Sulphur 401 Jul-Aug 2022

31 July 2022

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

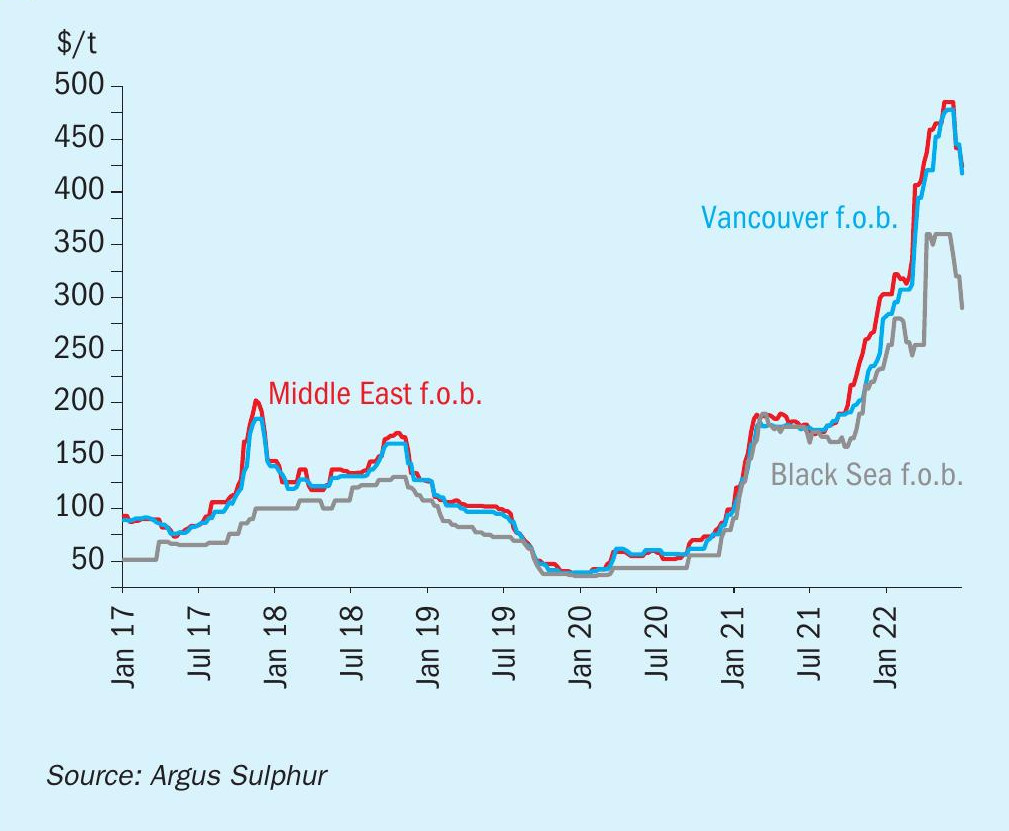

SULPHUR

The global sulphur market has reached a peak and started to correct following an 18-month long bull run. This peak has come on the culmination of a number of factors. Prior to the start of the conflict in Russia and Ukraine, the sulphur market appeared to already be close to reaching a peak, with a softer sentiment emerging in the downstream phosphate fertilizer market. But fears over potential disruption to supply from the Russia and Central Asian region led to another spike in pricing, beyond previous expectations. In the months that followed, sulphur originating from Kazakhstan has continued to be transported via Russian rail to ports for the export market, with the disruption that had been expected not emerging. Russian sulphur exports have been disrupted, but previously agreed shipments to key markets continued through the first half of the year. At the same time, demand side fundamentals led to a slowdown in consumption, and this has impacted import demand. With significant downward pressure from the DAP market which turned to a bearish sentiment, sulphur prices began correcting in June. Expectations for further softening in DAP prices will likely lead sulphur prices to further decreases albeit at a slower rate.

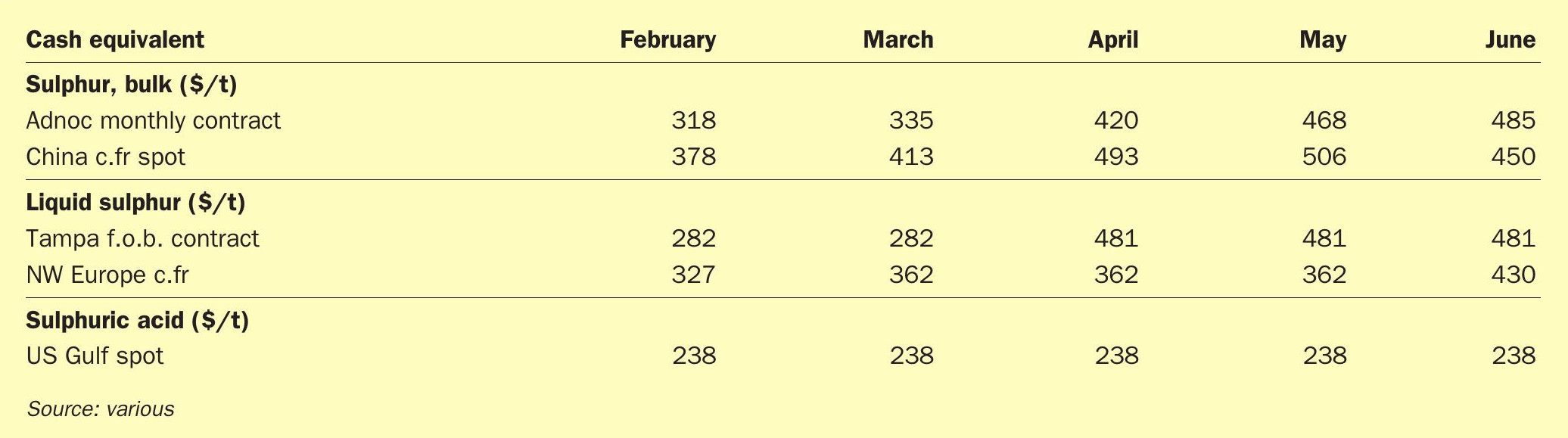

Middle East prices decreased by around $60/t through June but prices at the end of the month were still around $121/t above prices at the start of the year and more than $200/t higher than a year earlier. Kuwait’s KPC set its July sulphur lifting price at $427/t f.o.b., down by $63/t from the June price. Muntajat set its July Qatar sulphur price at $428/t f.o.b. Ras Laffan/Mesaieed, down by $62/t from the June QSP of $490/t f.o.b. These decreases have come on the back of the lack of appetite from buyers in key markets and the weakening fertilizer market. In June, Adnoc/UAE was in negotiations for supply for the third quarter. Market sources quoted a $420/t f.o.b. Ruwais price for the third quarter concluded with some traders and end users. The July price had not been announced at the time of writing.

Third quarter contract negotiations for north Africa were under way in June for supply from the Middle East, Kazakhstan via the Baltic and Black seas and Turkmenistan. Key consumer OCP has been absent from the spot market in the run-up to the third quarter contract settlements, in line with the seasonal trend. In Egypt, market participants reported small cargoes arriving from Russia placed some downward pressure on the north African price.

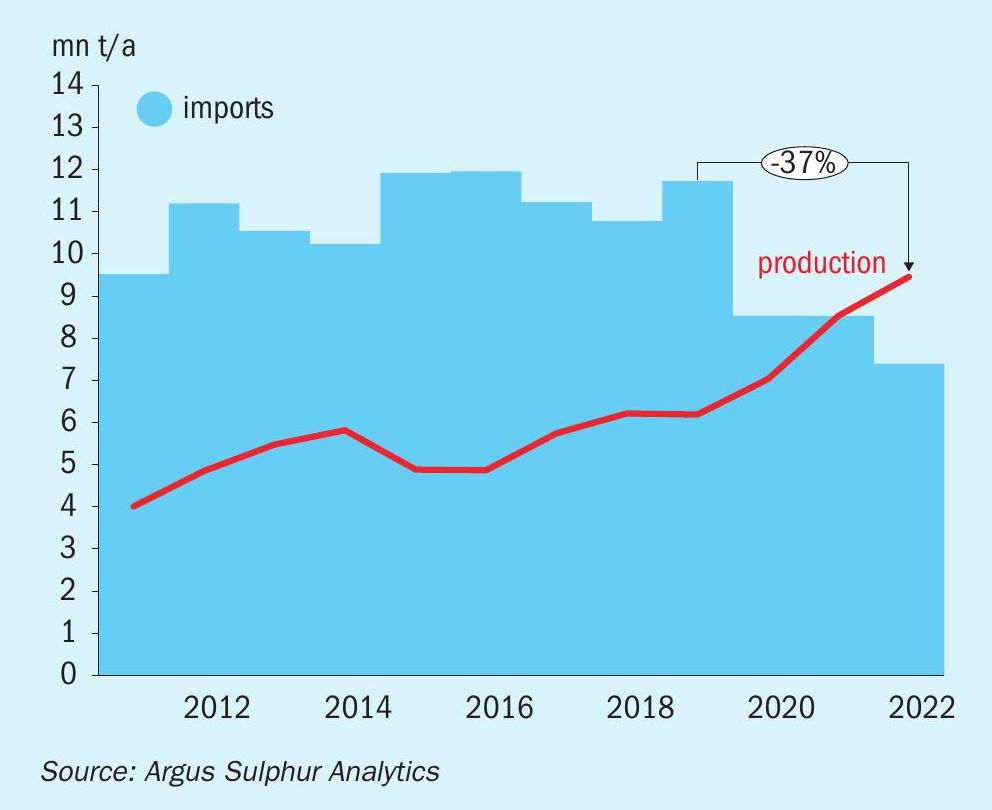

The China c.fr all forms range was assessed by Argus at $230-450/t c.fr at the end of June, with the low end reflecting molten product and the high end granular sulphur. Average prices dropped by around $63/t through the month of June but were around $100/t higher than at the start of 2021. Chinese imports dropped in January-May by 12% year on year to 3.2 million tonnes. South Korea and Japan were the leading suppliers in the first five months of the year. This marks a reversal in trend as Saudi Arabia, the UAE and Qatar have typically been the main suppliers. Sulphur imports from these three countries combined totalled 797,000t, down by 48% on the year. High sulphur prices are likely to have contributed to this shift, with molten sulphur prices being more attractive.

Other factors are the healthy rates of domestic production from the refining sector and the slowdown in the demand from the phosphates industry amid export restrictions. The Chinese benchmark is expected to fall further, in line with the global trend, during the second half of the year. The restrictions on phosphate fertilizer exports are a key factor for the forward view for import demand. But the continued increase in sulphur production in the domestic market will also put downward pressure on imports for the year. We currently expect Chinese imports to drop down to 7.4 million tonnes in 2022, this would reflect a drop of 1.1 million tonnes, or 13%, on 2021 levels.

In capacity news, Chinese private-sector Shenghong Petrochemical started trial operations at its greenfield Lianyungang refinery, targeting commercial production late in the third quarter of this year when it will also be able to produce 420,000 t/a of sulphur. The refinery, located in Lianyungang, was previously expected to come on stream in March. But the start date was delayed as crude futures spiked to multi-year highs, preventing the refinery from building sufficient crude stocks for long-term operations.

Other capacity changes are concentrated in the Middle East region for the short term, with an additional 1.4 million tonnes of capacity expected online in 2022. Saudi Arabia, Kuwait and Qatar are all expected to ramp up projects, although available volumes for the market will likely be well below capacity rates. But the forward view remains a growth story for exports out of the region as oil and gas-based projects come to fruition at last.

SULPHURIC ACID

The global sulphuric acid market has been more stable on the pricing front compared to sulphur, but there has been a recent shift in market tone to bearish. Major export prices for sulphuric eased through June. NW European prices dropped by $5/t down to $210/t f.o.b. at the end of the month. This is around $18/t below levels at the start of 2021 but still $75/t above prices a year ago. There are still planned turnarounds at smelters in the second half of 2022 that will impact the market balance, potentially limiting the extent of further price softening. Umicore’s Hoboken smelter in Belgium has a planned maintenance in November, lasting five weeks. Nyrstar also has a planned maintenance in the summer at its Auby, France smelter, lasting seven weeks while the company’s Budel, Netherlands plant will undergo a 14-day turnaround. Meanwhile the Stolberg smelter in Germany is expected to come back online in the summer after its prolonged outage. Third quarter contract discussions were underway in June in NW Europe with early indications prices would rollover or see slight increases on the previous quarter. Logistics across the continent remain a concern with the shortage of truck drivers persisting through the second quarter.

While the Japan/South Korea export price remained stable at $138/t f.o.b. the China export prices dropped by $7.5/t to $1425/t f.o.b. over the month of June. China remains a major global exporter of acid and we expect availability to rise to 3 million tonnes for the first time in 2022. Exports have more than doubled in the first five month of the year, totalling close to 2 million tonnes. The leading market is Morocco, followed by Chile and India. Smelter acid capacity is forecast to rise by 2 million t/a in 2022 on last year, with copper smelters in development ramping up or coming online.

China’s Daye Non-ferrous has delayed the commissioning of its 400,000 t/a copper smelter to the end of July or early August because of the impacts of the Covid-19 pandemic. The smelter had delayed the start-up to 13 June from late 2021 because of a delay in the shipments of its imported equipment and parts, owing to the pandemic. Daye Non-ferrous, located in Huangshi city in central China’s Hubei province, is a subsidiary of state-owned China Nonferrous Metal Mining. Acid capacity at the smelter will eventually reach 1.5 million t/a.

Over in Latin America, the Chile price has dropped by $38/t since the start of the year but remains $90/t higher than a year earlier. Freights have been increasing and continues to support the delivered price in the short term. Codelco and the umbrella union representing its employees agreed to stop a planned strike at the end of June, which started after the company announces it plans to close its Ventanas smelter. Sulphuric acid capacity is estimated at 300,000 t/a. Chilean acid imports totalled 1.1 million tonnes in January-April 2022, up by 28% on the same period a year earlier. China is the leading supplier followed by Peru.

Higher operating rates at sulphur burners has provided support to the US market in June. The increase in sulphur production from US Gulf refineries has enabled acid producers to meet contract volumes and participate in the spot market, slowing the need for imported volumes. High imports earlier in the second quarter was needed to meet domestic demand during a period of maintenance.

The outlook for pricing for acid is complex because of the high costs many downstream end users are facing across a range of industries. Some regions have ample availability while logistics issues and costs are also a factor for the short term view. Rising freight prices are expected to support delivered ranges while putting downward pressure on export pricing in key markets. Copper prices dropped by around 17% over the past quarter on the London Metal Exchange (LME) and remained below $10,000/t while nickel was down 27%. Metal prices were also weighed on by strengthening in the US dollar at the end of June which makes purchasing more expensive in other currencies.

Price Indications