Market Outlook

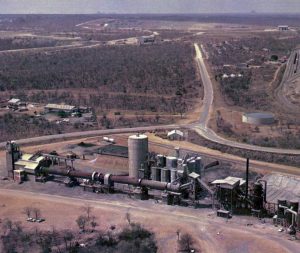

Major projects to consider in the short term outlook are Barzan in Qatar and the Clean Fuels Project in Kuwait. Combined these would add over 3 million t/a of sulphur capacity.

Major projects to consider in the short term outlook are Barzan in Qatar and the Clean Fuels Project in Kuwait. Combined these would add over 3 million t/a of sulphur capacity.

Although 2020 saw a contraction in GDP by 10% due to the impact of the coronavirus pandemic, the country had been one of the fastest growing of the world’s top 10 economies, with growth of 8.3% in 2016, although this had slowed to 4.1% in 2019. Its population is growing, and it is due to become the most populous country in the world by 2027 according to UN figures, with total population reaching 1.64 billion by 2050. The country thus continues to require more food, leading to rising sulphur/sulphuric acid consumption for the phosphate industry on the one hand, although increasing vehicle use and growth in domestic refining is also leading to some additional sulphur production.

There is an old adage that if you put two economists in a room, you will get three different opinions. As the world enters its second year of dealing with the coronavirus pandemic, that certainly still seems to be the case among those grappling with predicting an increasingly uncertain world.

Ineos subsidiary Inovyn has announced the permanent closure of its ‘sulphur chemicals’ (mainly sulphuric acid) plant at its Runcorn site, and its withdrawal from the UK sulphur chemicals market. The company said in a statement that the decision follows a management review of the business in the light of recent events. Specifically, in October 2020, an unexpected interruption to the third-party power supply to the Runcorn site resulted in the plant being taken offline, and during restart, it was identified that a number of critical plant components had suffered significant damage. As a result, to ensure the safety and integrity of the plant it was taken back offline. Since then, in spite of significant effort and investment to rectify these issues, Inovyn says that it has become clear that it will not be possible to safely restart the plant for at least a further 18-24 months, and the company has decided to close the plant permanently.

The economic conversion of phosphogypsum waste into a valuable product has been pursued for decades. Results of intensive research by thyssenkrupp Industrial Solutions (tkIS) in this area are presented by Peter Stockhoff, Dirk Koester, Stefan Helmle and Carsten Fabian. The approach developed by tkIS shows great potential as a controlled treatment process for phosphogypsum.

Wet sulphuric acid technology when used as tail gas treatment for a Claus unit, or in place of a Claus unit with amine-based tail gas unit, brings many benefits if there is a market for the sulphuric acid and steam. A new alternative is to have a WSA unit in combination with a Claus unit and to recycle the acid to the Claus unit for higher sulphur recovery efficiency.

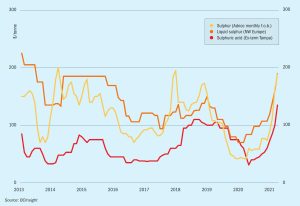

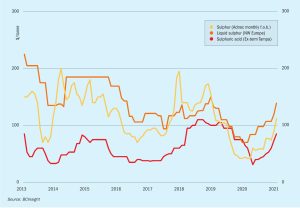

Restrictions and lockdowns across the globe have significantly reduced oil demand, impacting refinery run rates. This has aided in reducing sulphur liquidity, supporting the short term view.

Storm Uri which blanketed the southern states of the US with snow, and led to widespread power outages in Texas, has had a major impact upon US Gulf Coast and Southern-Midwest refined products supply. Most Gulf Coast refineries were shut down or forced to operate at reduced rates. IHS Markit estimated that more than 5.2 million bbl/d of Gulf Coast capacity and 730,000 bbl/d in PADD 2 was impacted by the winter weather at its height, and close to 20% of lower 48 US natural gas production was shut-in in the first half of February. A drop in crude oil production of between 2.2 and 4 million bbl/d was estimated.

Automatic identification and optimum online monitoring using sonic velocity measurements can now be used to determine the concentration of both sulphuric acid and oleum.C. Kahrmann and T. Knape of SensoTech report on a new user-friendly method of measurement providing a significant step towards automated process control.

All acid towers eventually require replacement. In this article, K. Sirikan, A. Mahecha-Botero et al of NORAM Engineering and Constructors Ltd discuss two recently executed acid tower replacement projects. The first project involved the replacement of a brick-lined tower by an alloy acid tower for a sulphur burning plant in North America. The second project involved the replacement of a brick-lined acid tower with a NORAM designed brick-lined tower for a smelter off gas acid plant in South America. The impacts of various design considerations on acid tower replacement projects are compared, including in-situ replacement versus a new location; brick-lined versus alloy shell, and selection criteria for mist eliminators.