Market Insight

Price trends and the market outlook, 10th April 2025

Price trends and the market outlook, 10th April 2025

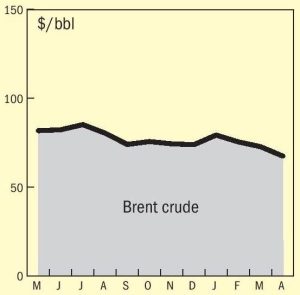

President Donald Trump delayed his ‘liberation day” tariffs by three months on 9th April, while simultaneously ramping up levies on China. In this latest twist to the on-off US tariffs saga, the Trump administration’s 90-day pause on additional duties should provide international suppliers to the world’s biggest fertilizer market with some respite – for now. With the exception of China, the US will now cut back its so-called ‘reciprocal tariffs’ to 10% for the duration of a three-month suspension period. The European Union’s tariff is now halved to 10%, for example, with the trade bloc also pausing its trade countermeasures against the US.

Indonesia has become the epicentre of the world nickel industry, and is now seeking to raise royalty rates to capture more value from this. Will this impact upon the continuing expansion of HPAL capacity there?

The Sulphur Institute (TSI) held its World Sulphur Symposium in Florence from April 8th-10th.

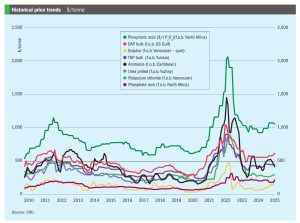

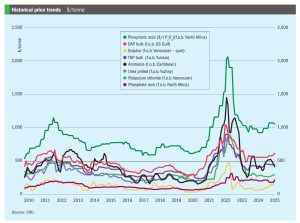

Sulphur markets have been on a tear over the past few months, driven by strong demand in Asia, with buyers primarily sourcing from the Middle East and Canada through late 2024 and into the early months of 2025. Steady buying from Indonesia and China, the two largest importers of sulphur, appears to have supported the market, in China’s case mainly for phosphate production as well as a variety of industrial processes, and in Indonesia’s case to feed the high pressure acid leach (HPAL) plants that are producing nickel for the battery and stainless steel industries. Prices saw a notable rally following the Chinese Lunar New Year celebrations. Nevertheless, this momentum finally began to shift as April began ago as the pace of price increases in Asia started to slow. As the spring fertilizer application season in China draws to a close, domestic prices began to drop, reaching the equivalent of a delivered price of around $272/t c.fr. As well as the narrowing window for spring application of phosphates, the decline was also driven by weakening demand amid uncertainty over tariffs and export restrictions. In southern China, phosphate producers continue to purchase import cargoes. A major phosphate producer in southwest China has been reported as having bought mainstream material at a price of $303/t c.fr, according to local market sources. Total sulphur port inventories in China had declined by 22,000 tonnes to 1.86 million tonnes by 16 April 2025. The volume at Yangtze River ports increased to 825,000 tonnes, while the port inventory at Dafeng decreased to 400,000 tonnes.

Samsung E&A has announced the termination of its $1.6 billion contract with the Mexican state-owned oil company PEMEX for a sulphur recovery facility project. Samsung says that the contract, originally signed nearly a decade ago, has faced significant delays and suspensions due to budget cuts imposed by the client. It concerns a hydrodesulphurisation (HDS) facility aimed at removing sulphur components from diesel fuel at the Salamanca refinery in Guanajuato state, central Mexico. In a statement, Samsung E&A confirmed that they have reached an amicable agreement regarding the contract termination, stating, “We have been fully compensated for the expenses incurred during the project suspension, and since this project was not included in our sales or operating profit forecasts for this year, there will be no financial loss due to the contract termination.”

The Middle East remains the world’s largest regional exporter of sulphur, with additional capacity continuing to come from both refineries and particularly sour gas processing.

Kazakh state gas company QazaqGaz says that work is progressing well and on schedule on the 1 billion m3 expansion project at the Kashagan Gas Processing Plant. A recent site report says that seven absorption columns have been installed at the sulphur treatment unit (each weighing between 50-170 tonnes); three sections of the smokestack have been installed at the sulphur recovery block, along with storage tanks and pumps for the heat carrier, instrumentation air, and nitrogen supply units; and a total of 2,177 t of process equipment has been installed. Welding works for tank assembly are ongoing, and over 12,000 meters of underground piping have been laid, and more than 38,000 cubic meters of concrete have been poured.

I am writing this freshly returned from the Sulphur Institute’s annual Sulphur World Symposium in Florence (for more on that see pages 24-25), where one of the topics causing some excitement was the anticipated commissioning of a demonstration plant for Travertine Technologies’ new Travertine Process. The plant is due to be commissioned at the Sabin Metals site near Rochester, New York in mid-2025 at a cost of $10.7 million. Capacity is put at “hundreds” of tonnes per year of gypsum processed, and removing “tens” of tonnes per year of CO 2 from the atmosphere.

• Global sulphur prices are expected to stay relatively stable as purchases in Asia slow down due to the closing of the purchasing window for the Chinese spring fertilizer application season.