State-of-the-art plant technology

Saipem, Stamicarbon, Toyo Engineering Corporation and KBR showcase recent projects and latest technology for urea and nitric acid plants.

Saipem, Stamicarbon, Toyo Engineering Corporation and KBR showcase recent projects and latest technology for urea and nitric acid plants.

The CRU Nitrogen + Syngas Conference returns to Berlin for a live event from 28-30 March 2022. The conference will be run as a hybrid event giving participants the option to attend live in-person or online via the virtual platform.

Rapidly escalating natural gas prices forced plant closures across Europe during September. Worst affected was the UK, where a fire at a cross-Channel electricity cable and low output from wind energy has, combined with low domestic storage capacity led to a surge in demand for gas for power stations and wholesale gas prices reached a record 350 pence per therm (equivalent to $46/ MMBtu) in October. On September 15th, CF Industries announced that it was halting operations at both its Billingham and Ince fertilizer plans due to high gas prices. Although ammonia prices have also risen, they have not kept pace with gas price rises, and there is a limit to what farmers could be expected to pay. CF CEO Anthony Will said: “$900 is the gas cost in a tonne of ammonia and the last trade in the ammonia market that was done was $700 a tonne”. As these plants supply most of the UK’s carbon dioxide for food and drink manufacture, the government said it would provide “limited financial support” to keep the Billingham plant operational, and that plant re-started on September 21st. Meanwhile, BASF closed its Antwerp and Ludwigshafen plants in Belgium and Germany due to what the company called “extremely challenging” economics. Fertiberia ceased production at its Palos de la Frontera site in Spain, and Puertellano remained down for scheduled maintenance. Yara shut 40% of its European ammonia production in September, and OCI partially closed its Geleen plant in the Netherlands. Achema in Lithuania decided against restarting its ammonia plant following maintenance in August, and OPZ in Ukraine shut one ammonia line at Odessa, with Ostchem and DniproAzot likely to follow. Borealis in Austria also reduced production.

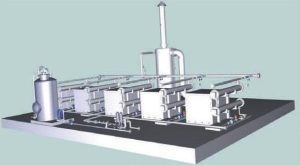

Nitrogen-rich wastewaters remain a major issue for fertilizer and other industries. Saipem’s new electrochemical technology, SPELL, is an important step towards the overall objective of zero industrial pollution. A complete engineering review of the technology, its alignment with all international applicable standards, and optimisation has now been concluded and the technology is ready for deployment for the removal of ammonium nitrogen from industrial waters and wastewaters. Saipem discusses the key features of SPELL and reports on the first two industrial references.

Although the stranded gas boom that led to the construction of the region’s nitrogen capacity in the 1980s-2000s may be largely over, the Middle East remains the largest nitrogen exporting region in the world.

We highlight the large-scale nitrogen projects that are currently under development across the globe – with a focus on ammonia and urea technology licensors and engineering contractors.

The Abu Dhabi National Oil Company (ADNOC) has awarded a $510 million engineering, procurement and construction (EPC) contract to Italy’s Saipem to expand production capacity at the Shah sour gas plant, as the UAE looks to increase its output of gas by 2030. The Optimum Shah Gas Expansion (OSGE) & Gas Gathering project has been awarded by ADNOC Sour Gas, a joint venture between ADNOC and US energy major Occidental. The contract will increase gas processing capacity at the Shah plant by 13% per cent to 1.45 bcf/d from 1.28 bcf/d by 2023 and supports ADNOC’s objective of enabling gas self-sufficiency for the UAE. The Shah gas plant currently meets 12% of the UAE’s total supply of natural gas, as well as producing 5% of the world’s elemental sulphur. The expansion will cumulatively represent a 45% increase on the plant’s original capacity of 1.0 bcf/d when it came on-stream in 2015.

Storm Uri which blanketed the southern states of the US with snow, and led to widespread power outages in Texas, has had a major impact upon US Gulf Coast and Southern-Midwest refined products supply. Most Gulf Coast refineries were shut down or forced to operate at reduced rates. IHS Markit estimated that more than 5.2 million bbl/d of Gulf Coast capacity and 730,000 bbl/d in PADD 2 was impacted by the winter weather at its height, and close to 20% of lower 48 US natural gas production was shut-in in the first half of February. A drop in crude oil production of between 2.2 and 4 million bbl/d was estimated.

From new materials of construction and improved equipment designs to the latest digital tools, Casale, thyssenkrupp Industrial Solutions, Saipem, TOYO and Stamicarbon report on some of their latest achievements.

Because of the ongoing pandemic, this year’s CRU Nitrogen + Syngas conference was held as a ‘virtual’ event, in early March 2021.