Sulphur 399 Mar-Apr 2022

31 March 2022

Price Trends

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

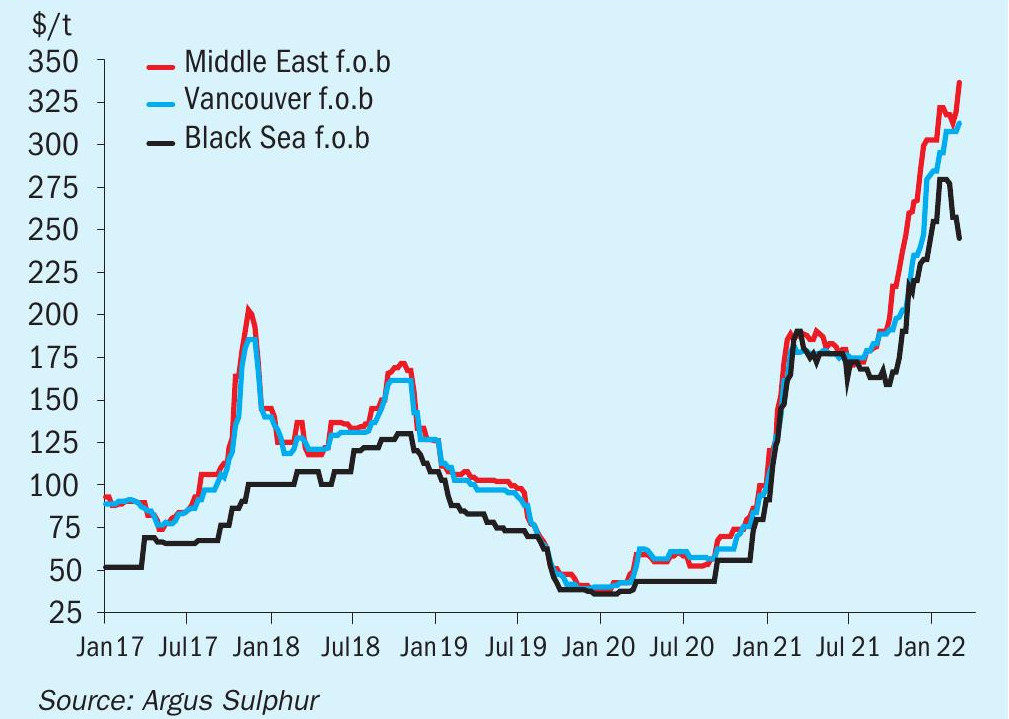

Russia’s invasion of Ukraine has propelled the sulphur and wider commodity markets to new levels of uncertainty. The potential threat of a significant shortage of sulphur availability from the Russian and Central Asian region has led global prices to even higher levels. Middle East prices increased by 8% at the time of writing after two weeks of conflict, up by $22-25/t to a range of $333-340/t f.o.b. on 3 March. This range was expected to see further significant increases in the short term, based on offer prices and market sentiment.

The range of financial and other trade sanctions now imposed on Russia in response to its actions is extensive and unprecedented. At the sanctions’ core has been the exclusion of Russian banks from the Swift international payment system. As the conflict continued a slew of European buyers including Italy’s Eni and Saras, Norway’s Equinor and Finland’s Neste withdrawing from purchases of Russian crude. Shell and BP are also stepping away from new oil contracts or deals with Russian entities.

Adnoc set its March official sulphur price for liftings to the Indian market at $335/t f.o.b. Ruwais, up by $15/t from the February price of $320/t f.o.b. The Middle East – East Coast India freight rate for a 30,00035,000t shipment was assessed at a minimum of $50/t at the start of March, implying a delivered price of $385-387/t c.fr. Kuwait’s KPC set its March sulphur lifting price at $343/t f.o.b., up by $28/t from the February price. Muntajat set the March Qatar sulphur price at $333/t f.o.b. Ras Laffan/Mesaieed, up by $18/t from the February QSP of $315/t f.o.b. These increases came on the back of the rapid rise in spot prices following the shock to the market of the Russian conflict. Climbing bunker prices also lifted freight costs globally, and this is adding support to further increases for delivered sulphur prices.

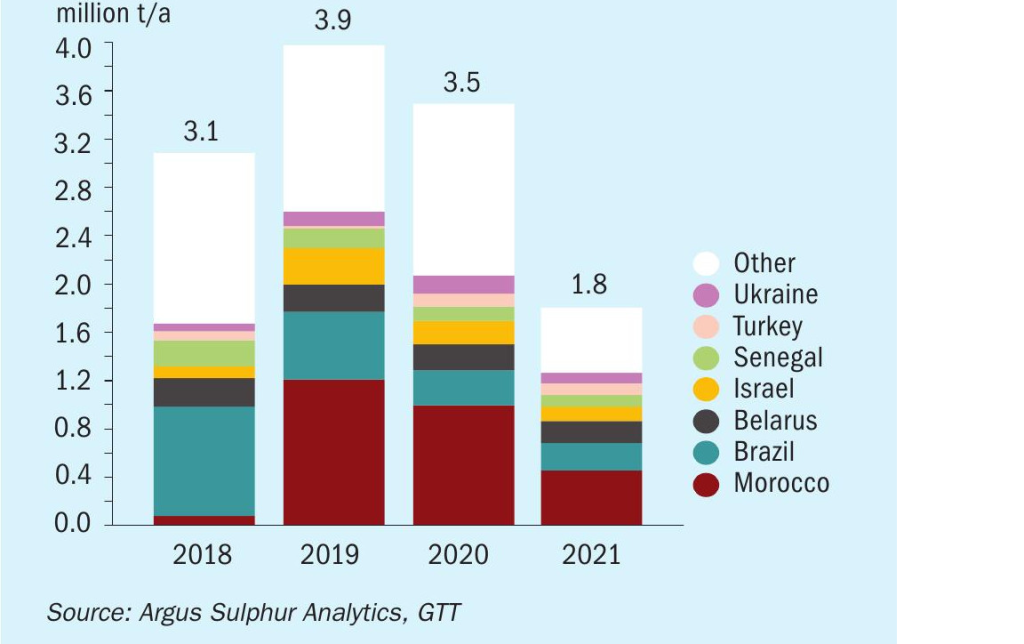

Russian sulphur exports totalled 1.8 million t in 2021, down by 48% on 2020 levels and well below exports in recent history, usually over 3 million t/a. The drop came because of a decrease in production as well as an increase in domestic demand in the processed phosphates sector. The main market for Russian sulphur tonnage in 2021 was Morocco followed by Brazil, together these two markets represented 38% of Russian exports. The two markets would be the most exposed to a drop in trade. For Morocco, Russian supply represented the fourth highest supplier in 2021, or 11% of its total imports, this was a significant decrease on 2020 levels because of the rise of supply from the UAE and Kazakhstan. Over in Brazil, Russian supply represented 8% of its imports while Kazakhstan was its leading supply source at over 800,000t.

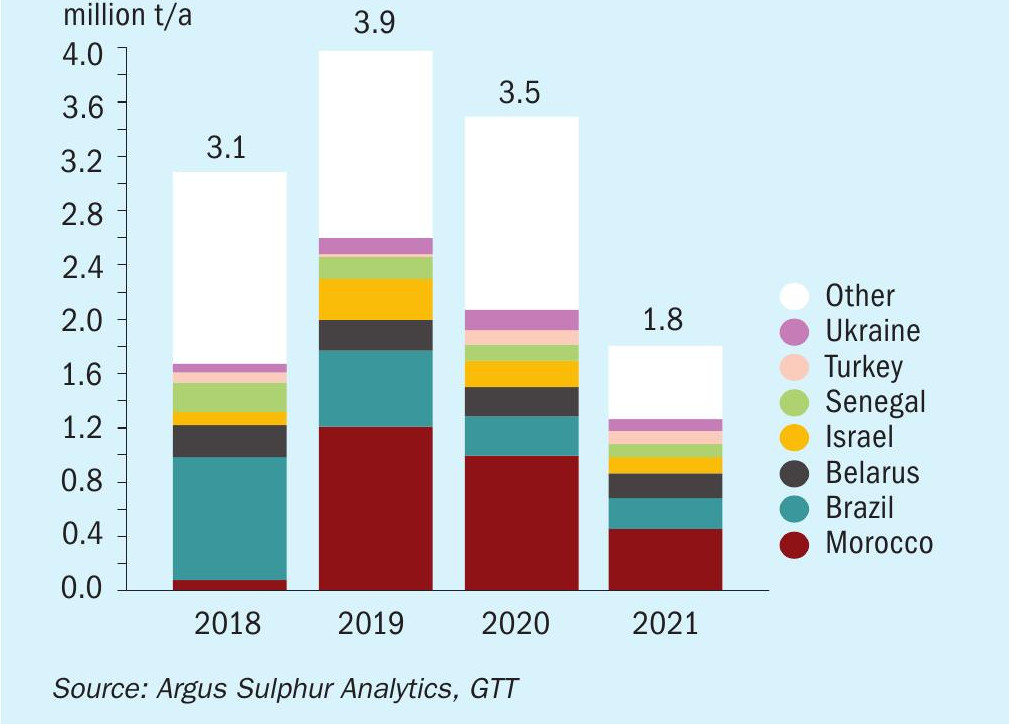

Sulphur supply from Kazakhstan is also at risk because of the conflict. According to trade statistics, Kazakhstan exported 3.9 million t of sulphur in 2021, with 3.6 million t of this going via Russia. Disruption to this trade route would impact numerous markets reliant on these volumes. There is concern around how a shortfall of sulphur from Russia, as well as product in other neighbouring markets that moves via Russian rail, will be met.

There is increasing focus on Middle East sulphur supply growth potential in the short term and whether this would offset potential losses from Russia and Kazakhstan. We expect production in the Middle East to rise by 1.2 million t in 2022 on a year earlier, which falls short of the total export losses from the conflict. Kuwait’s Al Zour was to begin commissioning with a gradual start-up of operations from March. While full sulphur capacity of 600,000 t/a is not expected this year, there is potential to see partial capacity in the months ahead. The Clean Fuels Project in the country is also adding supply this year, with Kuwait’s exports expected to double in 2022. New supply is also expected in Saudi Arabia. Saudi Aramco has been gradually commissioning its newest refinery, a 400,000 bbl/d complex at Jizan. We expect sulphur output to slowly ramp up through 2022-23.

Other factors to consider are on the demand side, with little clarity yet on how the processed phosphates sector will be impacted. Ammonia exports have been affected and this in turn will affect buyers of the raw material in the production of processed phosphates. This raises questions around how sulphur consumption will fare. Prior to the conflict, we had been forecasting global sulphur demand to rise by 2.1 million t in 2022. Around 19% of this was expected to come a rise in phosphoric acid production. Without clarity on how exports of Russian finished fertilizers will be impacted or procurement plans for raw materials in key markets such as Brazil and Morocco it is difficult to assess potential sulphur consumption losses. Meanwhile nickel prices have accelerated to unprecedented levels in the wake of recent events, providing strong support to nickel HPAL projects in markets including Indonesia. Sulphur demand for nickel is expected to rise by around 900,000 t in 2022 to just under 3 million t, supporting trade in this sector.

SULPHURIC ACID

Global sulphuric acid prices have been more stable since the start of the year with some ranges easing slightly. There is concern in the market over the implications of military action taken by Russia although the acid market is not exposed in the same way as sulphur because acid is largely produced for captive use in the country.

The NW European export benchmark increased at the start of the year but has since remained stable at an average price of $235/t f.o.b. The elevated price has been underpinned by the tight supply fundamentals and the upcoming turnaround schedule at European smelters was expected to keep the market tight through the first half of 2022. Supply losses from planned maintenances at smelters and sulphur burners are expected to total over 700,000t, with some plants yet to disclose full timescales for shutdowns. The distribution of sulphuric acid was also hampered through much of 2021. Issues remained in getting barged acid on to trucks at the start of the year, because of the shortage of truck drivers in Europe. First quarter contract prices for sulphur-based acid were settled at an increase of e50-70/t on 4Q 2021 levels, bringing the range to e173220/t c.fr. This is a e53/t premium to the NW Europe smelter grade contract price. More recently high energy prices have led some end users of acid plants to lower production in Europe and there is some concern on the supplier side around demand in the region.

The tightness in the copper concentrate market was expected to somewhat relax in 2022, buoyed by higher copper prices and increased Covid-19 vaccination rates, allowing healthier staffing at mines. This is expected to lead to an increase in smelter-acid production in China through the year. Strengthening domestic demand in March limited available acid for the export market but an uptick in supply through the is expected to lead to higher export volumes. The China export price was assessed by Argus at $125-135/t f.o.b. on 10 March, the same level as the Japan/South Korea price. This represents around a $100/t gap with the European export price because of differing fundamentals. This gap is expected to close once the European supply balance improves, but this is unlikely during 2022.

Base metals prices on the London Metal Exchange (LME) have been mixed amid recent volatility. Nickel prices were suspended after unprecedented increases in the benchmark prices, which surged above $100,000/t, led the exchange to put trading of the metal on hold. Copper prices on the LME also firmed to over $10,000/t with a large drawdown of copper inventories in the LME warehouse system supported prices. Stocks were already tight prior to the decline. Higher metals prices support sulphuric acid consumption at mining operations. There is some concern over acid consumption in Chile as the newly elected Chilean-government took a first step towards its promise of nationalising metals mines in a motion passed on 5 March. The environmental committee of Chile’s constituent assembly, which is in charge of writing the country’s new constitution, approved an early proposal targeting large scale copper, lithium and gold mines by 13 votes to 3. Chile consumed 8.7 million t of acid in 2021 and imported 2.9 million t. The Chilean price was assessed by Argus at $235-245/t c.fr. on 10 March with the market in flux. Buyers had been expected lower prices after the second quarter but higher freights and bunkers and a tighter supply stream from Asia may push prices higher.

Buyers in India adopted a wait and see approach in mid-March following the increase in prices to $165-175/t c.fr. on higher freight and tender awards. Fertilizer producer Iffco has a planned 3-week turnaround at its Paradip plant in March. Sulphuric acid demand was expected to be strong in 2022, supporting the outlook for strong imports from the country. The Indian government raised the budget allocated to fertilizer subsidies for the 2022-23 financial year, doubling funds for phosphates-based fertilizers. The drawdown of finished fertilizer stocks is a scenario that suppliers will be keen to avoid following the issues this caused last year. But the ammonia supply disruptions has raised questions for the phosphate industry and in turn sulphuric acid demand is likely to fluctuate.

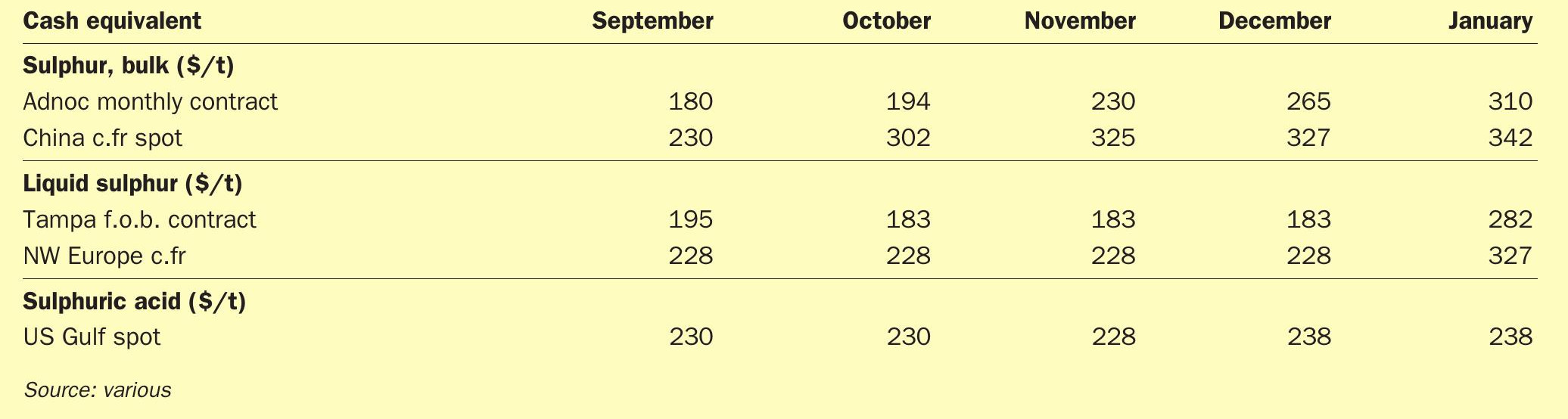

Price Indications