Fertilizer financial scorecard – earnings decline as market normalises

We compare and contrast the 2023 financial performance of selected major fertilizer producers following the publication of fourth quarter results.

We compare and contrast the 2023 financial performance of selected major fertilizer producers following the publication of fourth quarter results.

Urea: Prices continued their global decline in mid-April, including at New Orleans. The notable exception was Brazil where prices firmed due to buyer interest in the market for May and beyond.

Urease and nitrification inhibitors are cost efficient and easy to implement solutions for improving the nitrogen use efficiency (NUE) of urea ammonium nitrate (UAN). The use of inhibitors enables farmers to substantially reduce nitrogen losses and achieve their environmental targets, explains Thomas Profitt , Syensqo’s Global Enhanced Efficiency Fertilizer Manager, while improving crop yields and generating a positive return on investment.

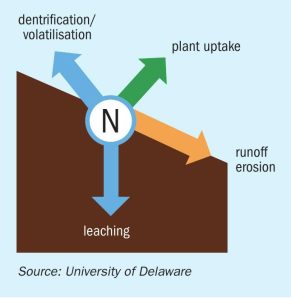

Addressing the ‘leaky’ nature of nitrogen fertilizers is a longstanding priority for growers, fertilizer producers and retailers alike. Dr Karl Wyant, Nutrien’s Director of Agronomy, examines the valuable role enhanced efficiency fertilizers (EEFs) can play in improving nitrogen use efficiency.

Biuret is a chemical compound with the chemical formula HN(CONH₂)₂ , also known as carbamylurea. It is a commonly occurring undesirable impurity in urea-based fertilizers, as biuret is toxic to plants. Biuret is formed from urea, according to the following overall reaction:

The ammonia market reverted to recent norms at the end of April, with prices more or less unchanged in the east, and several benchmarks west of Suez moving downward in line with May’s Tampa settlement. Following a trio of high-priced c.fr spot deals many wondered whether such business would be replicated in Asia, but the hype did not live up to the expectation, with the majority of tonnes continuing to move on a contract basis into the likes of South Korea and Taiwan, China. The $430/t c.fr concluded into China has been attributed to both supply uncertainty and an uptick in domestic demand, though several inland prices declined this week, rendering price direction difficult.

Although it has been a major exporter of urea, increasing Chinese government restrictions have restricted the seasonal window for exports.

The board of Petrobras has approved the resumption of operations at the company’s Araucária Nitrogenados SA (ANSA) site at Araucaria, Parana state. The plant, which has the capacity to produce 475,000 t/a of ammonia and 720,000 t/a of urea, has been idled 2020.

Prices in the West are unlikely to garner much support moving into the latter stages of Q2. The May Tampa ammonia settlement was settled by Yara and Mosaic at $450/t c.fr, down $25/t on the $475/t c.fr agreed for April. With seasonal domestic demand in the US drawing to a close 2H April, many had anticipated that either a rollover or a slight decline would be agreed.

Paradeep Phosphates Limited (PPL) and Mangalore Chemicals & Fertilizers Limited (MCFL) have agreed to merge.