The merchant market for sulphuric acid

Short term supply constraints are dominating acid markets at present, but increasing smelter production across Asia may lead to oversupply in the longer term.

Short term supply constraints are dominating acid markets at present, but increasing smelter production across Asia may lead to oversupply in the longer term.

Global sulphur prices are expected to continue rising in certain regions but at a reduced rate of increase. Recent higher spot prices in the Middle East are likely to carry over to other markets. Sulphur affordability in key markets such as China remains good, reinforced by recent increases in phosphate prices.

Beyond its use in the manufacture of sulphuric acid, sulphur dioxide also has many industrial uses, especially in the food, paper, pharmaceutical and refining industries.

A report on CRU’s annual Sulphur+Sulphuric Acid Conference, held in Barcelona, in early November.

For six decades, Chemetics has been a pioneering force in the sulphuric acid design and equipment industry, consistently introducing groundbreaking technologies that have revolutionised the field by optimising the methodology in which chemicals are produced. This year, Chemetics celebrates its 60-year anniversary as one of the leading designers, direct equipment suppliers and fabricators that has modernised the sulphuric acid industry of today. This article dives into Chemetics’ rich history and key innovations that have shaped and moulded the industry.

OCP’s recent award of a contract to Worley Chemetics for three new greenfield sulphuric acid plants has confirmed the phosphate giant’s plans for its new Mzinda Phosphate Hub in Morocco, one of the largest investments in new phosphate capacity anywhere in the world over the next few years. It is part of a number of new investments under way in Morocco as OCP continues to expand its already considerable phosphate facilities. Three new fertilizer lines came onstream at Jorf Lasfar in 2023 and 2024, each with a capacity of 1 million t/a of diammonium phosphate (DAP). The Mzinda mega-project will add another 4 million t/a of triple superphosphate (TSP) capacity by around 2028-29, and will relieve some of the issues that OCP has in importing ammonia for DAP production, as TSP only requires phosphate rock and phosphoric acid. There is also an additional 1 million t/a of TSP capacity under construction at Jorf Lasfar, which is expected to be completed next year, and OCP also announced last year that it would build an integrated purified phosphoric acid (PPA) plant at Jorf Lasfar. The first phase of the project consists of 200,000 t/a of P2 O5 pretreated phosphoric acid capacity, 100,000 t/a (P2 O5 ) of PPA capacity, and 100,000 t/a of technical MAP (tMAP) capacity. The site will also be home to downstream production of phosphate salts and lithium iron phosphate (LFP) capacities. The initial plants will be delivered starting in mid-2026, carrying through into 2029, constructed in conjunction with JESA, a joint venture between OCP and Worley.

OCP Group has launched what it calls the Mzinda-Meskala Strategic Programme, aimed at significantly expanding fertilizer production in the country. Initially announced in December 2022, the program is set to enhance production capacity in two key regions: the Mzinda-Safi Corridor and the Meskala-Essaouira Corridor. This initiative is part of OCP’s broader strategy to meet growing global demand for fertilizers while committing to long-term sustainability goals, including achieving carbon neutrality by 2040.

This year will be the 40th Sulphur – now Sulphur + Sulphuric Acid – Conference to be held. From its beginnings in Canada to this year’s meeting at the Hyatt Regency hotel in Barcelona, much has changed, but its mission – to be an essential annual forum for the global sulphur and acid community – remains the same.

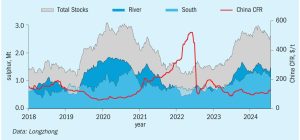

In the last two years there have been significant changes to the level and location of sulphur inventory, which has caused swings in short-term supply availability. Inventory plays a necessary role in balancing the sulphur market but exactly when, where, how, and why inventory enters the market can trigger a diverse range of price responses. In this insight article, CRU’s Peter Harrisson looks at how inventory change influences sulphur availability and pricing.

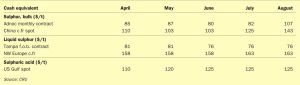

At the end of August, the Qatar Chemical and Petrochemical Marketing and Distribution Company (Muntajat) tendered for 35,000 tonnes of sulphur for September loading from Ras Laffan, with offer prices reported at or around $130s/t f.o.b., according to market sources. Bids were received at multiple levels, with market participants initially anticipating awards around the mid-$120s/t f.o.b. The tender result was higher than market expectations and would equate to delivered prices to key Asian markets at $150-155/t c.fr. But prices in China and Indonesia remained lower this week at around $140-145/t c.fr, with India at $145-150/t c.fr. Prices have increased steeply since Muntajat’s 25 June session, which was indicated awarded in the mid-$80s/t f.o.b.. and Muntajat posted its Qatar Sulphur Price (QSP) for September at $125/t f.o.b., up $19/t from $106/t f.o.b. in August. This represents the highest QSP since March 2023 at $133/t f.o.b., and reflects delivered levels to China nearing $150/t c.fr at current freight rates. Tight supply and strong downstream demand have pushed tender prices higher. Muntajat tenders were previously awarded at $92/t f.o.b. in April, up from $88/t in March and the low $80s/t f.o.b. in February.