Sulphur 400 May-Jun 2022

31 May 2022

Price Trends

SULPHUR

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

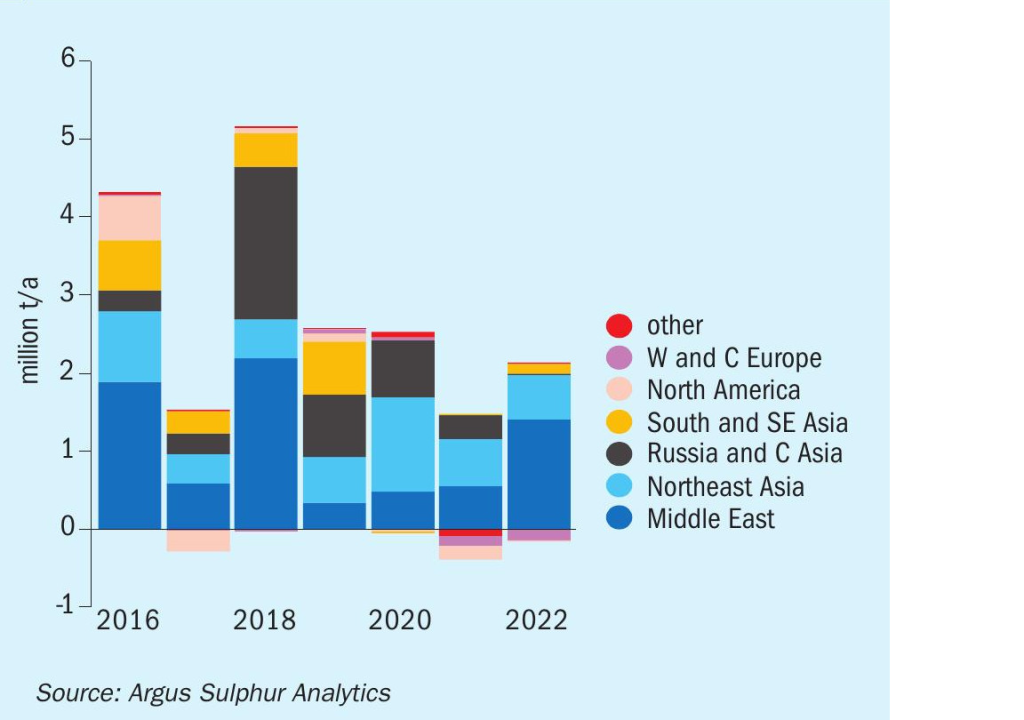

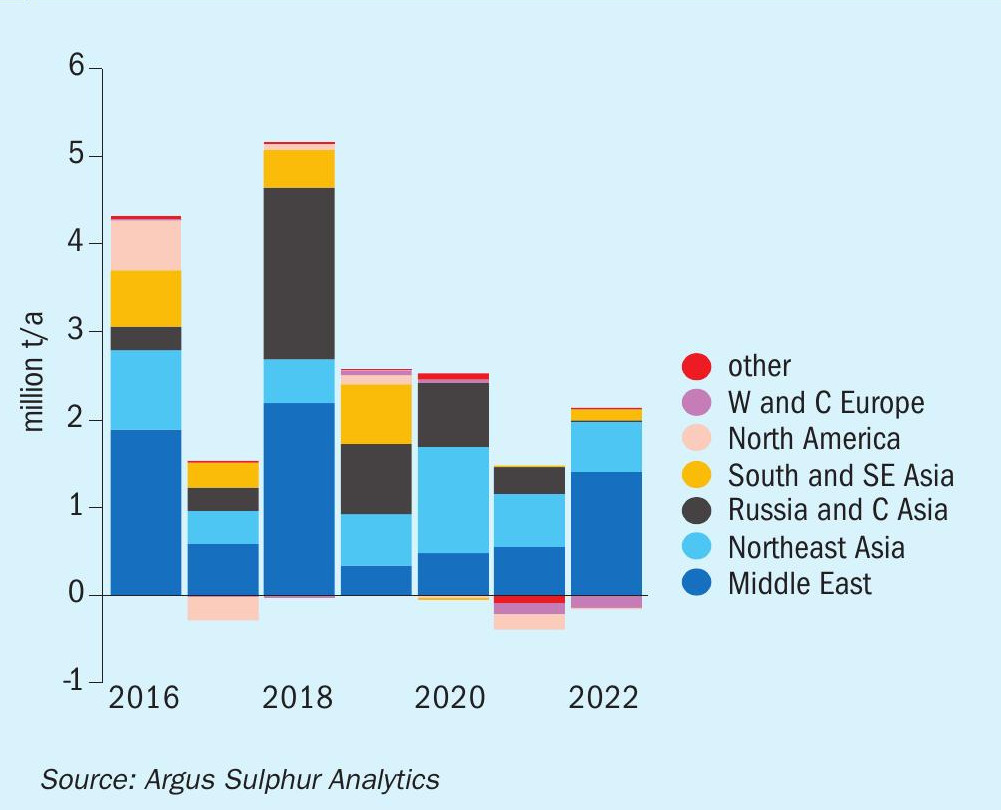

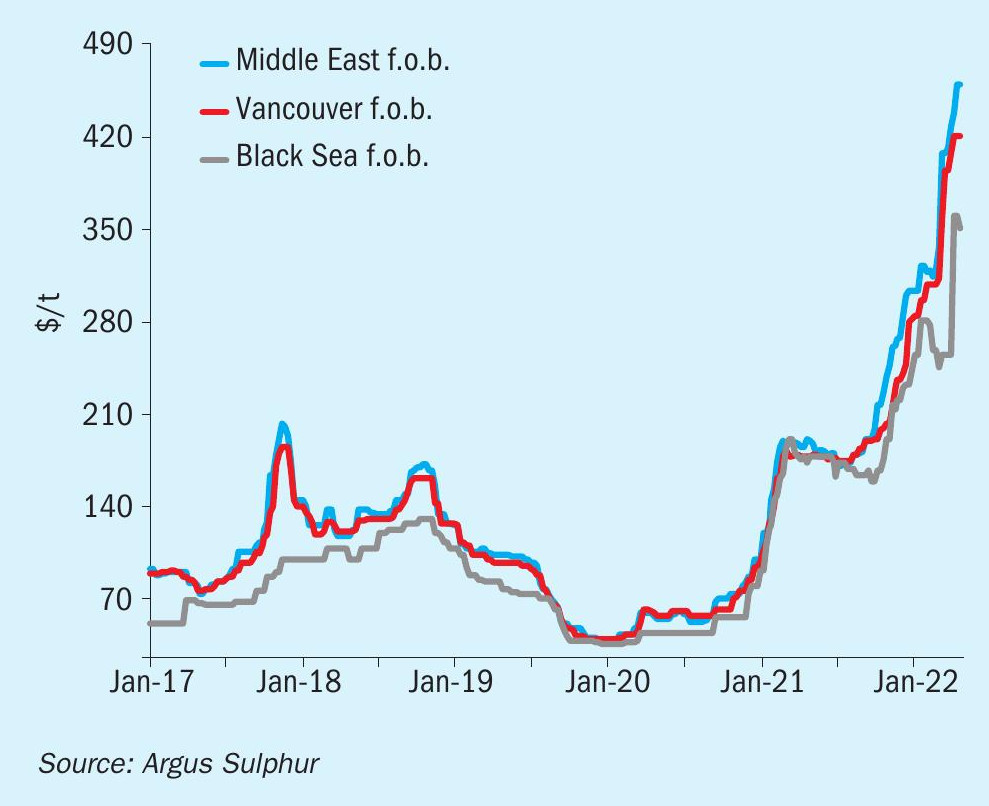

The global sulphur market has continued to firm, with key benchmark prices at elevated levels not seen since 2008. Lower liquidity emerged in April, with some buyers operating on a hand-to-mouth basis. The latest round of economic and financial sanctions in the wake of the Russia-Ukraine conflict has made financing arrangements more challenging. Further price increases are expected through May, particularly while sulphur from Russia and in some cases nearby markets explore alternate transport routes. The tight balance is expected through the remainder of the first half of 2022 before easing with the potential for a price correction increasingly likely as the market grapples with the ongoing conflict.

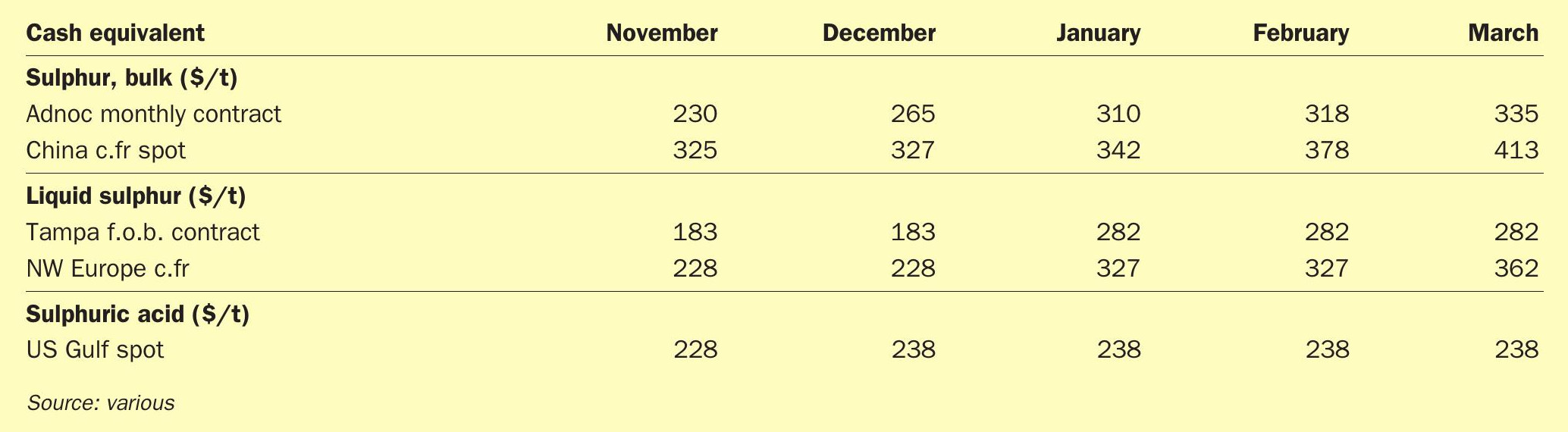

The Brazil c.fr price has risen to $510520/t, the highest level on Argus’ records, and other benchmarks are expected to increase to similar levels in the short term. A lack of available vessels because of self-sanctioning, steep insurance premiums and rising freight costs continue to hamper supply from the Black and Baltic seas. As international buyers continue to seek alternative supply to Russian product, sourcing from the Middle East and North America has supported increased export prices in these regions. The Middle East spot range increased to $454-464/t f.o.b. in April and is expected to rise further in the outlook. The benchmark has risen by 53% since the turn of the year. The range for Middle East contract supply for second-quarter delivery was concluded at $380-405/t f.o.b. Middle East to end-users and trading firms, a $105-120/t rise on the first quarter.

Adnoc set its April official sulphur price for liftings to the Indian market at $420/t f.o.b. Ruwais, up by $85/t from the March price. Kuwait’s K% set its April sulphur lifting price at $435/t f.o.b., up by $92/t from the March price. Muntajat set the April Qatar sulphur price at $430/t f.o.b. Ras Laffan/Mesaieed, up by $97/t from the March QSP of $333/t f.o.b. These increases came largely as a response to the bottlenecks to Russian supply seen since the start of the conflict.

There is still an appetite among some non-OECD countries to procure Russian sulphur, with product that has become available as a result of self-sanctioning by buyers – and attracting higher logistics costs and risks – being priced at the lower end of the global range. Should the financial, legal and logistical framework be in place, then a two-tier pricing structure for sulphur will continue to develop. No Turkmen sulphur was delivered by rail to Kavkaz in the first quarter, and transport along the Volga-Don canal was yet to restart at time of writing. Turkmen product has continued to be loaded at Poti, Georgia, under lower freight costs relative to other Black Sea ports, but delays to loading persist as a result of inland bottlenecks.

The IEA has cut its global oil demand growth forecast for this year following Covid19 lockdowns in China. Shanghai has partially loosened its Covid-19 quarantine policies after implementing a city-wide lockdown from 1 April, as the government pushes ahead with its economic growth plans. The city is home to the world’s largest and busiest container port, which is subject to delays owing to logistical bottlenecks. This is creating disruption across global supply chains that are already under severe stress. The Chinese economy is the biggest single driver of global growth, and slashed forecasts will ratchet up the problems associated with rising inflation and economic stagnation in the country.

Metals-based demand for sulphur is providing support for prices to firm further as margins are boosted by rising commodity prices. At present, demand is deemed sufficient to maintain pricing at historically elevated levels and is likely to prevent a significant downturn in the second quarter. But the balance between the cost of sulphur feedstock and the revenue generated from goods sold is becoming a delicate one. This is evident in the industrial sector in western Europe, where demand erosion is becoming a real possibility. Manufacturers of caprolactam/ammonium sulphate, which use sulphur or sulphuric acid in their production processes, have struggled to pass on elevated costs to consumers. This has forced many sulphur users to reduce operating rates.

Developments in the processed phosphates sector underpin our view for sulphur price changes through the rest of 2022. We forecast a softening by June as export restrictions on Chinese fertilizers come to an end. The rate of softening will increase through the third quarter as demand erosion and normalised exports from China alleviate the supply concerns that have persisted since the fourth quarter. The introduction of new Middle Eastern sulphur capacity during the second half of the year will likely add to the softening trend, but the extent of the price reduction will be driven by the pace at which fresh Middle East supply will enter the market. The key projects impacting this balance are in Qatar, Saudi Arabia and Kuwait.

SULPHURIC ACID

The global sulphuric acid market has continued on a more stable footing compared to sulphur, albeit with prices stabilising at high levels in recent months. The NW European export benchmark has broadened slightly with the average price easing by $5/t to a mid-point of $230/t f.o.b in April. The benchmark has increased by 132% over the past year and has reached unprecedented levels since 2021. The tight supply/demand balance in the region has provided the support for prices to remain at a premium compared to export prices in other regions.

Direct impact from the Russia-Ukraine conflict remains limited but associated markets continue to be affected. NW European contracts for the second quarter settled in a range of e203-260/t c.fr for sulphur-based supply, representing an increase on the first quarter. The smelter price for second quarter contracts increased in a range of e20-30/t to e146-191/t c.fr. Tight molten sulphur supply fundamentals continue to drive the local market fundamentals. Logistics in the region is hampering the short-term outlook. There has been a shortage of truck drivers on the continent since the start of the conflict in Russia/Ukraine. The increase in fuel prices has led to some sellers adding surcharges to deliveries. The Stolberg smelter in Germany had been expected to return to operations in the Spring but this has now been delayed to the summer. With heavy reliance on trucked transport at the plant concern is growing that there will be difficulty procuring trucks.

Meanwhile the Grillo Werke facility returned to operation following its maintenance in mid-April. The upcoming Aurubis Hamburg smelter maintenance is scheduled to last for 90 days. Contract commitments are expected to be covered during this period. On the buy-side there has been some demand destruction noted in NW Europe across both the fertilizer and non-fertilizer markets.

Over in Chile, acid shipments from Asia led to higher delivered prices at $280-285/t c.fr in mid-April, representing an increase of around $24/t on a month earlier. Spot demand is expected to increase for arrivals in the second half of the year. Some buyers took short positions for contract tonnage and will likely return to the market for spot volumes. Concern remains in the market following industrial action in Peru and Chile leading to supply worries. Congestion is likely at ports because of delays to cargoes and potentially arriving close together. Imports of acid in January-February 2022 totalled 514,000t, up by 25% on a year earlier. China was the leading supplier at 200,000t of supply.

In North America, Rio Tinto reached a new collective bargaining agreement with Kennecott union workers at the end of March, averting a potential stoppage. The agreement lasts five years from April, was reached after seven weeks of negotiations. The unions involved represent about 1,300 of the more than 2,000 employees at the Kennecott copper mine operations near Salt Lake, Utah. The smelter has the capacity to produce around 1million t/a sulphuric acid. The domestic US market has been tight on the back of logistical challenges and plant turnarounds. Rising demand from the fertilizer sector has emerged ahead of the spring application season. Trucking and rail transport have seen delays with reports of difficulty in procuring trucks for spot volumes.

China remains a key acid exporter but the rise in Covid-19 cases has led to logistical challenges in transporting acid. Chinese exports are expected to rise in 2022 on 2021 levels, but short-term disruption may hamper availability. Prices in April were stable at $135-150/t f.o.b., with the high end $10/t above the Japan/South Korea export range. South Korean acid exports dropped in March, down by 26% on a year earlier to 182,000t, with fewer delivered to Chile, China and southeast Asia.

The short-term outlook is bullish because of rallying freight rates and strong demand from industries including metals. Short term supply is expected to be disrupted, likely leading to higher prices for spot out of Asia. The second half of the year is likely to see stretched spot demand, but much will hinge on when Chinese supply will rise for the export market.

Price Indications