Fertilizer Industry News Roundup

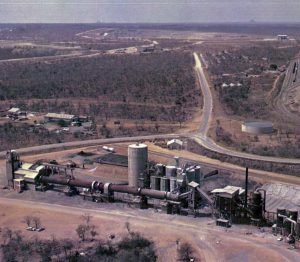

Yara International has approved a project to partly convert its Pilbara plant near Karratha in Western Australia to green ammonia production.

Yara International has approved a project to partly convert its Pilbara plant near Karratha in Western Australia to green ammonia production.

At the organisation’s first face to face meeting since covid, in Vienna in early October, OPEC+ ministers agreed to cut global oil supplies by 2 million bbl/d in November. OPEC+ is a group of 24 oil-producing nations, made up of the 14 members of the Organisation of Petroleum Exporting Countries (OPEC), and 10 other non-OPEC members, including Russia. In a statement, the group said the decision to cut production was made “in light of the uncertainty that surrounds the global economic and oil market outlooks.”

The phosphate fertilizer industry is turning to production methods that are able to consume low-grade phosphate rock and/ or generate pure gypsum as a by-product. Gypsum-free processes, and technologies that capture phosphorus from waste streams, are also on the rise.

Researchers from Australia’s Monash University say that they have created a new generation of lithium-sulphur batteries which could provide a cheaper, cleaner and faster-charging energy storage solution that outlasts lithium-ion alternatives and is rechargeable hundreds of times without failing. The team has creating a new interlayer which allows for exceptionally fast lithium transfer, as well as an improvement in the performance and lifetime of the batteries.

The economic conversion of phosphogypsum waste into a valuable product has been pursued for decades. Although phosphogypsum is still generally disposed of as waste, industry attitudes are changing and greater use of phosphogypsum will be expected in a circular economy.

Switzerland-based EuroChem Group AG says it has entered into exclusive negotiations to acquire the nitrogen business of the Borealis group, after having submitted a binding offer. One of Europe’s leading fertilizer producers, Borealis operates fertilizer plants in Germany, Austria and France, as well as more than 50 distribution points across Europe. It supplies 3.9 million tonnes of fertilizer products per year, including 800,000 t/a of technical nitrogen solutions and 150,000 t/a of melamine via the Borealis LAT distribution network. It is a market leader in melamine, with its operations in Austria and Germany supplying primarily the woodworking industry. EuroChem says that melamine and technical nitrogen solutions represent important new business lines for the company to expand its nitrogen-based product portfolio in Europe.

Global demand for oil products has seen strong recovery in 2021, but depressed kerosene demand from the aviation sector continues to be a major barrier to full recovery, according to data and analytics company GlobalData. The company’s analysis of oil product flows suggests that when kerosene is excluded, oil product demand in Q3 2021 had fully recovered compared to the same period in 2019. However, demand for kerosene, mostly used for jet fuel, has hovered at around two thirds of pre-Covid-19 levels throughout the year, and when that is taken into account, total oil product demand was 3% below pre-Covid levels for Q3 2021. Kerosene demand saw the greatest impact from Covid-19 due to restrictions on air travel. While the sector recovered, to an extent, in the second half of 2020, recovery stalled in 2021 due to new waves of infections and restrictions, with new restrictions linked to the Omicron variant likely to have hit demand again in Q4.

More than 230 delegates from 45 countries participated in CRU’s Sustainable Fertilizer Production Technology Forum, 20-23 September 2021. To highlight this successful virtual event, we report on keynote and selected technical presentations.

Topsoe has begun operations at a demonstration plant for the production of methanol from biogas. The aim is to validate the company’s electrified technology for cost-competitive production of sustainable methanol from biogas as well as other products. The project is supported by the EUDP Energy Technology Development and Demonstration Program and is developed together with Aarhus University, Sintex A/S, Blue World Technology, Technical University of Denmark, Energinet A/S, Aalborg University, and Plan-Energi. The demonstration plant is located at Aarhus University’s research facility in Foulum, and will have an annual capacity of 7.9 t/a of CO 2 -neutral methanol from biogas and green power and is scheduled to be fully operational by the beginning of 2022. It uses Topsoe’s eSMR ™ technology, which is CO 2 -neutral when based on biogas as feedstock and green electricity for heating. It also uses half the CO 2 that makes up about 40% of biogas and typically is costly to separate and vent in production of grid quality biogas.

Rapidly escalating natural gas prices forced plant closures across Europe during September. Worst affected was the UK, where a fire at a cross-Channel electricity cable and low output from wind energy has, combined with low domestic storage capacity led to a surge in demand for gas for power stations and wholesale gas prices reached a record 350 pence per therm (equivalent to $46/ MMBtu) in October. On September 15th, CF Industries announced that it was halting operations at both its Billingham and Ince fertilizer plans due to high gas prices. Although ammonia prices have also risen, they have not kept pace with gas price rises, and there is a limit to what farmers could be expected to pay. CF CEO Anthony Will said: “$900 is the gas cost in a tonne of ammonia and the last trade in the ammonia market that was done was $700 a tonne”. As these plants supply most of the UK’s carbon dioxide for food and drink manufacture, the government said it would provide “limited financial support” to keep the Billingham plant operational, and that plant re-started on September 21st. Meanwhile, BASF closed its Antwerp and Ludwigshafen plants in Belgium and Germany due to what the company called “extremely challenging” economics. Fertiberia ceased production at its Palos de la Frontera site in Spain, and Puertellano remained down for scheduled maintenance. Yara shut 40% of its European ammonia production in September, and OCI partially closed its Geleen plant in the Netherlands. Achema in Lithuania decided against restarting its ammonia plant following maintenance in August, and OPZ in Ukraine shut one ammonia line at Odessa, with Ostchem and DniproAzot likely to follow. Borealis in Austria also reduced production.