Sulphur 399 Mar-Apr 2022

31 March 2022

Can HPAL supply enough nickel?

NICKEL

Can HPAL supply enough nickel?

A shortages of highly pure nickel is driving major new investment in high pressure acid leaching plants, especially in Indonesia, with a significant impact upon sulphuric acid and sulphur demand.

Sulphuric acid’s greatest use by volume is for extraction of valuable elements from mineral ores. While the phosphate fertilizer industry represents the lion’s share of this, processing of other ores has been a rapidly growing sector over the past few decades. This began with copper leaching via solvent extraction/electrowinning, use of which began in earnest in the 1970s, but which became far more widespread in the 1990s, especially in Chile and Peru. Acid leaching of uranium also increased rapidly at around the same time, especially in Kazakhstan. And nickel leaching of laterite ores – a process commercialised at Moa in Cuba in the 1960s – led to a leap in demand for acid and sulphur from the late 1990s and early 2000s to help feed China’s industrial boom, via the high pressure acid leach (HPAL) process in Australia, Philippines, Madagascar and New Caledonia. Acid demand for HPAL processing rose within a few years to several million t/a.

The end of China’s breakneck industrialisation, the commercialisation of cheaper methods of laterite processing, and technical issues with HPAL production have meant a pause in development over the 2010s, but now there is a new burst of enthusiasm based on demand for nickel sulphate for batteries. But is even the current slate of HPAL projects enough to supply rapidly increasing demand for so-called ‘Class 1’ nickel?

Demand

Nickel demand reached 2.45 million t/a. The primary demand driver is for stainless steel production. Figures from the International Nickel Study Group show that in 2020 just over 70% of nickel went to make stainless steel. Alloy steels and casting, non-ferrous nickel alloys, and nickel electroplating each occupied 7-8% of finished nickel demand. And nickel demand for battery production reached 6% that year and an estimated 8% in 2021. However, this balance is changing rapidly. Stainless steel demand peaked in 2019 and has actually run slightly lower for 2020 and 2021 because of the covid-19 pandemic as people drove less and bought fewer new cars. Battery demand, conversely, is rising rapidly as electric vehicle use gains traction. The quantity of nickel used in the battery sector is growing rapidly, as nickel is used in nickel-cadmium, nickel-metal-hydride, nickel-iron, nickel-zinc, nickel-hydrogen and, increasingly in lithium-ion batteries because of the high energy density of nickel-containing cathodes. This growth is expected to continue with the increasing adoption of high nickel intensity battery chemistries.

Nickel consumption in the batteries sector is forecast to expand to 10% in 2022, driven by the rapid penetration of electric vehicles. In the first 10 months of 2021, total new energy vehicle sales grew by 177% in China compared to the same period for 2020, according to the China Association of Automobile Manufacturers.

A rebound in stainless steel production is also forecast as covid worries fade in the developed world. Global stainless steel production is on track to rise 14% year on year in 2022, with Indonesian production forecast to nearly double, and all major regions seeing double-digit growth.

Sources of nickel

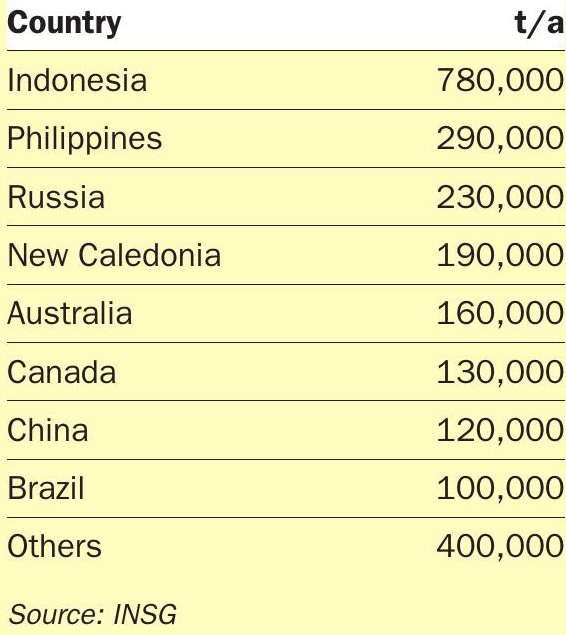

China is the major consumer of nickel, accounting for 59% of the nickel market in 2020, and the country has been the main driver of new nickel demand and production for three decades now. While China is the main consumer, its domestic reserves of nickel are relatively modest, and so it must import it from overseas. The countries with the largest reserves of nickel are Indonesia and Australia, each with about 20 million tonnes, followed by Brazil (11 million tonnes) and Russia (6 million tonnes). But these do not necessarily represent the largest current sources of nickel, which are shown in Table 1.

The reason for this discrepancy is in part due to different nickel ore distribution. Nickel ores broadly exist in two different forms; sulphides, and laterites, which are an oxidised form found mainly in tropical regions. Laterites are the more common form of nickel, representing about 60% of all known deposits, and sulphides only 40%. However, sulphides tend to have higher nickel concentrations and are easier to extract the metal from, so their mining was historically preferred. Processing of nickel laterite ores is more difficult and has come to rely upon two main routes; pyrochemical or acid leaching. Pyrochemical routes are generally cheaper, but the nickel that they produce is often compounded with iron. This is not a problem if the destination for the nickel is stainless steel use, but it means that the nickel cannot be used for demand uses that require high purity nickel. Much of the growth in nickel supply, especially in Indonesia, was used in China to produce so-called ‘nickel pig iron’ (NPI) for steel production. But batteries require so-called Class 1 nickel (>99.8% purity), which pyrochemical processes cannot achieve using nickel laterite ores.

Acid leaching

Acid leaching of nickel is much more difficult than it is for, e.g. copper, because the nickel is more tightly chemically bound to the ore. This means that standard SX/EW routes cannot be used to process nickel. Nickel acid leaching therefore takes one of two forms. The first, heap leaching, is a fairly simple process involving pouring acid over crushed rocks at atmospheric pressure. However, it is a very slow process requiring several passes and can consume very large volumes of acid – up to 60 tonnes per tonne of nickel produced. It also means dealing with large volumes of acidic waste water. For these reasons, commercial nickel heap leaching projects remain few and far between, with one in China and another under development in Brazil.

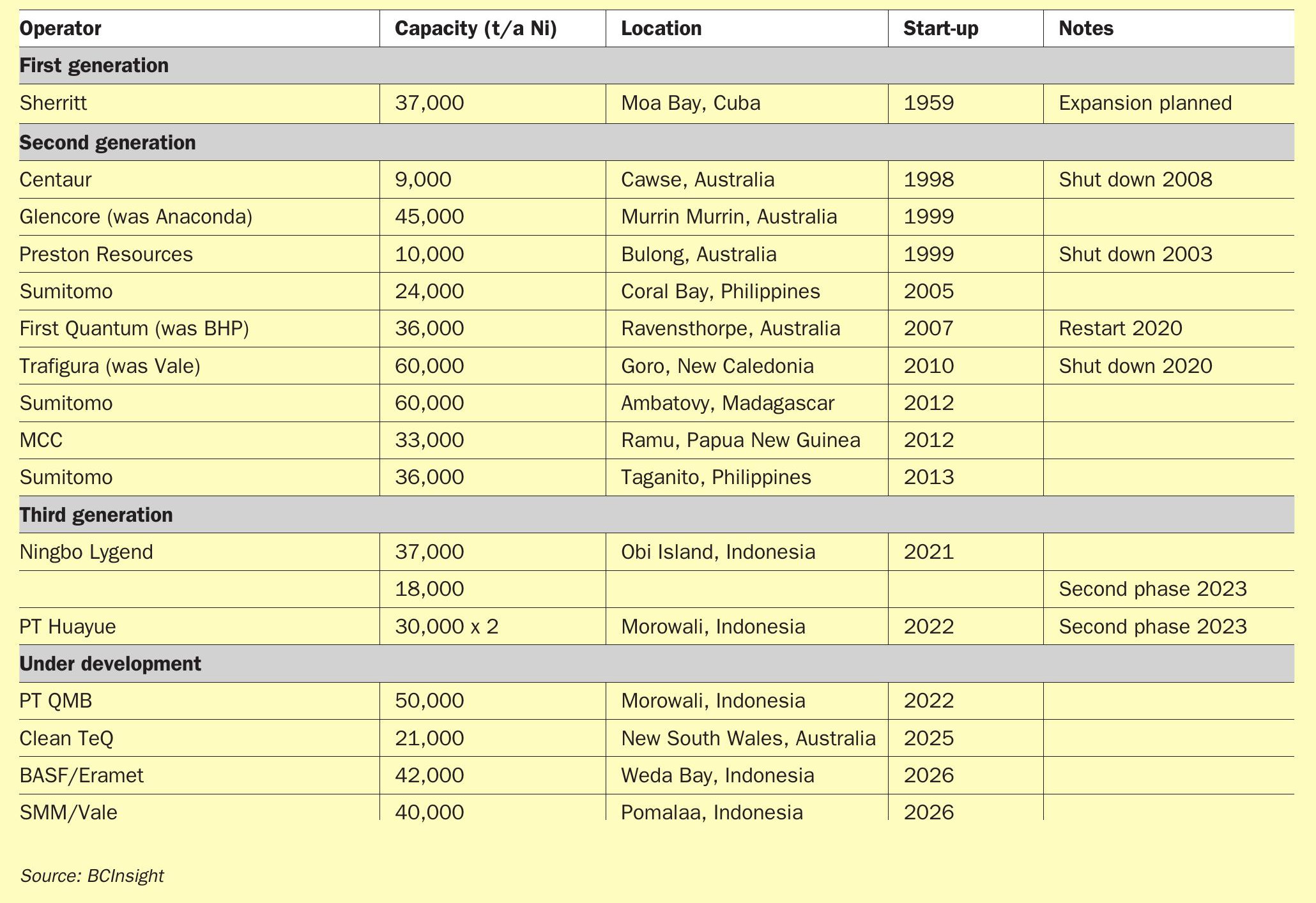

The process can be speeded up and contained by using higher temperatures and pressures. This is the basis of the high pressure acid leach (HPAL) process. However, as any acid producer knows, high pressure and temperature sulphuric acid is ferociously corrosive, and the process uses expensive titanium-clad autoclaves as reaction vessels. The extremely strenuous reaction conditions make HPAL an infamously temperamental process. It can also be very expensive Of the nine HPAL sites that made up the second wave of adoption (see Table 2), over the period 1998-2013, some (e.g. Bulong) were forced to close due to technical issues, and others (Ravensthorpe, Ambatovy) by production costs. Part of the problem was the growth in NPI production, which undercut HPAL for stainless steel use. It is the battery market which has driven the current wave of HPAL projects.

Shortage of Class 1 nickel

The key issue for the nickel market at the moment is the shortage of Class 1 nickel production because of the huge rise in uptake of electric vehicles. Global sales of electric passenger vehicles are projected to surpass 10.5 million units this year, 4 million more than in 2021. By 2030, electric vehicles are expected to occupy 40-50% of global sales for new cars. This will mean that 1.8 million t/a of Class 1 nickel is required for battery production by that time.

This time last year, Elon Musk identified lack of supply of Class 1 nickel as one of the key constraints in expanding the production and use of electric vehicles. Last year, Chinese Tsingshan announced plans to convert NPI into nickel matte which can be further processed into sulphate, but the Bank of America says that it expects tightness in refined Class 1 nickel for 2022, with a deficit of 41,000 tonnes compared with a growing surplus for Class 2 nickel, as NPI. Rystad Energy forecasts that global nickel demand will climb to 3.4 million t/a in 2024 from 2.5 million t/a this year, and suggests that current mines and projects cannot be brought on stream quickly enough to avoid a gap between supply and demand of 200,000 t/a in 2024 and 560,000 t/a in 2026.

Nickel prices

Nickel prices dipped around March-April 2021, but since then have been rising steadily (see Figure 1). Expectations of strong supply growth were not borne out as nickel pig iron operations, particularly in China and Indonesia, did not match supply expectations due to covid-related travel restrictions and power issues. Norilsk also reported lower production, and Vale lowered its production guidance following disruptions and license issues at Onca Puma. Rising power prices also caused some ferronickel producers to halt production. Delays to HPAL projects also contributed to supply being lower than expected, although it still rose by 5.6% year on year according to the INSG. The forecast for 2022 is that delayed projects will finally come onstream, especially among Indonesia NPI producers, and supply will grow by 15%.

In spite of this, the 14% growth in stainless production forecast for this year and 40% increase in electric vehicle demand means that while the deficit in the overall nickel market may be corrected in 2022, the structural tightness in the battery nickel market will continue to support higher prices for Class 1 nickel.

Russia

One of the factors adding fresh pressure to the nickel market right now are the sanctions that have been imposed on Russia in the wake of the invasion of Ukraine. Russia produces 17% of the world’s ‘Class 1’ nickel, required for electric vehicle batteries, from Norilsk Nickel’s huge mines in northern Siberia. With customers in Europe and North America unlikely or unable to buy Russian nickel, the competition for alternative sources is likely to be intense. This has been a major factor in driving nickel prices past $26,000/tonne on the London Metal Exchange, an 11-year high. So far, Norilsk Nickel’s shipments have not been significantly disrupted, according to Bloomberg, though some shippers have declined to transport its nickel and there is reportedly a shortage of containers, but it was early days at time of writing.

From January to November 2021, the majority of Russia’s class 1 nickel products went to China and the Netherlands, which each received 37% of the exports, according to the International Nickel Study Group. Germany received about 16% of Russia’s class 1 nickel exports during the same period.

HPAL projects

The rush for HPAL projects, particularly by Chinese battery makers, has been an attempt to secure supplies of Class 1 nickel to avoid this looming shortage. The initial focus has been on Indonesia, which has a history of tie-ups between Chinese consumers and local nickel producers, especially for nickel pig iron production. When Indonesia banned the export of nickel ore a lot of Chinese NPI production effectively offshored to Indonesia.

HPAL project announcements have come thick and fast. Among the first to start up, in March last year, was Chinese mining firm Ningbo Lygend, which produces mixed (cobalt/nickel) hydroxide precipitates (MHP), including 100,000 t/a of nickel sulphate (35,000 t/a nickel) in the first phase and 160,000 t/a of nickel sulphate in the second phase, as well as 20,000 t/a of cobalt sulphate.

Zhejiang Huayou Cobalt’s Indonesian joint venture shipped its first batch of MHP in February. The joint venture, PT Huayue, set up with Tsingshan Holding Group and China Molybdenum Co, started trial production in end-November, has the capacity to produce 30,000 t/a of nickel and 3,900 t/a of cobalt in the first phase. A second identical phase is due to start up in 2023.

PT QMB New Energy Materials being developed by majority owner Jingmen GEM and Guangdong Brunp, also at the Indonesia Morowali Industrial Park (IMIP). Start-up is due for later this year.

Sumitomo Metal Mining (SMM) said in November last year that construction should begin in 2022 on the Pomalaa nickel project in Indonesia. This would be a partnership with PT Vale Indonesia to build a 40,000 t/a mixed nickel sulphide HPAL plant, with mechanical completion in 2026.

Meanwhile, in Australia, Clean TeQ is aiming to produce an average of 21,300 t/a of nickel and 4,400 t/a of cobalt (as sulphates), as well as scandium oxide and an estimated 50,000 t/a of ammonium sulphate. The $1.4 billion project will include a sulphur burning acid plant to feed the HPAL autoclaves, and will use renewable solar power. Clean TeQ says that the ore body has a low acid consumption compared to other HPAL projects, and at capacity should require 660,000 t/a of sulphuric acid.

BASF and Eramet have initiated a feasibility study on building an HPAL plant at Weda Bay, Indonesia with a base metal refinery at a location to be determined. The HPAL plant would process locally secured mining ore from the Weda Bay deposit to produce a nickel and cobalt intermediate. Projected capacity is 42,000 t/a of nickel and 5,000 t/a of cobalt, with a potential start-up in 2026.

In addition to these, there are a number of other more speculative projects in both Indonesia and Australia which are at the feasibility study stage.

Acid impact

Sulphuric acid consumption in HPAL is around 260-400 kg/tonne of ore processed, depending on the rock grade and reaction conditions, which translates to around 30-40 tonnes of acid per tonne of nickel produced. As Table 2 shows, plants recently finished or currently under construction will add 165,000 t/a of HPAL nickel over the next few years, with another 100,000 t/a of potential additional capacity from 2025-26. In theory, this represents several million t/a of additional sulphuric acid demand, and with most HPAL units likely to work off captive sulphur burning acid plants, perhaps 2-3 million t/a of sulphur demand.

The caveat is of course the difficulty and reliability of the HPAL process. Historically it has required an average of four years to achieve 80% of nameplate capacity for existing HPAL producers, and although some have been considerably faster, Murrin Murrin in Australia took seven years to achieve more than 50% capacity. Even so, this could represent an additional 5 million t/a of acid demand. CRU is forecasting that total acid demand from the battery metals sector could reach 11 million t/a by 2025, double what it was in 2020.

With potential shortfalls looming, nickel prices are forecast to remain high for the next few years, especially for the purest grades, and this should continue to allow HPAL projects to be financed and built, and, indeed, may encourage more new project developments. With electric vehicle uptake to represent around 40% of all new vehicles by 2020, it looks as if this sector of the acid market may be about to take off.