Sulphur 395 Jul-Aug 2021

31 July 2021

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

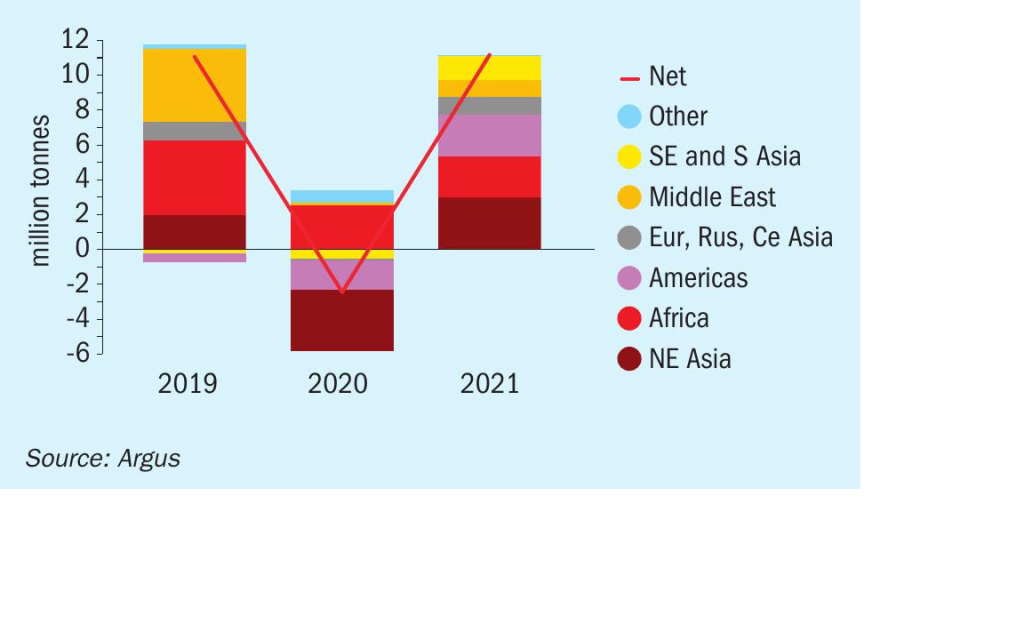

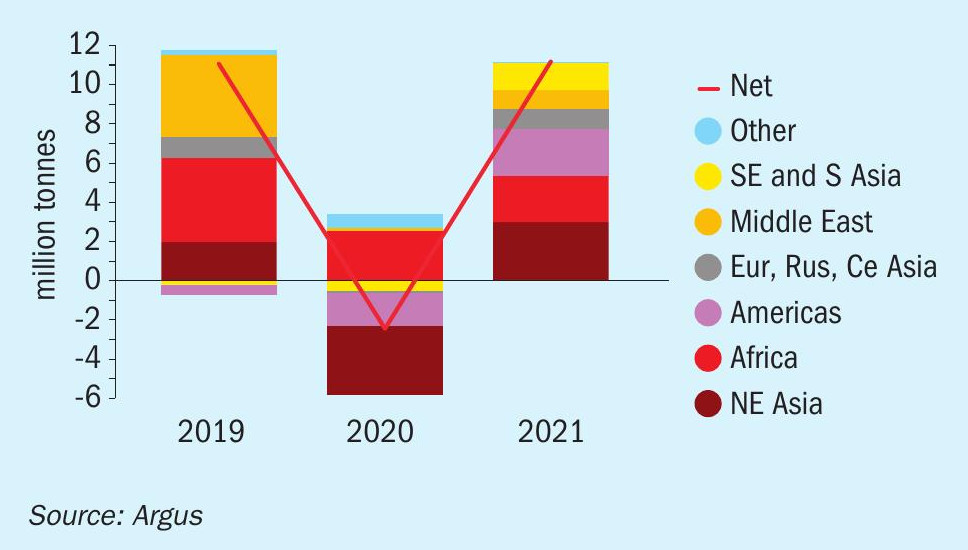

SULPHUR

The upturn in demand for fuel oil and refined products through the second quarter has led to an increase in oil production, with this trend expected to continue through the second half of the year. OPEC+ was planning to continue to reintroduce 2.1 million bbl/d of supply back into the market between May and July. The impact of the vaccine rollout in some countries is evident with fuel demand rising as the weeks go on. Operating rates at refineries in the US have continued to improve and through May and June European refiners restarted idled capacity, also increasing throughput. But in sulphur terms, we have yet to see a major easing in the tight supply situation. Availability in some regions remains squeezed. The Middle East appears to be the first region to be filtering additional cargoes into the market, resulting in softer prices through June and the view that the sentiment that a price correction is under way.

The main focus through July will be third quarter contract negotiations. In North Africa, Moroccan end user OCP was in discussions with major suppliers through June. The curtailment of availability of supply from Russian producer Gazprom is likely to limit the downside potential in pricing. While OCP reduced DAP production in the first quarter of this year, sulphur demand remained strong for phosphoric acid production. Consumption in Morocco is expected to remain healthy through the second half of the year, keeping import demand strong. Any shortfall in supply from Russia is expected to be met by cargoes from the Middle East region. The US import duties on OCP phosphate products deterred any sales to the US since April, while alternative markets have been found with global fertilizer demand remaining strong in recent months.

In Russia, fertilizer-based sulphur consumption will drive the region’s demand growth in the forecast with expansions at existing phosphoric acid lines ramping up. Phosagro has completed construction at its Volkhov expansion. An extra 395,000 t/a of P2 O5 capacity will be available by the end of the year, increasing sulphur demand by over 300,000 t/a. Phosagro has also completed construction at its expansion at Balakovo, increasing sulphur consumption. Commissioning will commence in 2022. The rise in domestic sulphur demand is expected to put downward pressure on sulphur exports from the country. In other demand news, Udokan Copper continues to progress with construction at its mine in the far east of Russia. Ore grinding facilities are complete and work continues on the concentrator and leaching site. Phase 1 start-up is expected in the second half of 2022. The company is understood to be considering options for the sulphuric acid requirement. This may be met by captive acid capacity through a sulphur burner or procured directly on the merchant market.

Over in Indonesia, Lygend’s Halmahera nickel HPAL site has begun production of nickel and cobalt. It is understood to be receiving sulphur cargoes at Obi Island for use at the site’s two sulphur burners. Sulphur demand at capacity will be over 300,000 t/a. Sulphur demand in the country is expected to rise further in the outlook as additional nickel HPAL projects come online at the Morowali Industrial Park on the island of Sulawesi. This is being driven by demand for battery metals for the electric vehicle (EV) sector.

Brazilian spot prices firmed through June with the benchmark assessed at $225-235/t c.fr at the end of the month. This rise came as freight rates from major f.o.b. markets firmed to all-time highs and offtakers looked to secure cargoes, placing upward pressure on prices. A period of stability is expected in the short term, but the bullish freight market remains a risk to this. Sulphur consumption in the fertilizer sector is expected to remain healthy through the rest of the year although Yara’s Serra do Salitre SSP facility is now expected to start up during the first quarter of 2022. Demand from the expansion project will add 300,000 t/a sulphur demand at capacity.

In the US, on the lithium front, there are three main projects in development that could impact the medium to long term sulphur market balance significantly. Lithium Americas’ Thacker Pass project sits as the most advanced and is expected to start up from 2024. The project includes two sulphur burners. Cypress Developments also plans a sulphur burner at its Clayton Valley project. A feasibility study is planned to be started in 2021 as well as a pilot plant. According to initial project plans, solid sulphur from west coast refineries would be trucked to the site. Ioneer’s Rhyolite Ridge project also includes plans for a sulphur burner.

As Covid-19 restrictions continue to ease across the US, refinery run rates have improved, data from the Energy Information Administration show. In the second week of June, refinery utilisation reached 93%, up from 91% the week prior and 74% this time last year. Sulphur demand is expected to hold firm in the coming months from both the fertilizer and industrial sectors.

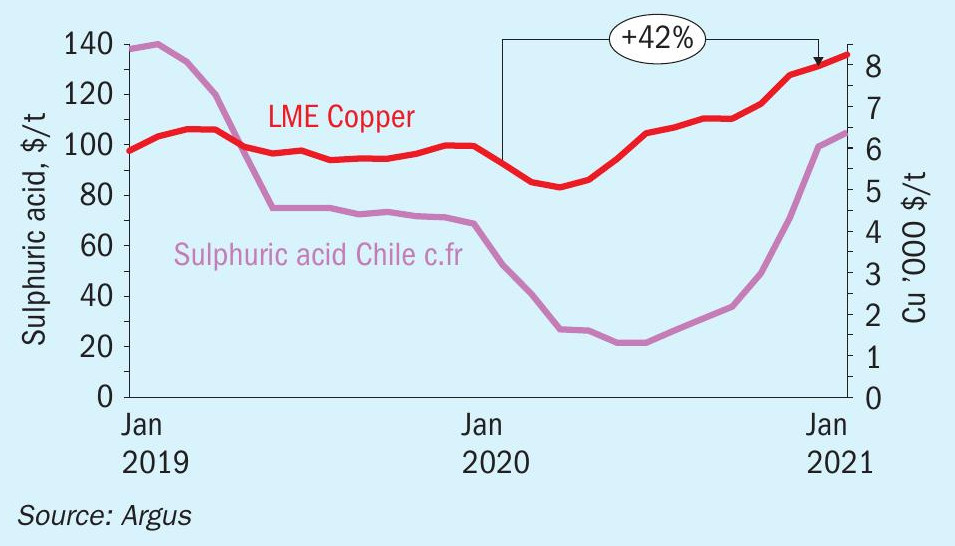

SULPHURIC ACID

Global sulphuric acid prices have continued to firm in recent months with signs of the price run slowing during June as buyer resistance has kept prices stable in some regions. Strong support remains on the demand front from the processed phosphates sector and industrial and metals markets. Supply remains tight for smelter acid and regional tightness in sulphur continues to put pressure on operating rates at sulphur burners. Sulphuric acid price premiums continue to rise further, disconnecting from the sulphur benchmark as global supply remains stretched from smelters and sulphur burners.

In NW Europe, average prices for exports firmed by $106/t to $135/t f.o.b. between January to July this year on the back of tight supply and healthy demand. The Western European supply squeeze is expected to persist into 2022, with the closure of the Inovyn UK acid plant adding to the tighter balance. Covid-19 remains a risk factor and some turnarounds have been delayed from the 2021 schedule to the first half of 2022. The UK acid import requirement is forecast to remain firm with a strong demand outlook from the water treatment sector, this has repercussions for acid trade flows across and from Europe.

Contract negotiations for the third quarter and the second half of 2021 continued into the start of July in the region. Some settlements were understood to have been reached. Smelter-based acid settlements increased by e15/t but some contract discussions were still ongoing. For six-monthly contracts, increases were forecast to be higher given the steep price rises since the start of the year.

North African prices firmed by $135/t between the start of 2021 and 1 July to $180/t c.fr. This has been driven by strong demand and a tight market balance. Acid trade to Morocco has been strong with imports to the country totalling 717,000 t in the January-April 2021 period, up by 41% on the year. China has led trade to the country and this trend is expected to continue as smelter-based acid supply grows in the forecast. We currently expect Moroccan acid imports to reach 1.9 million t in 2021 but there is potential for levels to exceed 2.0 million tonnes.

On the demand front robust copper prices have been supporting short term operations at mines as well as the potential for new projects to start up. Latin American demand is forecast to remain firm across the metals sectors. Peru and other countries in the region have struggled with rising infection rates despite rolling out vaccines. Brazil is driving demand from new projects, expanding its phosphoric acid output, which will largely be met by captive sulphur-based acid supply from 2022.

In Chile, third quarter contracts were reported concluded by buyers ranging $190-215/t c.fr but figures are expected to vary according to the size of the buyer. BHP reports that negotiations with workers regarding the planned August strike at Escondidos are likely to continue into the first week of August. Glencore is suspending its maintenance at AltoNorte until October. It has been expected to be offline in July for 30 days, taking a potential 124,000 t off the market. Sulphur based acid producer Noracid was heard suspending its August turnaround, but this was unconfirmed by the company.

Vale, a large nickel and sulphuric acid producer, halted operations in June at its Sudbury, Canada operations after workers went on strike. Progress was not heard made by 1 July with off-takers concerned around supply sources. The North American balance is set to remain tight in the near term until the plant returns to production. Prices increased notionally in early July to $190-210/t c.fr in line with other markets but while enquiries continued, trade remained muted.

Chinese smelter acid production is forecast to rise by 5%, or 1.8 million tonnes, in 2021 on a year earlier, but tightness in the copper concentrate market remains a risk. Environmental concerns are also adding uncertainty, with major smelters pledging to reduce concentrate purchases by 8.8% this year. This is because of climate change mitigation strategies, equivalent to 300,000 t of refined metal. Smelters are the leading driver in the short term for capacity growth, with over 6 million t/a of new capacity expected to be added between 2021 and 2022. Prices out of China have been firm and above levels achieved out of Japan/South Korea through the year so far. This was largely because higher liquidity for the spot market from China to test pricing.

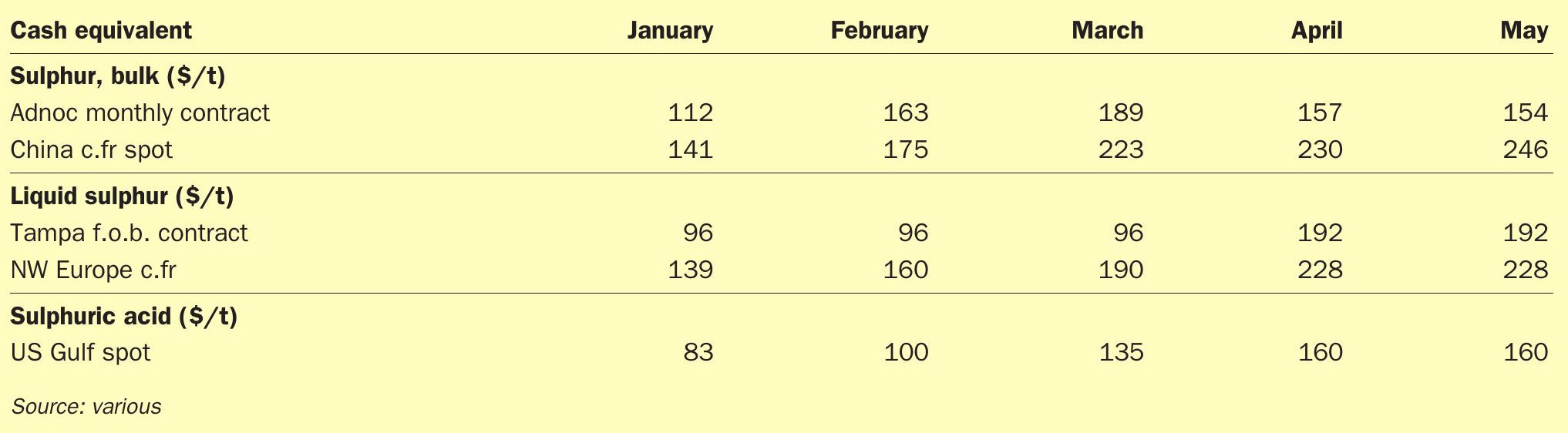

PRICE INDICATIONS