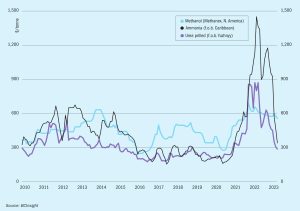

Price Trends

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

Further downward corrections are possible but the rate of demand is stabilising, suggesting the market floor is in sight, though some have suggested that May could bring another sharp reduction in the Tampa contract price towards the mid$300s c.fr. Demand remains sluggish in both eastern and western hemispheres.

In 1967 Stamicarbon revolutionised the urea process by the invention of the high-pressure CO2 stripper by Petrus J. C. Kaasenbrood. The high-pressure CO2 stripper led to following benefits:

Last year, in the wake of Russia’s invasion of Ukraine and the associated disruption to fertilizer and grain exports from both countries, there were dire predictions of the impact upon global food supply. That the worst of these predictions have not so far come to pass is in no small part due to the deal brokered by the United Nations and Turkey in July 2022 to allow exports of grain and fertilizers from Black Sea ports. According to the UN, since last July, some 29.5 million tonnes of grain and foodstuffs have been exported from Ukraine via the Black Sea, including nearly 600,000 tonnes in World Food Programme vessels for aid operations in Afghanistan Ethiopia, Kenya, Somalia and Yemen. Before the war, Ukrainian grain fed the equivalent of up to 400 million people worldwide, and the deal ensured that Ukrainian grain exports ‘only’ fell by 5 million t/a over the past year.

Mining, metals and fertilizer business intelligence company CRU has launched a new low-emissions ammonia (LEA) price assessment in its Fertilizer Week price reporting service. The price takes a value-based approach, whereby a premium on the Northwest European ammonia price is calculated on an emissions-mitigated basis, and leverages CRU’s proprietary nitrogen asset emissions data combined with weekly European carbon prices to calculate the value of emissions mitigated. CRU says that it has leveraged its Emissions Analysis Tool to develop the premiums on an emissions-mitigated basis as opposed to a cost basis, allowing end-users to assess how the switch to LEA can deliver value to their business while contributing to their decarbonisation strategies. The Emissions Analysis Tool is a comprehensive asset-byasset emissions dataset for the nitrogen industry.

The first global review of phosphate rock resources since 2010 has reported that technically recoverable reserves should last for more than 300 years.

Market Insight courtesy of Argus Media. Urea: Scarcity continued to drive urea prices higher in some markets at the end of April. The US market remains short on urea and prices spiked to reflect this. Nola barges for April were trading as high as $450/st f.o.b. ($490/t cfr), 55 percent up on this year’s low point. Southeast Asia remains short on urea too, amid planned and unplanned turnarounds, with one cargo trading at around $345/t f.o.b.

Mining major Anglo American is to invest up to $4 billion to complete its Wood-smith mine project in the UK.

Micronutrient products are one the fertilizer industry’s fastest growing segments. In response, ICL, Koch Agronomic Services, Levity Crop Science, Omex and SQM have all strengthened their micronutrient portfolios.

Market Insight courtesy of Argus Media. Urea: Prices fell in most global markets in early March as suppliers chased limited demand. Although India’s purchase tender has yet to formally conclude, IPL looks set to book 1.15 million tonnes of urea at $330-334.8/t cfr, with traders mainly sourcing from Russian and Middle Eastern producers.