Sulphur 397 Nov-Dec 2021

30 November 2021

Trends in demand for sulphur fertilizers

FERTILIZERS

Trends in demand for sulphur fertilizers

Sulphur is becoming an increasingly important crop nutrient, due to a combination of lower airborne sulphur emissions, the increasing prevalence of high analysis fertilizers, and higher cropping intensities.

Sulphur is present in all crops and plays an important metabolic role. It is essential for the formation of proteins, amino acids, vitamins and enzymes, and is involved in photosynthesis, energy metabolism and carbohydrate production. Sulphur also contributes to the flavour and aroma of crops such as onions and can therefore influence the quality of farm produce. Plant availability of sulphur can also govern its uptake of nitrogen, and hence limit growth. For this reason it is an important plant nutrient; on average the fourth most required soil nutrient after nitrogen, phosphorus and potassium, but much higher for some crops such as oilseed rape.

Farmers, especially in the developed world, were once used to receiving this sulphur for ‘free’, via atmospheric deposition caused by sulphur dioxide pollution. The crackdown on burning sulphur in power plants and road vehicles from the 1980s onwards has reduced this atmospheric deposition to a fraction of its original value, and consequently led to many soils becoming depleted in sulphur.

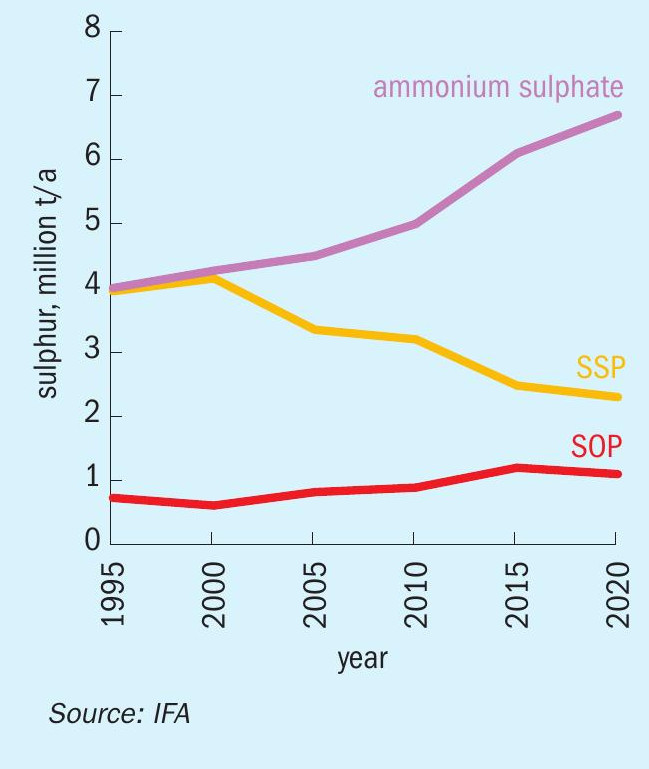

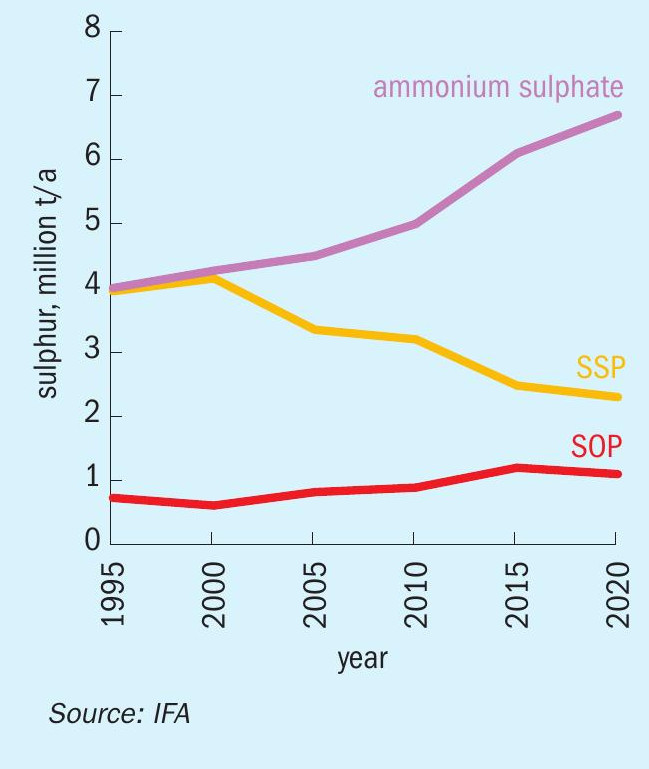

At the same time, use of traditional fertilizers such as ammonium sulphate, single superphosphate and potassium sulphate have decreased, with a preference for higher analysis fertilizers such as urea, diammonium phosphate and potassium chloride. Although as Figure 1 shows, while global use of SSP has declined in absolute terms, use of ammonium sulphate and SOP has actually increased slightly, just nowhere near as much as use of other fertilizer types has.

Sulphur-enhanced fertilizers

These traditional sulphur fertilizers still represent the bulk of plant nutrient sulphur that is delivered to fields as fertilizer; perhaps 70% in 2017 according to figures from the International Fertilizer Association. However, with a growing recognition of the issue of sulphur deficiencies in soils has come a range of new sulphur containing or enhanced fertilizers which incorporate elemental sulphur into higher analysis fertilizers, either within granules or as an external coating. Introducing a liquid sulphur spray to Urea, TSP, MAP or DAP during drum or pan granulation, for example, results in N and P products with a 5-20% elemental sulphur content.

Sulphur-enhanced fertilizers combine nutrient availability with high use-efficiency, and also have good storage and handling properties. The market for sulphur-enhanced NP+S products has developed over the past decade, with particular take-up in the US, Brazil, India and parts of Africa. Shell license a micronized sulphur enhanced product as Thiogro, and this technology is now used to produce sulphur enhanced phosphates. A related technology is used for urea enhanced sulphur, Urea-ES.

Urea can also be coated with elemental sulphur. Sulphur-coated urea combines 77-82% urea (36-38% N) with a 14-20% sulphur coating. IFA estimated the market for sulphur-coated urea to be 900,000 t/a (tonnes product) in 2016, with almost all of this market (ca 95%) in east Asia.

There are also blends. Yara offers two ammonium nitrate/calcium sulphate blends. Mosaic’s MicroEssentials fertilizer range contains 10-15% sulphur in a 50-50 mixed form of both sulphate (for initial availability) and elemental sulphur to keep plants growing throughout the season. EuroChem produces urea ammonium sulphate at its plant at Novomoskovsky Azot, as well as ammonium sulphate nitrate.

Finally, sulphur can be applied in elemental granular form, though it must oxidise to sulphate to become available to the plant. HJ Baker & Bro mix it with 10% bentonite clay to cause the clay to absorb moisture and swell to break up the granule in the ground and assist with its conversion to sulphate.

For the moment, these remain relatively niche products, though their use is growing. Total demand for sulphur as a fertilizer is only about 15 million t/a, compared to over 110 million t/a for nitrogen. Nor does all of that 15 million t/a come from recovered elemental sulphur – SOP is mined as sulphate, and some SSP and AS come from smelter acid used to treat phosphate rock or produce caprolactam respectively, the latter particularly in China. However, the Sulphur Institute estimates that the global requirement for sulphur fertilizer at closer to 24 million t/a S to tackle the increasing sulphur deficiency in soils in order to achieve the kind of crop yields that the world will need in order to sustain a growing population.