Sulphur 396 Sept-Oct 2021

30 September 2021

China’s sulphur and sulphuric acid industries

CHINA

China’s sulphur and sulphuric acid industries

China is the world’s largest importer of sulphur, mainly to feed domestic phosphate production. Sour gas in Sichuan and new refinery production, coupled with rationalisation in the phosphate sector are all leading to reduced imports, while new smelters are increasing sulphuric acid production and reducing the need for pyrite-based and sulphur burning acid production.

As the foremost industrial nation in the world, China’s various industries, from metal processing to fertilizer to refining and sour gas, have a major impact upon global demand for sulphur and sulphuric acid. China is the largest producer and consumer of sulphuric acid, over one third of the world’s output, as well as the largest importer and consumer of sulphur – although its position as largest importer seems set to be claimed by Morocco this year.

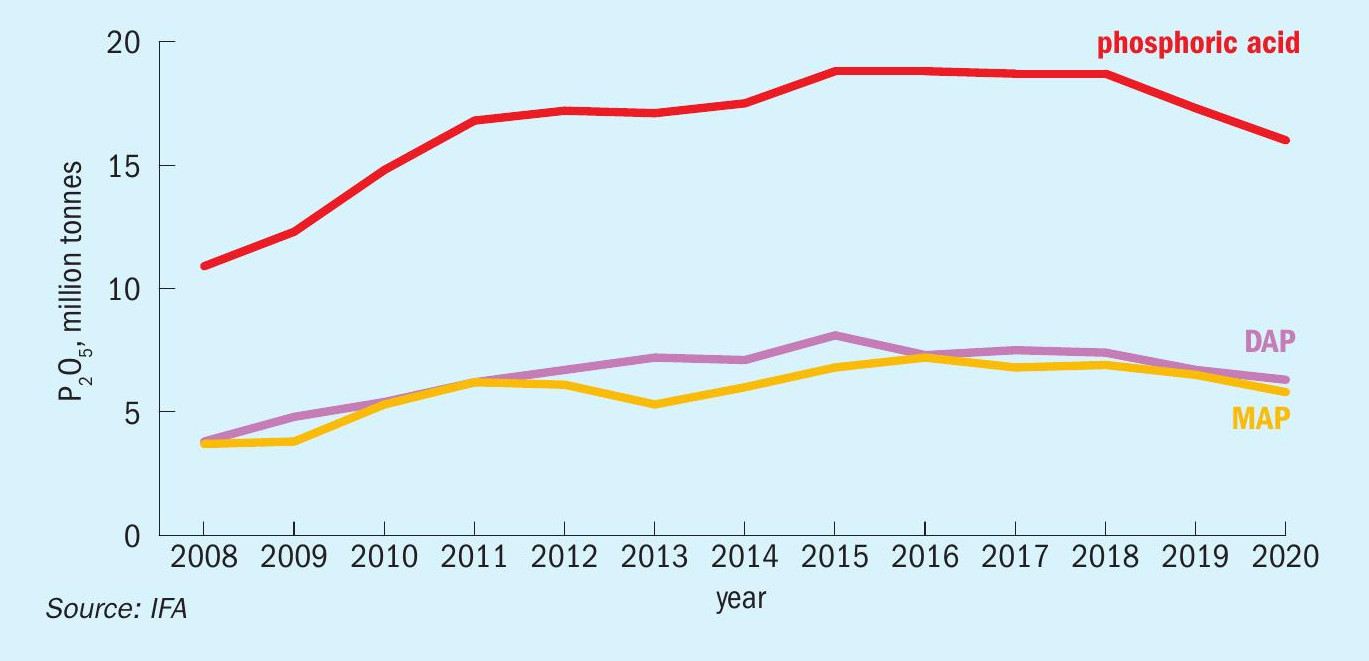

China’s sulphuric acid consumption has traditionally been dominated by its phosphate fertilizer industry. China has the world’s second largest phosphate reserves after Morocco, and has long been a major consumer of phosphate fertilizer to feed its huge population. Around the turn of the century, China was actually one of the largest importers of phosphates, but from 2000 up to 2015 embarked upon a massive expansion of domestic mono- and di-ammonium phosphate (MAP/DAP) capacity, with processed phosphate capacity more than doubling from 2008-2015 (see Figure 1). Indeed, China overbuilt capacity to a considerable degree, and although much was able to find its way onto export markets, much was not, as China faced stiff competition from lower cost capacity in North Africa and the Middle East.

The past five years have seen something of a shakeout in the Chinese phosphate industry, with higher cost, less efficient capacity closing. There have also been two major policy developments; the first an attempt to cap use of fertilizer and prevent over-application and its attendant issues of pollution of water courses, and to encourage more efficient use of fertilizer; and the second to cut back on air and water pollution by closing factories that breach new emissions targets or which were within 1km of the Yangtse River. This has led both to falling domestic consumption of phosphates and a reduction in capacity and production. Chinese DAP consumption peaked in 2013 at 5.6 million t/a P2 O5 , but fell to 3.7 in 2019. MAP consumption reached 6.2 million t/a P2 O5 in 2016, but fell to 5.7 million t/a in 2019. And over the period 2015-17, about 1.8 million t/a of DAP capacity and 2.5 million t/a of MAP capacity (both in terms of tonnes product) was idled, most of it from smaller scale producers.

The coronavirus pandemic posed a further challenge for the Chinese phosphate industry. Hubei province, where the outbreak began and was at its worst, is the centre of the Chinese phosphate industry, with 28% of the country’s production capacity, and covid-related closures meant that Chinese DAP production was down by 12% in 1H 2020 compared to 2019, and MAP production was down 7%. Chinese DAP exports dropped 26% over the same period. At the same time, however, domestic demand held up relatively well, falling only 2.5% over 2020 compared to 2019. Looking forward, however, Chinese fertilizer consumption continues to be on a long-term declining trend as farmers move to more efficient use of nutrient and higher value compound fertilizers. While the rationalisation of MAP/DAP capacity of the past few years has largely passed, and there is new capacity being built, it is likely to be matched by closures elsewhere.

All of this has seen phosphates’ share of sulphuric acid consumption fall, dropping 2.1% to 57% of acid consumption in 2019. At the same time, industrial acid consumption has been increasing, in spite of overcapacity in industries like caprolactam. Titanium dioxide is a major acid consumer, representing 11.4 million t/a of acid demand in 2019, or 28% of industrial demand. Other major industrial consumers are hydrofluoric acid production, animal feed calcium, viscose fibre manufacture and so on. Industrial demand is likely to see the main gains in Chinese acid consumption over the next few years.

Overall Chinese sulphuric acid consumption was 95.2 million t/a in 2019 (100% acid basis), down 0.8% on 2018 and part of a declining trend since 2016 as phosphate capacity was rationalised. Although consumption is projected to rise over the next few years, it will likely only be by a modest amount.

Acid production

At the same time that acid consumption has plateaued, Chinese sulphuric acid capacity has been growing rapidly, mainly due to the rapid expansion of non-ferrous metal smelting. Acid capacity rose by 8.7 million t/a to 124 million t/a in 2019, mostly due to smelter expansions. Smelter acid production capacity stood at 44 million t/a that year (36%), sulphur burning acid capacity 53 million t/a (43%) and there was still a considerable holdover of pyrite roasting acid capacity at 23.5 million t/a (19%).

Geographically, much of China’s sulphuric acid output is concentrated in Hubei and Yunnan provinces, with significant production also in Guizhou, Sichuan, Shandong and Anhui. Yunnan, Hubei, Guizhou and Sichuan are major fertilizer producing regions and capacity there is dominated by sulphur burning plants, while Shandong is a coastal chemical producing region, and Anhui has a lot of smelter capacity.

Actual acid production figures are skewed slightly more favourably towards smelter acid production and against sulphur burning. Chinese acid production in 2019 was 97.4 million t/a, up 0.5%, with smelter acid representing 37.4 million t/a of this (38%), up 7% on 2018’s figure. Rising smelter acid production displaced some sulphur burning output, which fell by 6% to 41.7 million t/a in 2019. Pyrite roasting still accounted for 18.2 million t/a. While pyrite roasting remains in relative decline in the long term, credits from the iron component of iron pyrites, with the metal slag being sold into the steel industry, have kept it afloat through times of lower acid prices.

Acid production has plateaued along with demand, as Figure 2 shows, running just ahead of demand, with exports increasing. In 2019, China exported 2.2 million t/a of sulphuric acid, 70% up on the previous year. Imports were down to 530,000 tonnes, 90% down on 2018, contributing to a net increase in Chinese acid exports by 1.3 million t/a. Major destinations were Morocco, Chile and India, accounting for 80% of all exports between them. Last year saw similar total volumes shipped overseas, with smelter acid taking an increasing share of acid exports.

New smelters

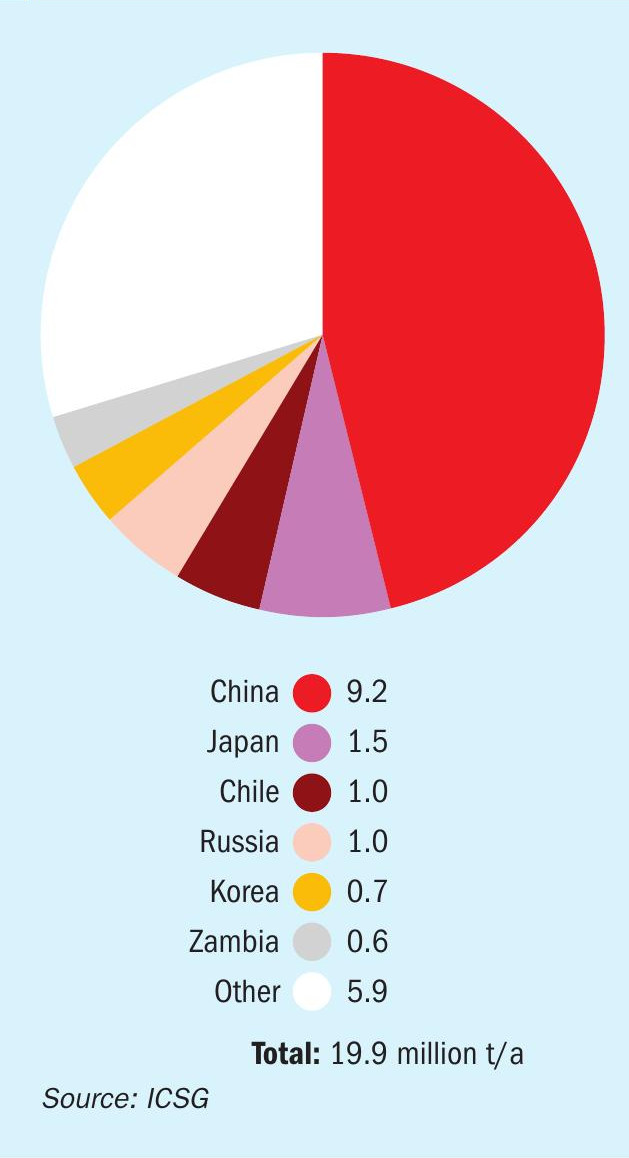

The investment in smelter acid capacity has been based on rapidly increasing copper demand in China. China already represents half of all copper consumption, and its status as the main manufacturing centre for domestic appliances as well as a need for new electric power cabling is driving new demand. Chinese manufacturing has rebounded quickly after a dip caused by the pandemic in early 2020. According to the ICSG, world demand for refined copper was down 9% in 2020 because of the pandemic, but will grow by about 6% in 2021, with China driving much of the increase.

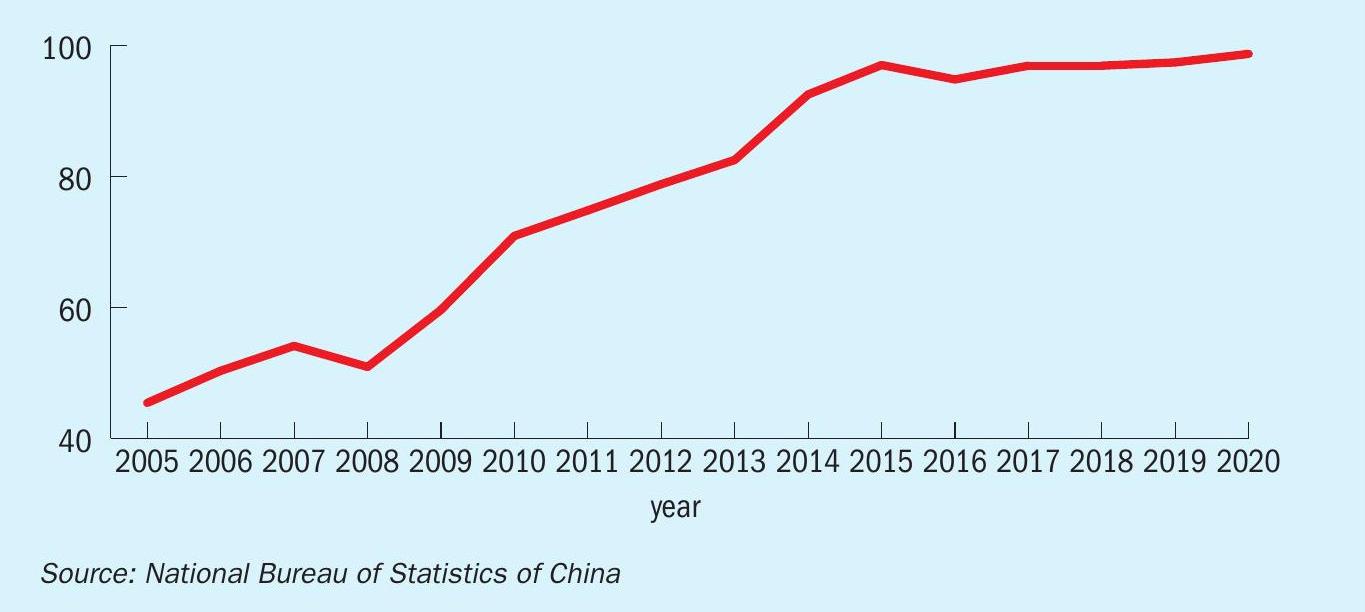

The past three decades have seen a steady increase in Chinese smelter acid capacity, with Asia’s share of world copper smelter output jumping from 27% in 1990 to 65% in 2019 as smelter production in China expanded. Figure 3 shows just how much of the world’s copper smelting capacity has come to be represented by Chinese production.

Last year the China Nonferrous Metals Industry Association estimated that over the period 2019 to 2023, total new Chinese sulphuric acid capacity will total 23.1 million t/a, of which 19.2 million t/a – more than 80% – will be from smelting, mainly in Hubei, Inner Mongolia, Guangxi, Gansu and Shandong provinces. However, there will also be some closures, and CNIA says that it expects smelter output to peak in the period – probably in 2022. The Chinese government is belatedly starting to put smelters under greater scrutiny and aiming to end the “blind expansion” that has characterised the past few years. Here, too, there are tightening emissions targets. In April this year the CNIA set a provisional goal of bringing nonferrous metal carbon emissions to a peak by 2025 and cutting them by 40% by 2040.

While the involuntary nature of smelter acid production means that it tends to be produced provided that metal prices justify it – and global copper prices have increased by 80% over the past eighteen months – overcapacity in the Chinese smelting sector means that there have been some cutbacks and extended maintenance shutdowns which have kept acid volumes slightly lower, and while acid exports have increased, many smelters are not in a position to export acid abroad. However, this has still led to increased acid availability within China, which in turn has had a knock-on effect on sulphur burning and pyrite-based acid production.

Sulphur production

Chinese sulphur production has long been outpaced by sulphur demand for acid production. Over the first two decades of the 21st century, the rapid growth in Chinese sulphur-burning acid capacity to feed the equally large increase in processed phosphates capacity led to a rapid ramp-up in sulphur consumption, and a corresponding increase in imports of sulphur, peaking at 12.2 million t/a in 2016, at which time it represented over one third of all global traded sulphur.

However, domestic sulphur production has been rising. There was an initial spurt over the past decade from sour gas processing, mainly in the south-central Sichuan province, beginning with the large Puguang gas field in 2011, and then followed by Yuanba in 2014 and Chuandongbei in 2016. The developments have not proceeded as fast as Sinopec had anticipated, however, and the Chuandongbei field development has suffered from the exit of joint venture partner Chevron from Phases 2 and 3 of the project in 2020. While sulphur capacity from sour gas processing runs at over 3 million t/a, actual production has been around 2.2 million t/a, although new production is expected from the Zhongjiang gas field in western Sichuan, as well as Chuandongbei Phase 2, potentially adding another 700,000 t/a of sulphur production over the next few years.

There is much more sulphur coming from new refinery capacity in China. Chinese refining capacity rose from 16 million bbl/d to 17.5 million bbl/d in 2020, and is expected to reach 20 million bbl/d in 2025. One of the key developments has been the government’s decision in 2015 to allow China’s small, independent refining sector – the so-called ‘teapots’, which represent about one quarter of refinery capacity, and which were mostly based in the coastal Shandong province – to import crude oil. Teapots typically ran at low utilisation rates and were inefficient and often evaded tax. In return for being allowed to import crude, the government pushed teapots to upgrade, modernise and be more competitive with the state-owned giant operators like Sinopec and PetroChina. The move has boosted operating rates and allowed teapots to invest in new, integrated capacity, leading to an extra 1.4 million bbl/d of capacity among this sector alone.

Refinery sulphur output is therefore on a steadily rising trend, reaching about 4.6 million t/a last year, and projected to reach 6 million t/a by 2024. Taken with rising sour gas production, this is likely to lead to Chinese sulphur production of around 9.3 million t/a by that time. Chinese imports of sulphur have fallen steadily as domestic production increases and demand for sulphur burning acid plants plateaus, reaching 8.4 million t/a in 2020. Although the figure for 2021 may be slightly higher, the longer-term trend remains downwards.