Market Outlook

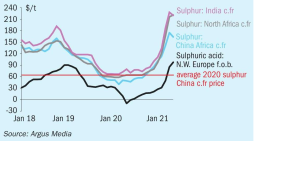

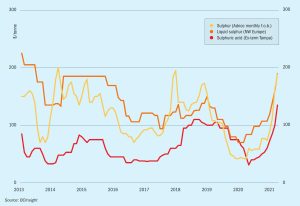

Significant capacity additions in the Middle East are still awaited. The more positive outlook for fuel demand is providing support to seeing these projects ramp up in the coming months. New supply is expected from Saudi Arabia following the commissioning of a gas project in 2020, sulphur availability is likely to improve from the country through the second half of 2021 and into 2022 as a result.