Sulphur 386 Jan-Feb 2020

31 January 2020

Phosphates: surviving the slump

PHOSPHATE

Phosphates: surviving the slump

After a poor 2019, when global demand contracted by nearly 2.5%, phosphate markets are expected to rebound in 2020. Saudi Arabia and Morocco dominate new capacity additions while India and Brazil continue to be the key importers. US and Chinese production is in slow decline, meanwhile.

Sulphuric acid demand continues to be predicated heavily upon phosphate fertilizer production, with about 60% of sulphuric acid going to make phosphates. The global phosphate industry has seen a period of falling prices and oversupply in 2019, as poor harvest and lower farm incomes and bad weather have reduced phosphate fertilizer applications.

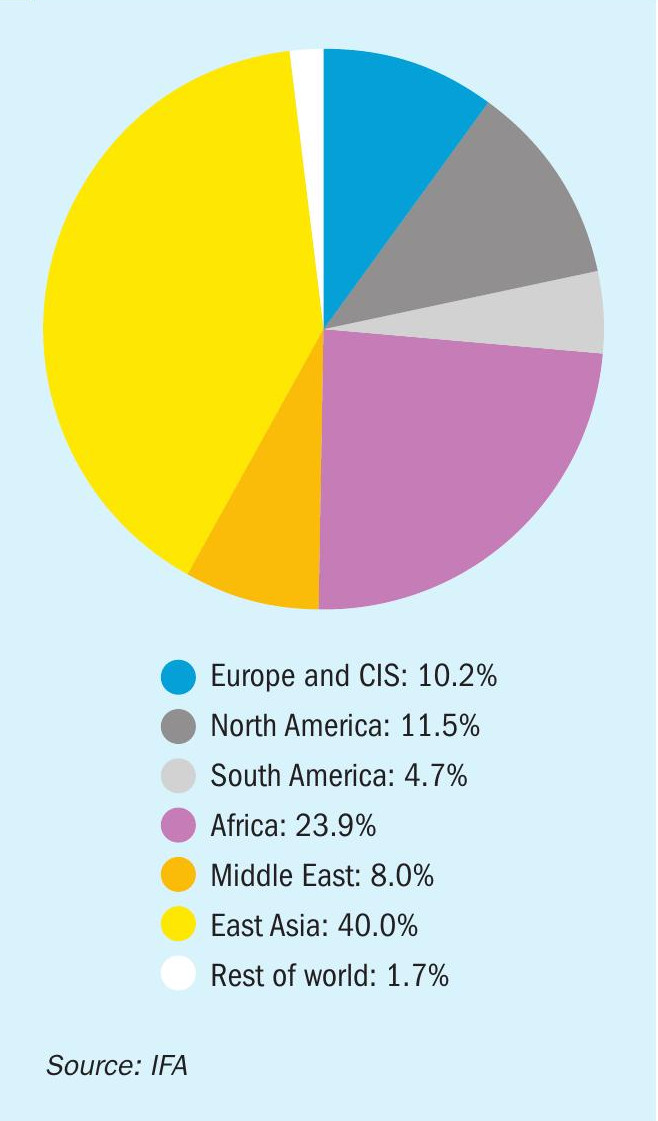

Global phosphate rock production stood at 63.3 million t/a P2 O5 in 2018, with production split as shown in Figure 1. The world’s largest producer remains China, which represents the vast bulk of East Asian production and which produced 23.2 million t/a P2 O5 of phosphate rock, 38% of the world’s supply, mostly for domestic consumption. Next comes Morocco, at 10.5 million t/a P2 O5 (17%), and the United States, with 7.4 million t/a P2 O5 (12%) of production. Russia was the fourth largest producer, followed by Jordan, Brazil and Saudi Arabia.

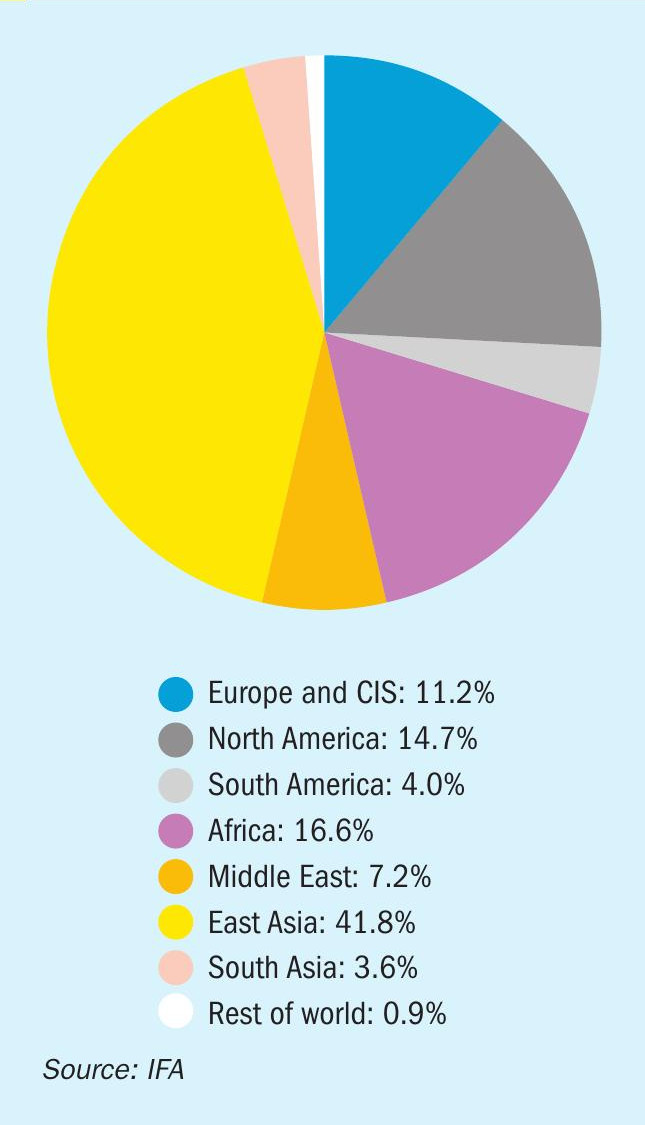

On the processed phosphate side, global phosphoric acid production was 47.0 million t/a P2 O5 , with production split as per Figure 2. On the whole the split is similar to Figure 1, but as Figure 2 shows, Africa produces less finished phosphates as share of world production, and exports phosphate rock to India, China and other places to produce finished phosphates. Hence the regions that have the greatest influence on phosphate production and trade, and hence consumption of sulphuric acid, are China, North America, India, South America and North Africa. China, India, Brazil and the USA between them account for 60% of all phosphate demand globally.

China

China is the largest producer and consumer of phosphates in the world, driving the country’s huge consumption of sulphur and sulphuric acid. China’s phosphate industry saw remarkable growth from 2000-2015, turning the country into the largest producer and consumer of phosphates in the world. However, since that rapid period of development, growth has slowed and stagnated even as new plants continued to be built, leading to overcapacity. China’s phosphate industry has soaked up most of China’s sulphuric acid production over that period, and led to China being the largest importer of sulphur in the world. However, government policy is now to make more efficient use of fertilizer and to cap fertilizer use at its 2020 level. Chinese phosphate consumption peaked in 2012 at 14.4 million t/a P2 O5 , but since then has fallen to 10.6 in 2018, and this is likely to continue to see a decline.

Phosphate production, meanwhile, also rose rapidly to reach 17.0 million t/a P2 O5 in 2018. Some 45% of this was represented by diammonium phosphate production, which has seen a particular excess and much ended up on the international market; 3.4 million t/a P2 O5 in 2018. But an increasing government crackdown on pollution has led to shutdowns or increased costs of compliance with environmental legislation, and much of the excess or unproductive capacity has been forced to close over the past few years, especially in the Yangtze River basin, where much of China’s phosphate capacity is concentrated. In 2015-17, about 1.8 million t/a of DAP capacity and 2.5 million t/a of MAP capacity (both in terms of tonnes product) was idled, most of it from smaller scale producers.

Meanwhile, closures on the phosphate rock mining side may turn China into a net importer of phosphate rock from about 2023. CRU reported at the Phosphates 2019 conference that Chinese phosphate rock production costs are expected to rise above the global average site cost by 2020.

In the shorter term, as global phosphate prices have fallen, so major Chinese producers have coordinate efforts to cut production capacity. In July they cut phosphate output by 40%, and this output cut has lasted into the start of 2020, removing over 1.5 million tonnes P2 O5 of phosphate production so far.

North America

The US was the largest producer of phosphate rock in the world throughout the 20th century, but its dominant position has declined over the past two decades as competition has evolved elsewhere. US production of phosphate rock peaked in 1980 at 54.4 million metric tons, and this had more than halved to 25.7 million t/a in 2018, as mines became exhausted. In Canada, the last phosphate mine – in Kapuskasing, Ontario – was closed when the reserves there were exhausted, and operator Agrium began instead importing phosphate rock from Morocco. Canada also has only one remaining downstream phosphate site, at Redwood, Alberta, although Arianne Phosphates is developing a new mine and downsteram complex at la a Paul in Quebec, and there is also a feasibility study underway on developing a 500,000 t/a phosphoric acid plant at Belledune in New Brunswick.

As phosphate rock mining and processing has shrunk in North America, the North American industry has consolidated. In the 1990s there were 18 different companies operating phosphate plants in the United States at 22 different sites. However, a continuous process of consolidation has seen that reduced to just four; Mosaic, Nutrien, Simplot and Itafos, with only nine phosphate processing sites now in operation. Downstream production of phosphoric acid in 2018 was 6.7 million tonnes P2 O5 . The North American share of global downstream phosphate production has steadily fallen since the mid-1990s, from 45% of global phosphoric acid production to 15% in 2018 – still significant but not the dominant force it once was.

Falling production and increased competition on the global market has meant that North American exports of phosphates have contracted– from 12 million t/a of DAP/MAP and TSP in 1996 to less than 3 million t/a in 2018, and North America’s share of the international phosphate trade fell from close to 60% to just 10% during that time.

As regional phosphate rock mining has contracted, North American demand for phosphate rock has begun to run slightly higher than supply. In 2017, the region imported 3.5 million t/a of phosphate rock to feed phosphoric acid production. US fertilizer demand for phosphate is relatively mature, and for most of the 1990s and 2000s fluctuated between 3.8-4.2 million t/a P2 O5 , with another 4-500,000 t/a from Canada. In general, there has been a gradual increase in demand over the past few years, due to increased plantings of maize and soybeans, which are more phosphate-hungry, as opposed to declining plantings of wheat, which uses less phosphate fertilizer, but 2019 saw poor weather, especially flooding, across the Mid-West in spring which reduced planting, while the trade war with China has reduced export opportunities for farmers. The result was a significant decline in phosphate applications last year, and US phosphate producers were forced to make production curtailments as a result. Mosaic idled operations at Faustina in Louisiana from October to December, at which time it announced it will reduce phosphate output in Florida. However, US phosphate demand is expected to rebound during 2020, making up for the losses in 2019.

India

India has a significant domestic finished phosphate industry but little domestic phosphate rock mining. Consequently the country is one of the most important importers of phosphate rock and phosphoric acid, and the largest importer of processed phosphates like DAP. India’s phosphate consumption ran between 6.7-7.0 million tonnes P2 O5 for the period 2015-2018, according to the Fertilizer Association of India, and was forecast to have reached 7.1 million t/a P2 O5 in 2019. India structurally applies too much urea – which has a higher subsidy level – and too little phosphate, and successive governments have failed to tackle this issue, which has contributed to stagnating crop yields. The Modi government is trying to move from nutrient-priced subsidies to fertilizer producers to a direct subsidy to farmers. It is hoped that this will gradually boost phosphate consumption at the expense of urea applications, but this will probably also require the government to tackle the unique subsidy status of urea.

Domestic phosphoric acid production was 1.7 million tonnes P2 O5 in 2018, with downstream phosphate production running well below the levels required to meet domestic demand. Consequently, India imports several million tonnes per year of DAP – the figure for the 2019-20 fertilizer year (which runs to April 1st) is expected to be around 5.5 million t/a (tonnes product) according to Argus. This is actually lower than for the previous year, as stocks are running high – 2018-19 was a record year for Indian DAP imports, which were 50% up on the figure for 2017-18. Total Indian phosphate fertilizer imports were 6.3 million tonnes product of MAP and DAP according to Nutrien figures.

South America

One of the fastest growing areas for new phosphate demand is South America, with Brazil the largest consumer. Brazil’s fertilizer requirements have more than doubled in the past two decades, and phosphate applications, aside from a dip in 2015 when the country was in severe recession and paralysed by political deadlock, have climbed from just over 3.5 million t/a P2 O5 in 2010 to closer to 6.0 million t/a in 2018. The rest of Latin America adds another 1.8 million t/a P2 O5 of consumption. Consumption is continuing to grow, with CRU forecasting that another 1.8 million t/a of P2 O5 demand will be added from 2018-2023; an increase of almost 20%. The US-Chinese trade war has ironically been a boost for Brazilian soybean exports to China, which require significant quantities of phosphate nutrient.

Regional production of phosphates is relatively low. Total phosphate capacity stands at only 2.6 million t/a P2 O5 , so exports run correspondingly high. In 2018 Brazil alone imported 4.5 million t/a (tonnes product) of MAP and DAP fertilizer, making it the second largest importer after India.

North Africa/Middle East

On the production side, North Africa and the Middle East are hugely important to the global phosphate industry in terms of phosphate rock production, but also increasingly in terms of finished phosphates (and hence sulphuric acid demand). Morocco is the world’s largest holder of phosphate reserves and the second largest producer. But with little domestic phosphate demand, it is by far the world’s largest exporter of phosphate rock and, increasingly, processed phosphates. State producer OCP is undergoing a huge expansion programme to not only boost phosphate rock production but also to develop more downstream phosphate production and export capacity in an attempt to capture more value from its phosphate resources.

Neighbouring Algeria is a major phosphate rock reserve holder and has exported around 1 million t/a but now, with $6 billion of Chinese money, it is attempting to develop four major projects, with state oil and gas producer Sonatrach and state fertilizer producer Semidal taking a 51% majority stake in the project and CITIC and Wengfu group the remaining 49%. The projects include developments in four areas, including the eastern province of Tebessa, where there is an investment budget of $1.2 billion in new mining, the eastern province of Souk Ahras with an investment put at $2.2 billion, the northeastern province of Skikda, with $2.5 billion, and the northeastern port of Annaba, with $200 million for infrastructure development. First production from the new sites is due to start in 2022.

Tunisia is attempting to rebuild its phosphate industry after years of stagnation due to industrial and political unrest. Phosphate rock production stood at 8 million t/a prior to the Arab Spring, but declined to less than half that in 2011 and has recovered only patchily since then. Like Algeria, the government has looked towards Chinese money as part of the Belt and Road initiative to try and boost production, but state producer GCT has been critical of a recent suggestion of recovering phosphates from phosphogypsum tailings (see Sulphuric Acid News, this issue).

In Egypt, another phosphate rock exporter (ca 3 million t/a), there are also moves to expand mining and greatly expand downstream phosphate production, at Abu Tatour, where 900,000 t/a of phosphoric acid capacity is planned, and Ain Sokhna, where anther 360,000 t/a of phosphoric acid capacity is planned. Moving further east, Jordan is a major phosphate producer, and now Saudi Arabia has also moved into phosphate expansion and processing via state-owned mining company Ma’aden. Two large phosphate complexes are already up and running, the most recent, the Wa’ad Al Shamal joint venture with Mosaic in 2017, and a third mega-complex is planned for 2024.

Taken as a whole, the region is the main source of new processed phosphate capacity over the next few years, with North Africa alone adding 3.7 million t/a P2 O5 of phosphoric acid capacity between 2018 and 2023, and Saudi Arabia another 1.5 million t/a.

Other issues

Europe’s decision to lower its limit on cadmium content of phosphate rock looks like changing the pattern of European consumption of phosphate, consolidating the hold that Russian phosphate producers have on the European market, and displacing Moroccan phosphate, which has a higher cadmium content.

The other major change in the phosphate industry globally is a move towards more complex fertilizers and away from the mono- and diammonium phosphate and single and triple superphosphate that have been the industry’s mainstays towards nitrophosphates and NPKs. India has particularly moved towards NP fertilizers.

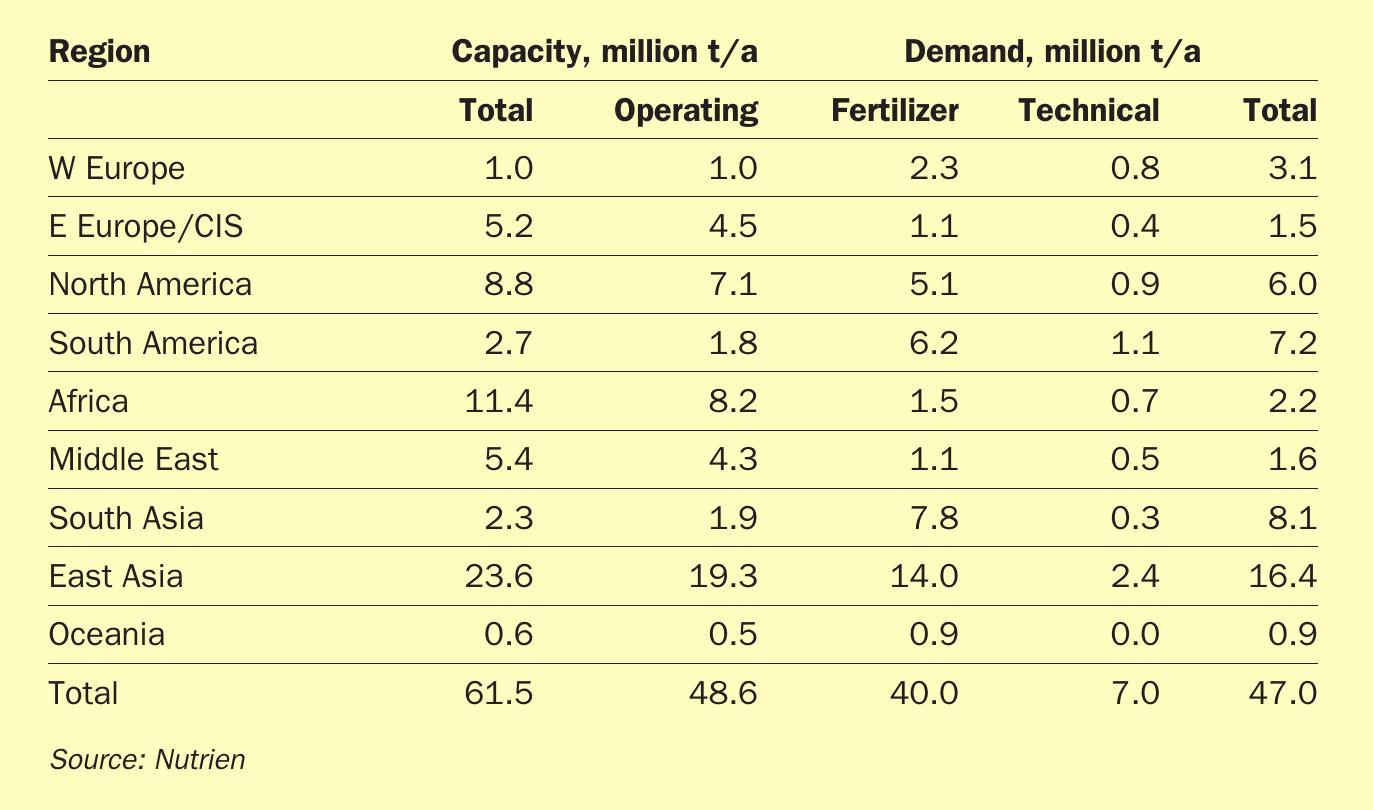

Sulphuric acid demand

Sulphuric acid demand for phosphate production is predicated on phosphoric acid production from phosphate rock. Table 1 shows the breakdown of phosphoric acid production and demand by region in 2018 according to figures from Nutrien. As noted above, the main new capacity additions will be in Morocco, Saudi Arabia, Algeria and Egypt, with additional projects in Russia and Kazakhstan, Brazil and Turkey. Capacity closures are likely in North America and possibly India. In its most recent forecast, IFA projected a baseline assumption of an additional 3.7 million t/a P2 O5 of phosphoric acid production from 2018 to 2023, at an average annual growth rate of 1.5% per year, representing an additional 11 million t/a of sulphuric acid demand over that period, mainly in North Africa and Saudi Arabia.