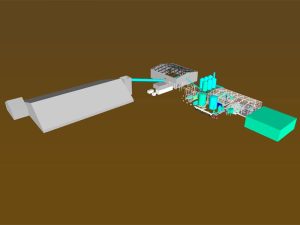

PetroChina has started production at Dukouhe-Qilibei, the last of three major sour gas fields in its high-sulphur Chuandongbei cluster in southwest China. The Dukouhe-Qilibei field’s hydrogen sulphide content reaches up to 17.1%, the highest of any integrated gas field currently in production in China. PetroChina confirmed that commissioning was completed on 30 June, with the Dazhou gas processing plant now running at its full design capacity of 4 million cubic metres per day. The Chuandongbei cluster originally comprised three key sour gas block: Luojiazhai, Tieshanpo, and Dukouhe-Qilibei, and was initially developed under a partnership between Chevron and PetroChina, with Chevron leading the early-phase project development. However, Chevron exited the project in 2020, transferring full control to PetroChina following operational delays and cost challenges. PetroChina says that the completion of Dukouhe-Qilibei solidifies its capabilities in handling high-sulphur content gas fields and marks a significant boost to China’s domestic gas supply, particularly in inland regions with growing industrial demand. n