Sulphur 392 Jan-Feb 2021

31 January 2021

China’s phosphate industry

PHOSPHATES

China’s phosphate industry

Continuing rationalisation in China’s phosphate industry has been reducing demand for sulphur and sulphuric acid at the same time that the country is producing more of both.

China’s phosphate industry has come to be one of the defining features of the global sulphur industry. The rapid expansion in Chinese phosphate capacity in the period 2000-2015, especially of mono- and di-ammonium phosphate capacity (MAP/DAP) initially began as in import replacement policy, but capacity building continued long after self-sufficiency was reached, and turned China from a net importer into a net exporter of phosphates, with India an increasingly important customer.

China has large reserves of phosphates – the second largest in the world – and was able to produce ammonia by coal gasification to draw upon large domestic reserves of coal. However, generating enough sulphuric acid to process the large volumes of phosphate rock was more than China’s metallurgical and pyrite-roasting acid capacity was able to supply. With domestic sulphur production relatively low, the net result was rising imports of sulphur to China to feed sulphur burning acid capacity.

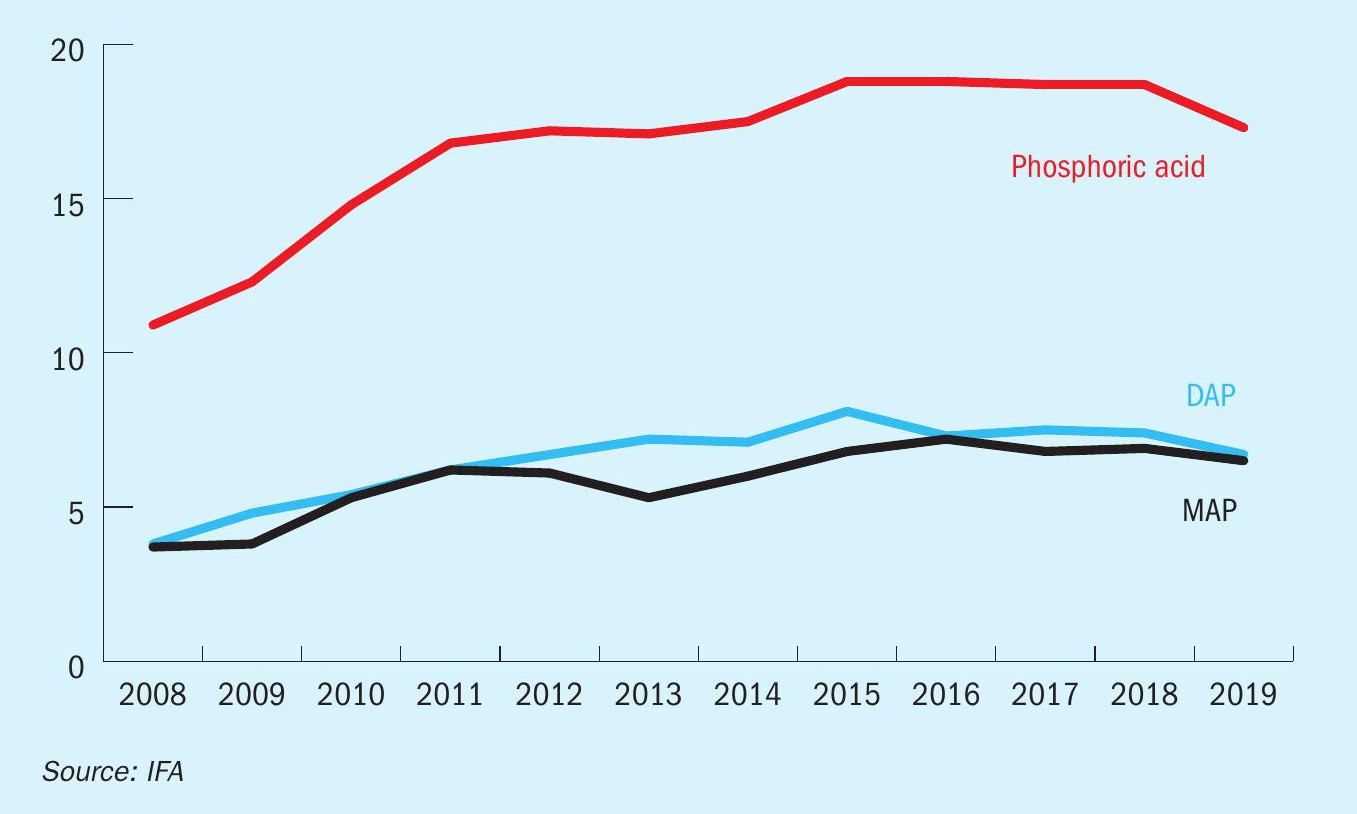

Chinese phosphoric acid production rose from 10.9 million t/a P2 O5 in 2008 to 18.8 million t/a P2 O5 in 2015. This was mostly due to a doubling of MAP and DAP production over that period, from 3.7 to 7.2 million t/a P2 O5 in the case of MAP, and from 3.8 million t/a to 8.1 million t/a P2 O5 in the case of DAP, as shown in Figure 1.However, since then there has been a slow but steady decline, especially in DAP production.

The major reasons for this are twofold; the government has tried to make Chinese use of phosphate more efficient, and to cap fertilizer consumption at its 2020 level. Chinese DAP consumption peaked in 2013 at 5.6 million t/a P2 O5 , but since then has fallen to 3.7 in 2019. MAP consumption reached 6.2 million t/a P2 O5 in 2016, but fell to 5.7 million t/a in 2019. Falling domestic consumption means that producers are more reliant on finding export markets for their product, and increasing supply and competition has been making that more difficult. Apart from a rally during 2018, DAP prices have been on a slide since 2014, dropping from $500/t to around $270/t f.o.b. the US Gulf in late 2019, some way below the average Chinese cost of production, which is just over $300/t.

Side by side with this has been a crackdown by the Chinese government on polluting industries and increasing environmental legislation. Much of the excess or unproductive capacity has been forced to close over the past few years, especially in the Yangtze River basin, where much of China’s phosphate capacity is concentrated. In 2015-17, about 1.8 million t/a of DAP capacity and 2.5 million t/a of MAP capacity (both in terms of tonnes product) was idled, most of it from smaller scale producers.

Chinese phosphate rock mining has also been falling as costs of production rise, and the country may become a net phosphate rock importer by 2023.

After the pandemic

The coronavirus pandemic was another challenge for the Chinese phosphate industry. Hubei province, where the outbreak began and was at its worst, is the centre of the Chinese phosphate industry, with 28% of the country’s production capacity. Closures dropped the fertilizer industry utilisation rate by 30-40% during 2Q 2020. Chinese DAP production was down by 12% in 1H 2020 compared to 2019, and MAP production was down 7%. Chinese DAP exports dropped 26% over the same period. However, the closures did remove a lot of the overcapacity in the international phosphate market, and led to prices heading back upwards from the middle of the year.

Domestic demand also held up well. Argus reckoned that China’s total processed phosphate consumption fell by 2.5% in 2020 compared to 2019, to a total of 15.5 million t/a P2 O5 for the full year. However, China’s ministry of agriculture has mandated an increase in grain planting areas this year, including requiring rice farmers to plant two seasons of the crop, to ensure sufficient food supply, and this is likely to boost Chinese phosphate demand, as will higher corn prices and low domestic DAP stocks.

Cheaper sulphur and sulphuric acid prices during 2020 helped lower the costs of production for Chinese DAP producers, although these began to rise again towards the end of the year, mitigated slightly by China’s recent announcement as from December 2020 that it will not charge import duties and value added tax on imports of sulphur.

Another boost for Chinese producers has been record Indian demand for fertilizer. Chinese exports of DAP were at 800,000 tonnes (product) in August 2020, 60% up on the previous year.

Looking forward

Chinese fertilizer consumption continues to be on a long term declining trend as farmers move to more efficient use of nutrient. The current Chinese MAP/DAP capacity rationalisation is drawing to a close, and there is more new capacity on the horizon. However, this will find some new regulations, such as restrictions on phosphogypsum storage, to be an additional burden, and may cap new production. Even in spite of this, however, there is a major overhang of idled capacity or capacity running at low rates which could be ramped back up depending upon the price environment. Chinese phosphate production, and hence sulphur demand, this depends very much upon international demand for processed phosphates. With more low cost DAP coming from Morocco and Saudi Arabia, Chinese producers may find themselves squeezed out of key markets. The general indication seems to be that the boom period for Chinese DAP production is over, and a slow period of decline is most likely for the medium term, aside from during temporary periods of market shortage.