but cost and technical challenges remain.

China’s drive to build new battery production capacity for electric vehicles and stationary storage is leading to a familiar problem for the Chinese economy; overcapacity.

Falling volumes of sulphur from refining and sour gas could turn Europe into a sulphur importer.

In January, Kazakh uranium producer Kazatomprom warned of potential adjustments to its 2024 uranium production due to challenges with sulphuric acid availability and construction delays at new uranium mining operations. In a statement the company said that its projected uranium output for 2024 will be between 21,000 t/a and 22,500 t/d U3 O8 , around 20% lower than the amount it had been expecting to be able to mine. Kazatomprom’s uranium output was 21,100 t/a U3O8 in 2023, down 1% on 2022 figures, with output flat during 4Q 2023. While it said it had sufficient inventory in stock to cover contracted deliveries in 2024, there could be problems for 2025 deliveries.

Sasol and Topsoe have appointed Jan Toschka as CEO of the joint venture established by the two companies to develop, build, own and operate sustainable aviation fuel (SAF) ventures and to market the products. Previously Toschka was president of Global Aviation for Shell, responsible for Shell’s global network of operations, joint ventures and sales of fuels, lubricants and sustainable solutions to the aviation industry. During his tenure at Shell, he has led teams across sales, mergers and acquisitions, trading, and retail businesses globally, spanning various industries including Marine and Retail. Toschka will assume his new role as CEO on 1 March 2024 and the joint venture will be launched during the same month. The new company will be headquartered in The Netherlands.

Fertilizer International spoke to Matt O’Leary , the MD of Aquifert, about the state of the water-soluble fertilizer (WSF) market at the 2024 Fertilizer Latino Americano Conference in Miami in February.

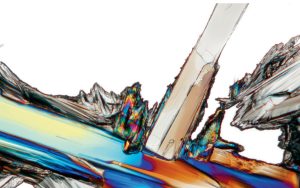

We review potash mining and mineral processing methods. Advances in equipment technology and major project investments are highlighted.

Specialty fertilizer products represent a small volume, high value segment of the overall fertilizer market that’s been growing at around four percent per annum in recent years. Economic, environmental, regulatory and agronomic imperatives are driving up their adoption – and an overall shift from volume to value in the fertilizer market.

Phospholutions, Inc., a sustainable fertilizer company headquartered in the United States, recently launched its flagship technology, RhizoSorb ® , to improve phosphorus fertilizer efficiency.