Sulphur 390 Sept-Oct 2020

30 September 2020

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

Global sulphur prices were broadly stable through August. The holiday season contributed to the slower pace of price movement with limited trades confirmed. There has been increasing focus on firming processed phosphate prices to see if this will lend support to the sulphur market. Phosphate fertilizer demand has been healthy with the sustained uptick in prices reflecting the seasonal demand boost. The global pandemic is weighing on the economic outlook with uncertainty surrounding the possibility of a second wave in the coming months.

In Morocco, OCP has shown its ability to quickly adapt processed phosphates production output to meet demand. Lockdown measures in India introduced in March saw the shutdown of many plants reliant on Moroccan phosphoric acid, but with Indian demand bolstered by good rains and record plantings, OCP increased output of finished fertilizers. In late May, as Indian production normalised, OCP lowered finished fertilizer output, while boosting phosphoric acid shipments to compensate, keeping sulphur demand healthy over the disruption period. A spike in Moroccan Covid-19 cases led the government to introduce strict lockdown measures across several major cities. We understand that mining, logistics and fertilizer production operations are to remain unaffected in the country and the government is unlikely to impose restrictions that would impact OCP’s operations. Moroccan DAP/MAP production is expected to increase in 2020 with an associated increase in sulphur consumption. There was a strong sulphur vessel line up at the port of Jorf Lasfar with 4.52 million tonnes of sulphur scheduled to discharge between 1 January and 25 August.

Looking to the nickel market, the outlook for Indonesian sulphur demand has been revised up with several high pressure acid leaching projects underway. The most imminent appears to be the Tsingshan, GEM and CATL joint venture. Plans are to produce 50,000 t/a of nickel and 4,000 t/a of cobalt. The facility will benefit from being constructed in Tsingshan’s industrial site in Morowali, where a sulphur burner will likely be constructed and lead to an increase in sulphur imports. Start up is planned for late-2020.

Meanwhile in Madagascar the Ambatovy nickel mine shut down operations in March after workers contracted Covid-19. When operational, the mine produces 60,000 t/a of nickel and 5,600 t/a of cobalt as well as producing and consuming 2 million t/a of sulphuric acid. Sumitomo, which owns 48% of the project, expects the mine to remain closed until Q1 2021. This has led to a downward revision for sulphur imports and consumption for the short term. The majority of tonnes would usually be procured from the Middle East region. Sumitomo recognized approximately $500 million of impairment loss this July due to revenue losses tied to low nickel prices and production cuts.

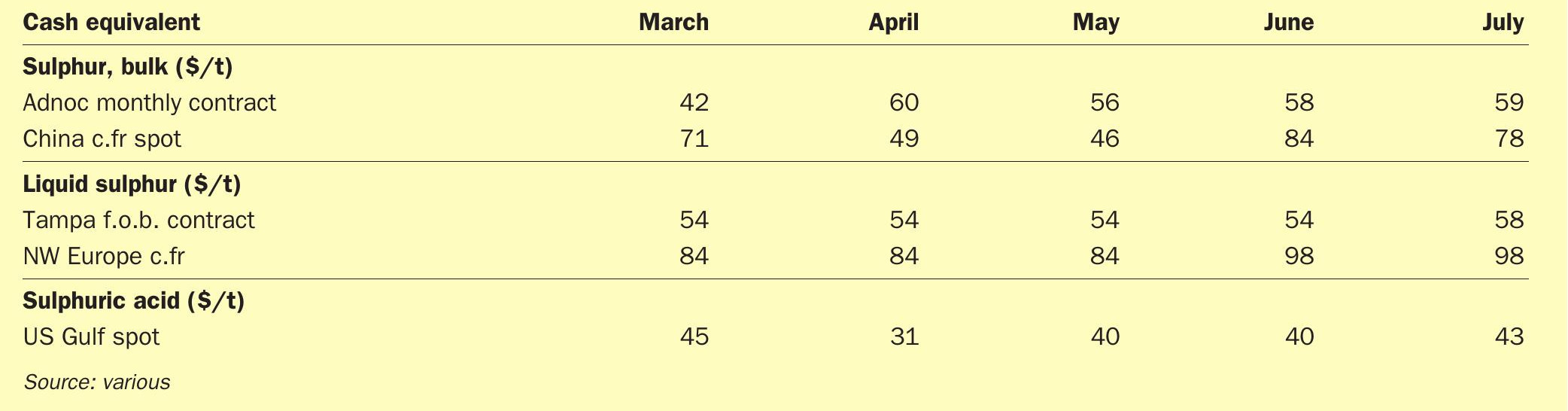

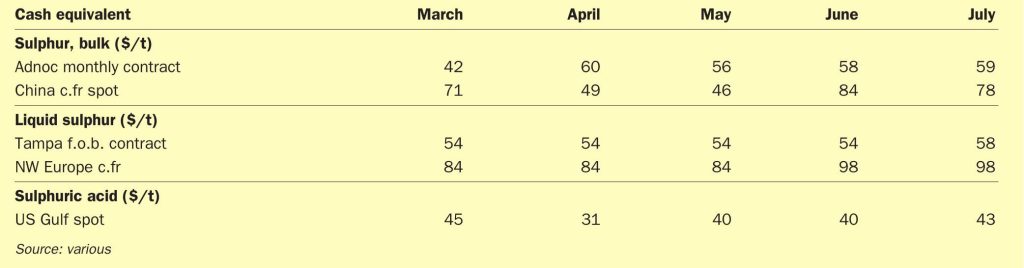

Middle East producer pricing for August reflected a slightly softer tone since July with slight decreases posted across the board. In the UAE, ADNOC set its August monthly price at $58/t f.o.b. Ruwais, $2/t down on July, for shipments to the Indian market. KPC/Kuwait set its price for June at $54/t f.o.b. Shuaiba, down by $6/t on the previous month. State-owned marketer Muntajat set its June Qatar Sulphur Price (QSP) at $56/t f.o.b. Ras Laffan/ Mesaieed. This was $2/t below July. The Muntajat spot tender in August was heard awarded in the high-$50s/t f.o.b.

Extensive supply disruption in the second quarter on the back of Covid-19 lockdowns has seen improvement in many regions but project delays appear to be emerging for new supply additions in the short term. In Kazakhstan operating rates at Kashagan are expected to improve from mid-September following the outage that began at the end of July. Production is likely to return to normal from the fourth quarter. In Kuwait, KNPC’s Al Zour refinery was initially expected to be commissioned in the fourth quarter but sources close to the matter have said this is likely to be delayed, potentially pushing a start up to Q1 2021.

In its Q2 2020 financial results Saudi Aramco reported reaching full capacity rates at its Fadhili Gas plant at 2.5 scf/d after successfully completing its commissioning activities. Crude processing at the Jazan refinery is expected to begin in Q1 2021, a slight delay on previous estimates. Aramco’s 325,000 bbl/day Ras Tanura refinery began maintenance in August, likely to last for a month, although this was unconfirmed. Upgrade work is set to be carried out at the facility.

Supply in the US faced temporary tightening with the arrival of Hurricane Laura. Refiners in Texas and Louisiana shutdown or reduced run rates, adding to the already tight market balance. No significant damage was noted to infrastructure however after the storm passed. Export prices out of the US Gulf were assessed at $56-60/t f.o.b. at the end of August. Data from the USGS for first half 2020 shows sulphur losses in the US were less than previously expected on the back of Covid-19 related disruption at refining operations. Total production was around 3% lower than a year earlier, equating to a drop of around 140,000 tonnes.

Supply has also been squeezed in parts of West Europe this year with refining capacity under pressure in the wake of the global pandemic’s impact on refinery margins and inventories. Looking ahead, the Grossenkneten gas field is scheduled to undergo maintenance from 8 September to 13 October. During this period sulphur output will be halted. The erosion of Western European supply provides support to the prospects for sulphur remelters in the region. Logistics and Services company Saconix appears to be planning to complete construction and begin testing of its remelter project in Brake by the end of 2020. Operations are currently expected to begin in early 2022.

China sulphur imports in the first half of the year dropped by 28% to 4.2 million tonnes, a level not seen since at least 2011 according to trade data. The drop can be attributed to high inventory levels at major ports and the disruption to end users earlier in the year on the back of Covid-19 lockdowns. Operating rates at major processed phosphates producers in the Hubei province were down significantly in the first quarter. Port stocks surged to just over 3 million tonnes in February, remaining high through the first half of the year. Average port stocks have been around 2.8 million tonnes, much higher than 1.4 million tonnes in the same period in 2019. Sulphur prices in China have edged down by $6/t since the start of the year, averaging $57/t c.fr in the month of August. Pricing is expected to remain fairly stable through to the end of the year. Domestic production in China is forecast to rise in 2020, supporting the view for lower import demand in 2020 vs 2019.

SULPHURIC ACID

Average NW European export prices for sulphuric acid have dropped by 58% so far this year but proved to be the most resilient of the major exporters. Recovery has been slow and steady since drifting into negative netbacks. Prices ranged $9-17/t f.o.b. at the end of August, up from the lows of minus $18/t f.o.b. seen in April. Spot business concluded to the Americas led to firmer export prices in recent weeks. Smelters in the region are planning maintenance turnarounds in the third quarter, some were delayed from earlier in the year due to Covid-19 disruption. There is potential for a more balanced European market in the coming months, supporting stable prices with further recovery a possibility.

Contract business in Europe settled at decreases, with second half 2020 contracts concluded at e61-72/t c.fr, down from e67-78/ t c.fr in the first half. Third quarter contracts settled at e69-79/t c.fr, down from e74-86/t c.fr in the second quarter. The downturn was expected based on stable output from smelters and demand erosion from the industrial sector.

South Korea and Japan export prices were broadly stable through August with prices ranging minus $22/t to minus $12/t f.o.b. The gap between East and West export prices has remained steadfast with additional competition from Chinese exports weighing on the market. The downturn in demand from key markets alongside stable supply has put proven an obstacle to recovery. China is expected to remain a major global exporter of sulphuric acid in 2020 despite anticipated lower volumes compared with 2019. In the first six months of the year China exported just over 1 million tonnes of acid, down 9% on a year earlier. Morocco has been the main market, with volumes increasing by 34% to 389,000 tonnes. Indian demand has also shot up to 361,000 tonnes, with attractive prices an incentive in recent months. The main decline in trade has been to Chile, with trade down by 70% to just 142,000 tonnes versus a year earlier.

The pandemic is expected to erode global sulphuric acid consumption by 1.2% in 2020, with substantial rebound forecast from 2021. Africa is the main exception this year with increased demand forecast in the processed phosphates sector in Morocco. Phosphoric acid-based demand has remained more resilient than other sectors with government support through the pandemic. An increase of 500,000 t on 2019 levels is forecast reaching 102.1 million tonnes for the sector. Not all regions will see an increase – the Middle East will see a decline of around 500,000 t. Shutdowns across phosphate plants in the region will lead to a 1.5% drop in demand this year on 2019. After recovering next year, ongoing expansions at Ma’aden in Saudi Arabia will be responsible for the majority of acid demand increases in the outlook. Meanwhile in Latin America, while major consumers in the region have seen a significant contraction in sulphuric acid consumption from a demand shock for metals, Brazilian demand is predominantly phosphoric acid based. The September soybean planting season was forecast to be one of the largest on record amid strong sale prices and demand from China.

In Chile acid demand has been disrupted by the rise of Covid-19 cases in the country. Major copper consumers in Asia also entered lockdown in the first half of 2020, reducing copper refinery output and sulphuric acid consumption. Supply side shocks have also been developing over the past few months and major copper producers have reduced operations at mines as cases rose across the country. In June, copper output declined for the first time since the pandemic hit, coinciding with Codelco halting construction work at El Teniente and Chuquicamata. Codelco’s mining operations continued, however the company idled its smelter at Chuquicamata at the end of June before restarting it earlier in August. Work at Chuquicamata has since resumed and expansion works at El Teniente are expected to restart later this month. We expect to see sulphuric acid imports to Chile dropping to around 2.6-2.8 million t/a in 2020, although this is dependent on the rate of recovery of the copper sector.

India looks set to become one of the worst affected countries by Covid-19. We expect a 15% decline in sulphuric acid demand across South Asia this year, almost all of which can be attributed to decreased phosphoric acid production. Despite a poor first half, declining sulphuric acid prices and a ramp up in fertilizer production as we enter a promising kharif season will aid in the recovery of sulphuric acid demand in India.

PRICE INDICATIONS