Market Insight

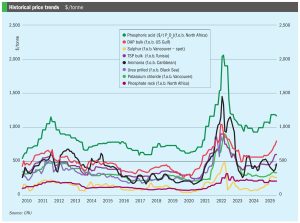

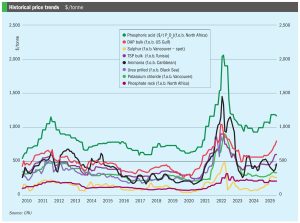

Price trends and market outlook, 21st August 2025

Price trends and market outlook, 21st August 2025

Stamicarbon has optimised urea granulation to meet rising global fertilizer demands by improving product robustness, reducing capital and operating costs through a simplified design.

Casale’s high-performance finishing technologies combine flexibility and innovation with seamless integration and sustainability across the nitrogen fertilizer value chain. Gabriele Marcon and Ken Monstrey of Casale present the latest developments in Casale’s comprehensive portfolio of fertilizer finishing technologies and highlight recent projects.

Casale’s integrated revamp solutions for ammonia and urea plants are designed to unlock latent potential and boost operational performance.

Revamping existing urea plants can deliver significant improvements – including higher capacity, lower costs and reduced emissions.

Two fertilizer plants, formerly part of the Interagro Group, are being offered for sale by the liquidator, Sierra Quadrant. The factories, Ga-Pro-Co in Săvinești and Donau Chem at Turnu Măgurele, are available for direct negotiation starting at €17.8 million plus VAT and €18 million plus VAT, according to the liquidator, with a public auction to be held in September. Assets available include plants for the production of ammonia, urea, nitric acid, ammonium nitrate and liquid fertilisers, as well as transportation infrastructure for both road and rail.

Egypt is looking towards hugely increased LNG imports to try and reduce domestic shortages. A second floating regasification and storage unit arrived in May and two more are expected to be in place soon. Reuters reports that the country has reached agreements with energy firms and trading houses to buy 150 to 160 cargoes of […]

Casale has signed two contracts with Xin Lian Xin Chemicals Group Co.,Ltd for the implementation of ammonia and urea technologies in the company’s new urea complex in Henan province. Capacities for the two plants will be 2,700 t/d of ammonia and 3,500 t/d of urea. Casale says that the complex will be its first grassroots […]

Abu Dhabi-based nitrogen producer and distributor Fertiglobe says that it is acquiring the distribution assets of Wengfu Australia Pty Ltd. through an asset sale and purchase agreement, expanding its downstream reach and enhancing access to supplying Australian customers. Fertiglobe currently supplies around 600,000 t/a of urea to Australia, with the potential to grow supply volumes […]

Reverse rotation of an inline four-stage centrifugal CO2 compressor is an unwanted phenomenon which sometimes occurs in urea plants. Reverse rotation can lead to damage to the internals of the CO2 compressor and an expected outage. This discussion shares experiences and provides suggestion on how to avoid reverse rotation of the CO2 compressor.