Sulphur 398 Jan-Feb 2022

31 January 2022

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

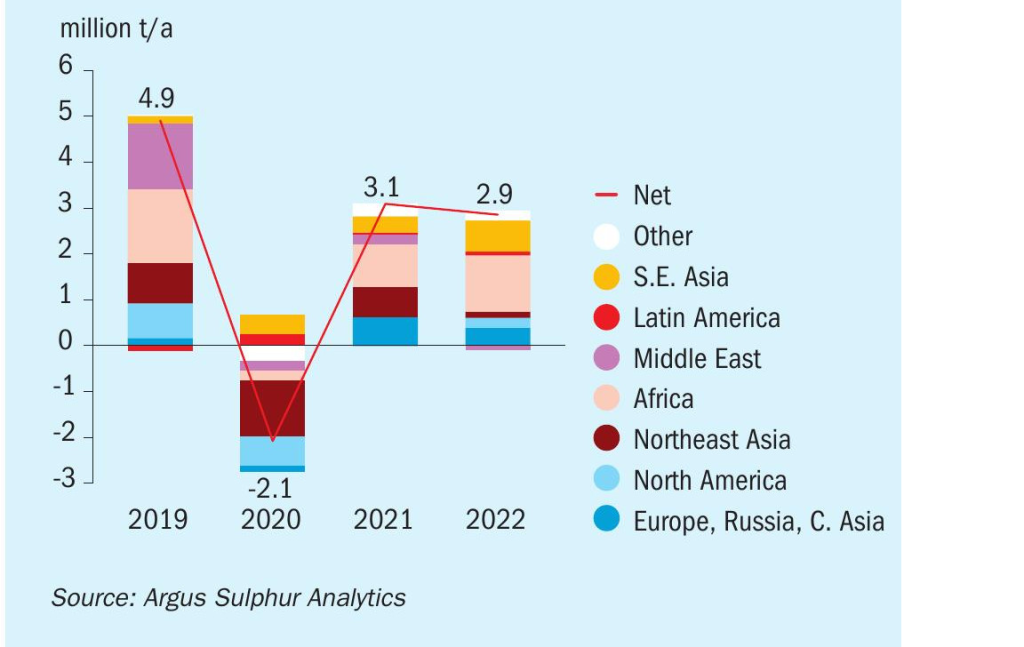

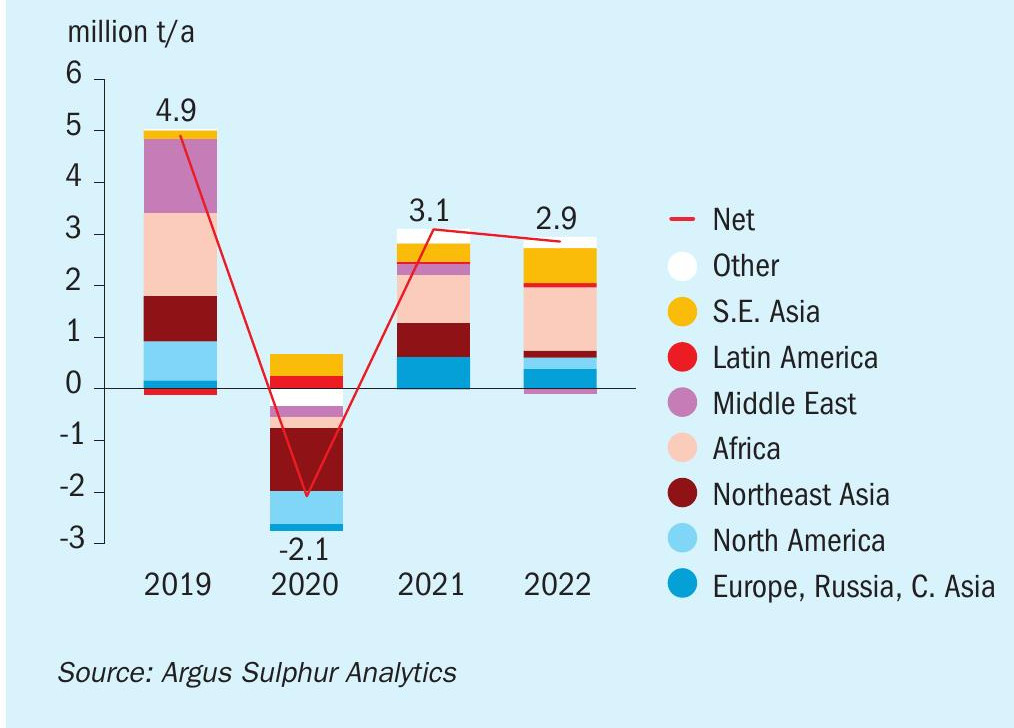

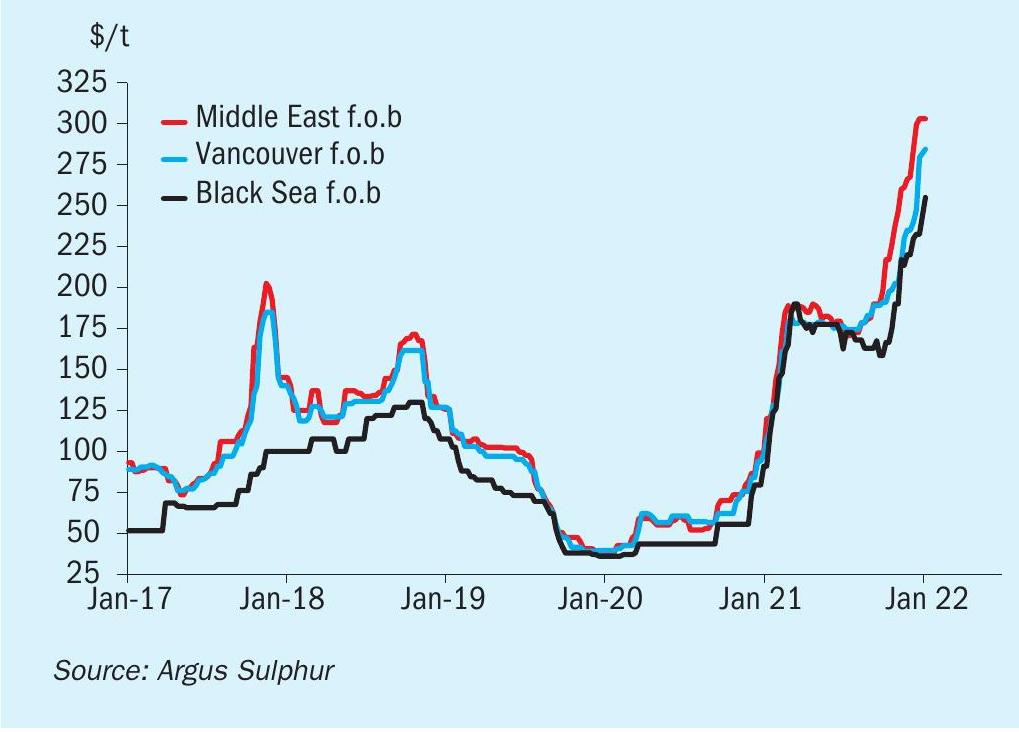

SULPHUR

Global sulphur prices continued to firm through the fourth quarter of 2021 and into the new year, strengthened by firmer processed phosphate fertilizer market prices, heightened demand from major importers and supply constrainers in key regions. The Middle East benchmark breached the $300/t f.o.b. level at the end of December with further increases expected in the short term. The absence of China from the fertilizer export market led to tightness in the DAP market in the fourth quarter. Some DAP prices continued to firm in December, but signs that Chinese exports may resume is increasingly pointing to the potential for a downward correction. This is leading to a more bearish view for sulphur in 2022, although for the short term the trend remains firm, with limited signals of potential softening through January-March. Restricted availability from the Middle East coupled with seasonal delays from the FSU are factors underpinning the firmer trend.

ADNOC set its January official sulphur price for liftings for the Indian market at $300/t f.o.b. Ruwais, up by $35/t from the December prices of $265/t f.o.b. This followed a similar increase between November to December 2021. The Middle East – East Coast India freight rate for a 30,000-35,000t shipment was assessed at $32-33/t at the start of January, implying a delivered price in the low $330s/t c.fr. Kuwait’s state-owned producer KPC also set its January sulphur lifting price at $300/t f.o.b., up by $33/t from the December price. Qatar’s state-controlled Muntajat set its January Qatar sulphur price at $301/t f.o.b. Ras Laffan/ Mesaieed, up by $46/t from the December QSP of $265/t f.o.b. These increases followed the spot tenders in the Middle East attracting bids up to the low/mid-$300s/t f.o.b. at the end of December. Meanwhile 1Q 2022 contracts from the Middle East are understood to have concluded at $275285/t f.o.b., although final confirmations were awaited at the time of writing.

In Kuwait, the $14 billion Clean Fuels Project is complete with sulphur exports expected to increase during 2022 during ramp up. The long delayed 615,000 bbl/d Al-Zour refinery is expected to ramp up in the coming months. Combined the projects will lift sulphur capacity by 2.3 million t/a. Production is not expected to reach these levels in 2022, but Kuwait exports are forecast to rise to around 1.2 million t/a in 2022, exceeding the 1 million t/a mark for the first time. Other significant capacity additions are expected in Saudi Arabia and Qatar. Saudi Aramco’s 400,000 bbl/d complex at Jazan was in final commissioning stages at the end of 2021. The Barzan project is expected to add 800,000 t/a sulphur capacity, with Qatar’s exports increasing in 2022.

Facing uncertainty over long term demand for oil products, Gulf countries are unlikely to approve any further export-oriented refinery projects, bringing an end to more than a decade of rapid expansion. Forecasts by Argus see global oil products demand plateauing by 2030 as the shift towards low-carbon fuels gathers pace.

In China, spot prices were assessed by Argus at $160-345/t c.fr in mid-January, with the high end representing an increase of $40/t on a month earlier. China’s restrictions on exports of fertilizers are in place until mid-2022 but small volumes of processed phosphates have moved from ports. Indications are that there will be a ramp up of Chinese fertilizer exports during the second quarter. Phosphates producers in Hubei province reduced production in mid-January because of maintenance, limited domestic demand and the upcoming lunar new year holidays, with run rates below 50% at plants. Average operating rates were around 55% in Guizhou and 60-65% in Yunnan. There is an expectation that DAP prices will start softening in February-March, after the lunar new year, but this will remain dependent on the export clearances situation. The potential downturn for phosphates implies a softer outlook for sulphur during 2022, with a price correction likely from the second quarter across key benchmarks.

Meanwhile, Morocco is expected to see increased sulphur demand in 2022 with continued ramp-up of phosphoric acid production. Argus forecasts sulphur imports to rise to 7.8 million t/a, with the potential for a more significant increase in the 2023-2024 period. Sulphur contracts for first quarter shipment concluded at the time of writing were reported in a range of $282-319/t c.fr, with some supply remaining under negotiation in mid-January. Spot prices were higher, at $290-323/t c.fr following a firmer sale for a small cargo. Offers for larger volumes from the Middle East and FSU were higher in the $340s/t c.fr and above in the spot market. Longer term Moroccan imports are forecast to rise to over 10 million t/a. The African region is the leading driver for the demand growth this year and in the medium term, forecast to close to 4 million t/a of sulphur consumption between 2021-2025.

SULPHURIC ACID

Global sulphuric acid prices have firmed over the past month in most regions with the tight supply situation alongside healthy demand supporting the short-term outlook. Signs of softening emerged in Pacific markets. The gap has widened between export prices out of northeast Asia compared to the European region. Chinese export prices eased down to $130-140/t f.o.b., according to Argus assessments in mid-January, reflecting an average prices drop of $9/t on a month earlier. The trend has come on the back of the weaker domestic market following the implementation of fertilizer export restrictions in 4Q 2021. Domestic Chinese prices have also been dropping, adding some additional downward pressure to the export price in the short term. Prices from South Korea/Japan were at a similar level to China but have remained broadly stable between December and January, at an average level of $135/t f.o.b. There is potential for further softening in the short term in Asia but other markets are expected to hold firm on tight market balances.

Over in NW Europe, prices have increased by $9/t between December 2021 and January 2022 to an average mid-point assessed by Argus at $231/t in January. This marks a $199/t increase on prices compared with January 2021. The squeeze on supply has not abated in the new year, and this is likely to keep prices elevated through the first quarter of 2022. The focus at the start of the year was on quarterly and half-yearly negotiations for 2022. The region has been plagued with tightness on the back of smelter operating rates being cut, sulphur burner disruption and maintenance turnarounds. Contract prices for sulphur-based acid are expected to see significant increases. A range of euro 50-60/t is argued on the basis of the tight market balance but this remains to be seen.

On the supply front global metals group Nyrstar put its Auby zinc smelter in France on care and maintenance from the first week of January because of high power prices in the country. Operations at Nyrstar’s two other European zinc smelters – Balen in Belgium and Budel in the Netherlands – are continuing at reduced capacity. Nyrstar had made the decision to curtail production by up to 50% back in October 2021 because high energy costs made it no longer economically feasible to operate at full capacity.

The upward pressure on sulphuric acid is likely to continue with Glencore’s Portovesme and Boliden’s Harjavalta not bringing product onto the regional markets. Further restrictions on European supply are on the horizon with maintenance planned at Polish-, Spanish-, German-, and Serbian-based acid producing facilities in the 2Q 2022.

Metals futures markets have been mixed on macro signals and concern about the impact of the Covid-19 Omicron variant. However, nickel prices surged to a new highest level since 2011 on 14th January on a drawdown of stocks. Strong demand from the electric vehicle sector is contributing to the tightness in nickel availability, supporting acid demand in this sector.

Chilean acid markets closed in a range of $234-245/t c.fr Chile in mid-December. Those involved in the negotiations expressed how for 2022 it has taken a lot longer than in previous years. There has been a steep increase of course – the contract settled in a range of $56-62/t c.fr Chile in 2020. But in 2021 the spot price crept up to levels not seen in 12 years, and most expect it will remain elevated through 1H 2022. Chile’s state-controlled miner Codelco has struck labour agreements with the union representing supervisors at its Salvador mine and the unions representing employees at its Chuquicamata mine. The SISPEL Supervisors Union, which represents supervisors at the Salvador mine, approved the new agreement with a vote of 94%. Codelco also reached agreements with the partners of the mining division at the Chuquicamata mine.

Buying activity picked up in South Asia in January but the India price softened down to $170-185/t c.fr in mid-January. The softening came amid reports that consumption has slowed as there was a lack of ammonia available for fertilizer producers and lower prices paid for prompt delivery.

In North America, US acid imports rose to $150-258/t c.fr in mid-January as market participants considered the continued firmness in global sulphur and acid markets along with domestic logistical constraints. Labour shortages from both rail crews and hazmat certified trucking reduced reliability for timely deliveries.

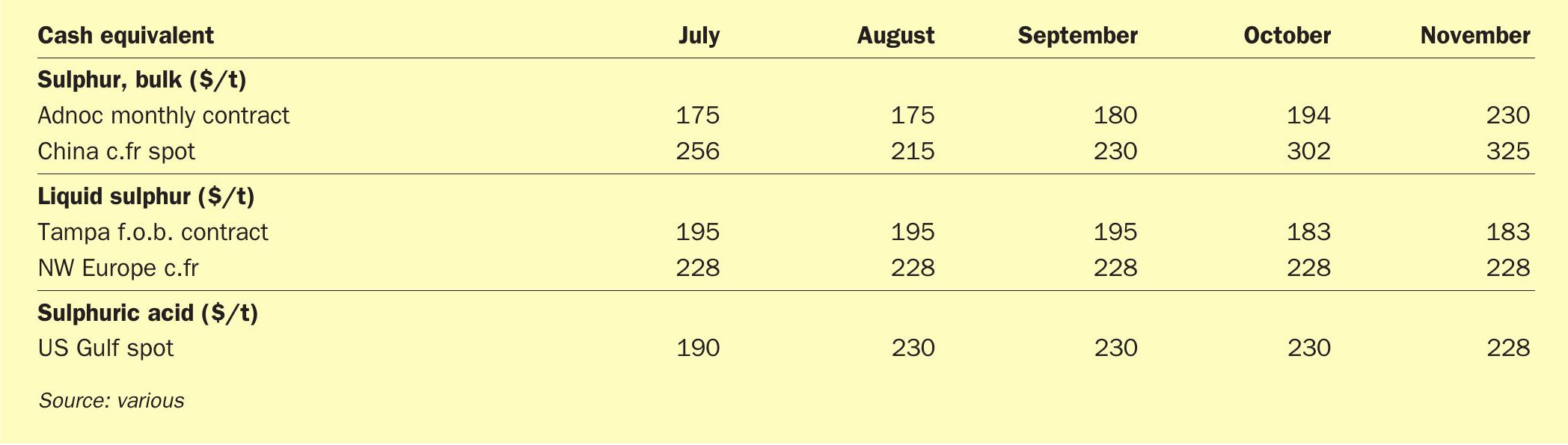

PRICE INDICATIONS